Polkadot Surges 100% as Ethereum Matches All-Time High

.jpg)

Market Outlook

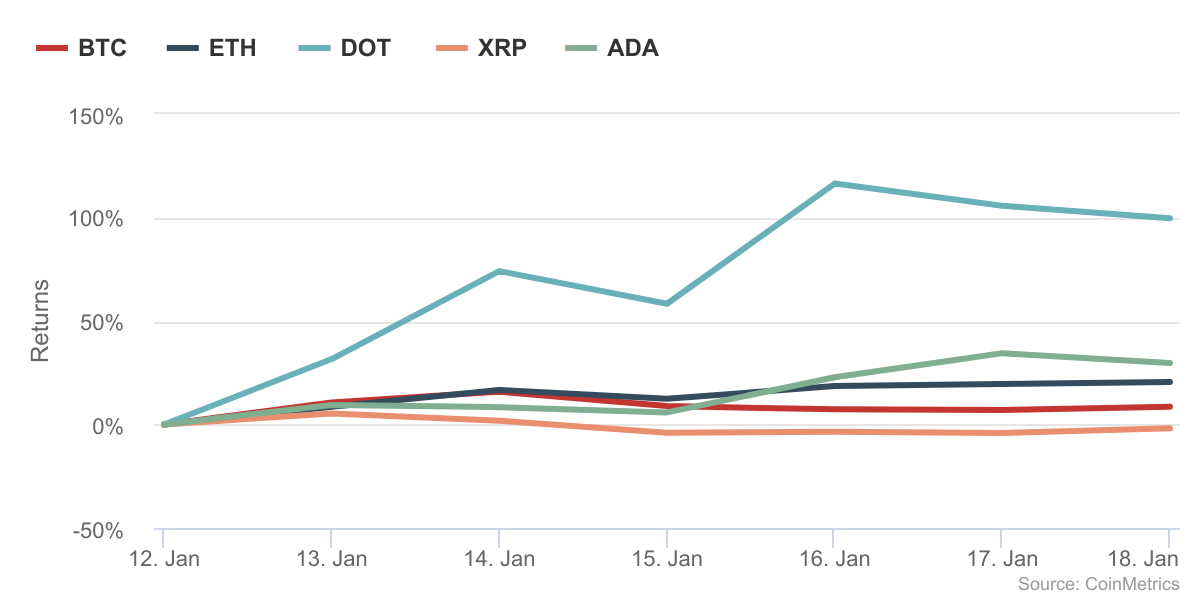

The market over the last week has been characterized by outperformance from an upcoming smart contract platform and Ethereum-competitor, Polkadot (DOT), which has returned nearly 100% over the last week. Ethereum, the leading smart contract platform, to has had a strong week where it returned around 20% and has, as of today, matched its 2018 all-time-high price of $1,420. It is possible that Ethereum, if it is able to consistently maintain new levels above its previous all-time-highs, can enter a period of price discovery in the same way that Bitcoin did as it climbed past its $20,000 levels before settling at $36,000.

