Trump Won and Bitcoin hit $93k, What’s Next? Post-election analysis

Key Takeaways

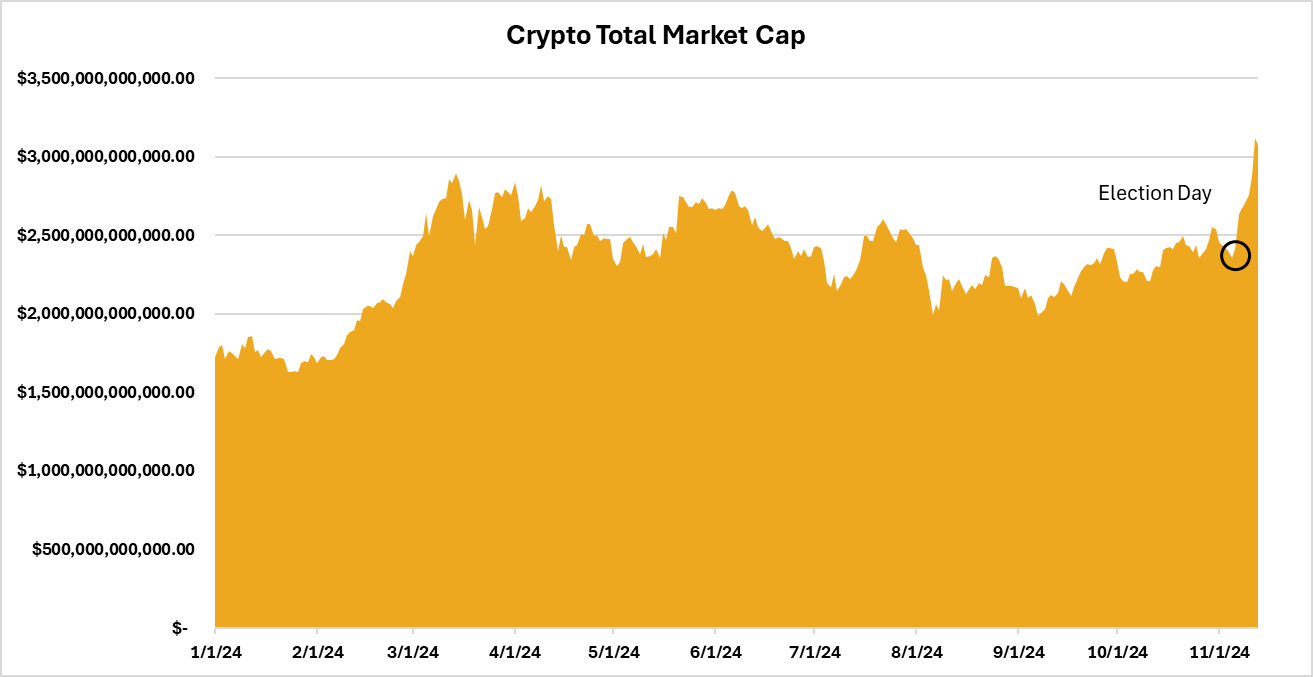

- The crypto total market cap surged by 31.25% following the presidential election, igniting renewed momentum in the market.

- Bitcoin and Ethereum typically rally leading up to Inauguration Day, with gains in 2020 exceeding 150% and 250% respectively.

- Bitcoin crossed $82K, ETH surpassed $3.3k, and Solana broke previous market cap highs and nears new price highs driven by its DeFi-ecosystem, boosting market optimism.

- XRP, Cardano, and Polkadot are rallying but remain well below their all-time highs, hinting at significant upside potential. Cardano, in particular, surged nearly 100% following rumors that founder Charles Hoskinson may collaborate with U.S. regulators on crypto policy.

In just a week, the U.S. presidential election has sparked a crypto market rally, pushing total market capitalization up by 31.25%, from $2.4T to $3.15T —a $750B surge. Leading the charge, Bitcoin rocketed almost 39% to an all-time high of $93K, while Ethereum broke out of its months-long slump, jumping over 44%. Market optimism is running high as investors anticipate a smooth transition between the Biden and Trump administrations, with upcoming monetary policy shifts and a mounting geopolitical landscape adding to the momentum.

Figure 1 - Crypto Market Capitalization in 2024

Source: Coingecko, 21Shares

Before diving into the factors shaping this market cycle, let’s take a closer look at how each crypto sector has performed in this historic week. Memecoins are leading the charge with over 50% growth, capturing significant attention, largely fueled by Solana’s high speeds. DeFi has also surged, driven by speculation around favorable regulatory changes, which we detailed further in our last newsletter.

Figure 2 - Market Capitalization Growth Across Sectors, Bitcoin and Ethereum

Source: Artemis, 21Shares, From November 3 - November 10, 2024

How Does The Market React Around Elections?

