An Opportunity in Disguise?

This Week in Crypto

Yesterday, the cryptoasset market was down by 17%, and Ethereum has had its worst trading day since 2021. Following the turbulent hours of the first trading day of the week, our research team broke down some of the primary factors driving markets; you can have a look here.

This morning, we saw some signs of recovery after yesterday’s sharp market drop. Here’s what happened where we left off on Monday:

- Japan stocks rallied more than 9% on Tuesday: NIKKEI 225 (+10.23%), TOPIX (+9.30%).

- Crypto and equities: Matching the sentiment, the total crypto market cap increased by 8.8%. Wall Street’s fear gauge VIX has cooled down to 38.57 from yesterday’s soaring 65.

- U.S. economic activity expands: Purchasing managers reported a 51.4% expansion (up from 48.8%) in the services sector last month, which spurred some optimism for a soft landing.

- Futures advance: Nasdaq 100 (+1.5%), STOXX 600 (+0.6%), showing initial signs of recovery after yesterday’s market turbulence.

For more information, read our full market update here.

How did BTC and ETH perform in previous bear markets?

Bitcoin is currently in the Extreme Fear zone, which shows that the asset is undervalued and may be an important investment opportunity . The last time Bitcoin was in this territory, it was trading around $16K following the FTX crash, followed by a historical price rally, reaching multiple all-time highs.

Figure 1 – Bitcoin Fear & Greed Index

Source: Glassnode

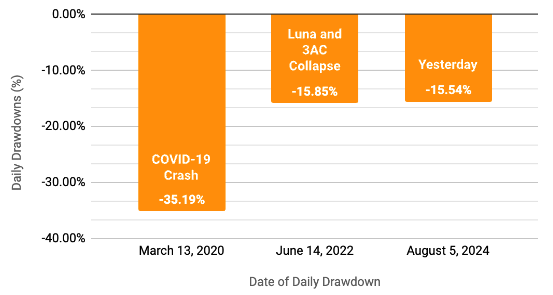

The two examples below, a macro-specific and crypto-specific event, led to the largest daily drawdowns of Bitcoin and Ethereum. These can be used to understand how their prices may move after yesterday’s events.

Figure 2 – Bitcoin 3 Biggest Daily Drawdowns Since 2020

Source: 21Shares

Figure 3 – Ethereum 3 Biggest Daily Drawdowns Since 2020

Source: 21Shares

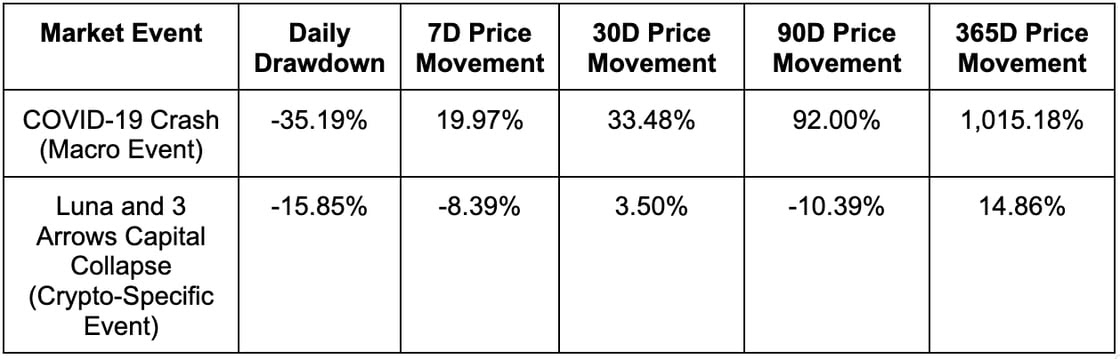

Potential Scenarios for BTC / ETH

Below, we outline the macro-specific events that potentially affect Bitcoin and Ethereum’s recovery in the near future.

* Short-term potential price movement

Important to note that past performance is not indicative of future results but can still serve as a useful reference point.

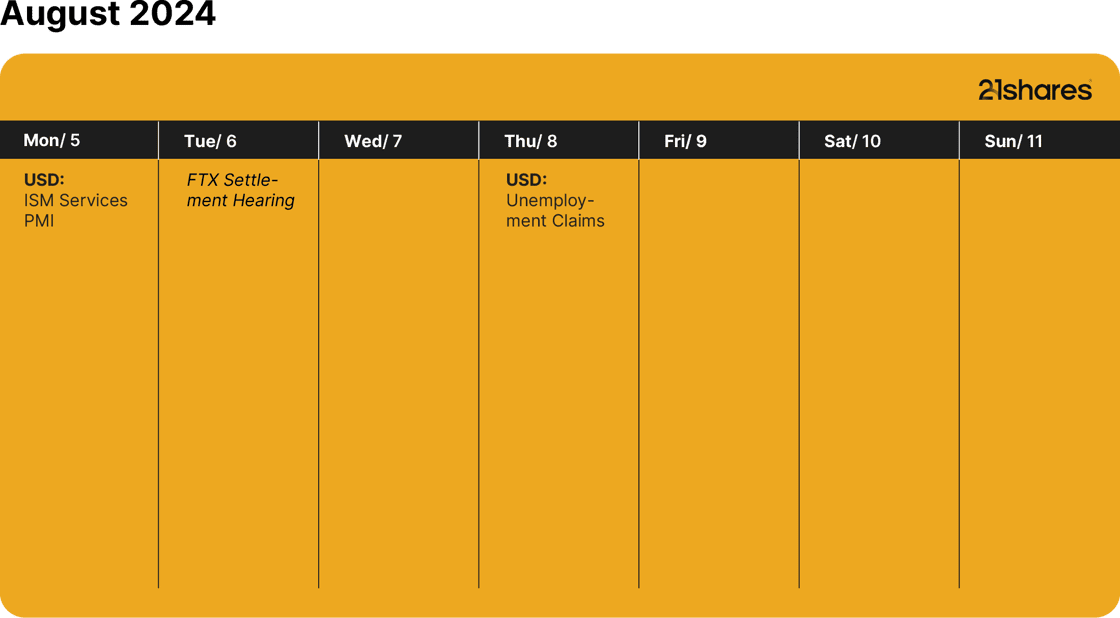

This Week's Calendar

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG in any jurisdiction. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever or for any other purpose in any jurisdiction. Nothing in this document should be considered investment advice.

This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.

This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States. Neither the US Securities and Exchange Commission nor any securities regulatory authority of any state or other jurisdiction of the United States has approved or disapproved of an investment in the securities or passed on the accuracy or adequacy of the contents of this presentation. Any representation to the contrary is a criminal offence in the United States.

Within the United Kingdom, this document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) persons who fall within Article 43(2) of the Order, including existing members and creditors of the Company or (iv) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Exclusively for potential investors in any EEA Member State that has implemented the Prospectus Regulation (EU) 2017/1129 the Issuer’s Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.

The approval of the Issuer’s Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the Issuer’s Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.

This document constitutes advertisement within the meaning of the Prospectus Regulation (EU) 2017/1129 and the Swiss Financial Services Act (the “FinSA”) and not a prospectus. The 2023 Base Prospectus of 21Shares AG has been deposited pursuant to article 54(2) FinSA with SIX Exchange Regulation AG in its function as Swiss prospectus review body within the meaning of article 52 FinSA. The 2023 Base Prospectus and the key information document for any products may be obtained at 21Shares AG's website (https://21shares.com/ir/prospectus or https://21shares.com/ir/kids).

.jpg)