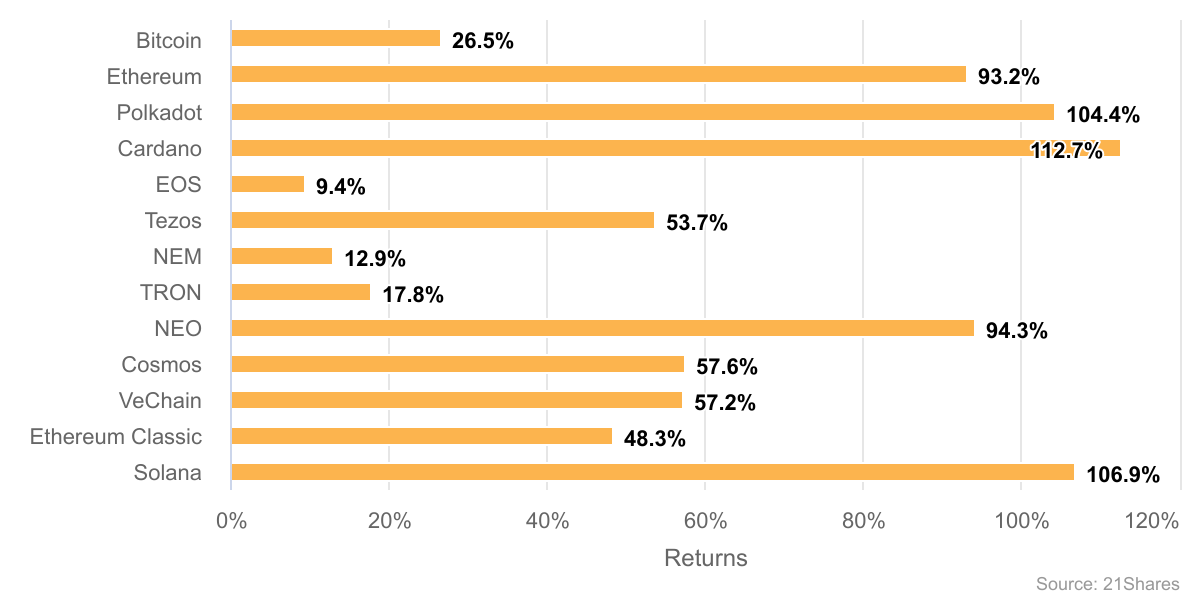

As the concept of Bitcoin as digital gold continues to be accepted within both mainstream retail and institutional investors, smart money will begin to flow to smart contracts and innovation within decentralized finance which are undoubtedly blockchain technology’s second-most important use case currently. The chart below shows the performance of the various smart contract platforms since the start of the year with market capitalizations above $1B compared to Bitcoin’s performance. Since the start of the year, smart contract platforms have generally drastically outperformed Bitcoin. You can get exposure to smart contract platforms such as Ethereum through our products, including AETH and KEYS.

Weekly Returns

The returns of the top five cryptoassets over the last week were as follows — BTC (8.55%), ETH (20.53%), DOT (99.62%), XRP (-1.87%), and ADA (29.71%).

Monthly ETP Returns

The performance of our line of ETPs over the last 30 days is as follows: ABTC (48.1%), AETH (77.3%), ABCH (42.5%), AXRP (-44.4%), ABNB (18.5%), AXTZ (4.4%), HODL (59.3%), ABBA (52.3%), KEYS (46.7%), and SBTC (-42.6%).

Learn more about our products here.

Media Coverage

Last week, Swissquote hosted a webinar session with the 21Shares team composed of our CEO Hany Rashwan alongside our Research Associates — Eliézer Ndinga, and Lanre Ige who presented to hundreds of people our end-year review of 2020 and expectations for 2021. Have a listen here.

The Financial Times featured us amongst other competitors as the journal covered the rising adoption of Bitcoin through institutional-grade products with volumes matching those of the most popular European funds listed on stock exchanges such as Deutsche Börse and the SIX Swiss Exchange. Read the full article here.

The German-speaking journal, Trending Topics, featured last week’s research note authored by our researchers, Lanre Ige and Eliézer Ndinga — in which they delved into the market correction that occurred last weekend and continued subsequently the following day on Monday, January 11th. Read the full article here.

News - Gary Gensler Is Picked to Lead S.E.C | The New York Times

What Happened?

There’s been speculation over the past week that Gary Gensler, the former chairman of the Commodity Future Trading Commission (CFTC) during the Obama administration, is expected to take the reign of the Securities and Exchange Commission (SEC). Yesterday, the New York Times confirmed the rumours as President-elect Joe Biden, who will be inaugurated on Wednesday, January 20th the 46th president of the United States, will nominate Gensler to lead the agency.

Why Does It Matter?

The inauguration of Joe Biden will occur amidst extraordinary political, public health, and national security crises. Hopefully, the transfer of power from the Trump administration to the Biden administration will peacefully take place. Otherwise, although anticipated due to the storming of the United States Capitol, a somewhat difficult transition could cause turbulence in the US markets and drive down the crypto market in the short term especially for Bitcoin, as traders in-the-money close their positions for cash.

On the other hand, the great news for the crypto industry is the nomination of Gary Gensler as his crypto-friendly stance and deep knowledge of Bitcoin and its underlying technology, the blockchain could potentially be opening the door for a US Bitcoin ETF.

At 21shares, we anticipate Gensler’s tenure to provide greater regulatory clarity specifically in the United States through pragmatic regulatory proposals and actions similar to Ripple’s lawsuit leading Grayscale and Kraken to dissolve XRP from their product suite in the US. For the record, in the past years, Gensler has been teaching a course called “Blockchain and Money” at MIT, as a review of Bitcoin and an understanding of the commercial, technical, and public policy fundamentals of blockchain technology, distributed ledgers, and smart contracts.

Gensler’s designation occurs at the perfect time as the crypto market, valued at over $1 trillion, has significantly matured over the past three years since the ICO craze of 2017. As a testament to this maturity, Anchorage recently became the first federally-chartered digital asset bank, while the NYC-based crypto exchange, Gemini, led by early Bitcoin investors, the Winklevoss brothers might go public going forward potentially becoming the second crypto-centric business to IPO alongside its competitor Coinbase.

To that end, we are also in the midst of rising institutional adoption of Bitcoin as a hedge against inflation and geopolitical instability. For example, politicians such as the former Canadian prime minister named Bitcoin as a potential reserve currency, while professional investors such as UK fund manager, Ruffer, praised the cryptoasset in their investor letter — despite the FCA’s ban and a controversial but for the moment irrelevant petition to ban crypto-related transactions in the UK:

“*We have done much work on assessing the danger that bitcoin is a wrong’un. We have been watching it for a longish time, and our judgement is that it is a unique beast as an emerging store of value, blending some of the benefits of technology and gold.*”

Learn more here.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)