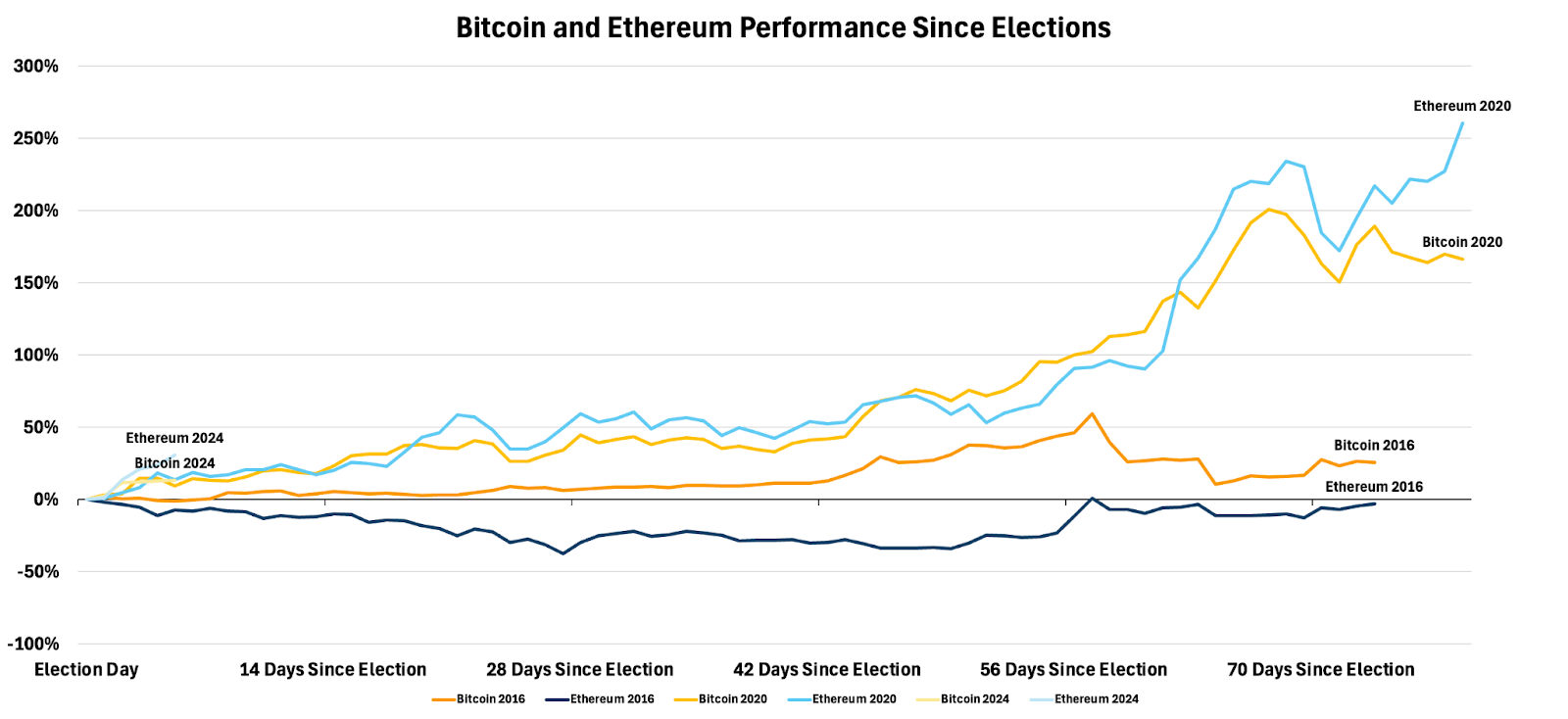

The period leading up to elections has typically weighed on crypto markets, with Bitcoin and Ethereum frequently experiencing declines as uncertainty peaks, as shown in Figure 3. This year, Bitcoin saw its steepest pre-election drop yet, falling nearly 7% in the days before Election Day. The decline was likely intensified by heightened scrutiny on the industry, prompting market participants to de-risk ahead of the election.

Figure 3 - Bitcoin and Ethereum Performance Leading up to Elections

Source: Coingecko, 21Shares

However, cryptoassets tend to rally in the months following an election—regardless of the political outcome. With a pro-crypto president-elect and a Congress now dominated by crypto-friendly representatives, market sentiment seems primed for a potential rebound. Historically, Bitcoin has averaged a November return of 44%, with particularly strong performance in years that coincide with both a U.S. election and a Bitcoin halving.

Figure 4 – Bitcoin and Ethereum Performance Since Elections

Source: Coingecko, 21Shares

Historically, Bitcoin and Ethereum have posted significant gains leading up to Inauguration Day on January 20. In 2020, for example, Ethereum surged over 250%, while Bitcoin rose by more than 150% during this period. Post-election January tends to be especially favorable for Ethereum, likely as capital flows from Bitcoin into other assets further down the tail.

Figure 5 – Bitcoin and Ethereum Performance in January Post-Elections

Bitcoin

Ethereum

January 2017

-0.04%

+31.92%

January 2021

+14.51%

+78.51%

Average

7.24%

55.22%

Source: Coinglass, 21Shares

Let’s take a look at how the market is shaping up this time and explore what we can expect in the months ahead.

Market Dynamics Post U.S. Election: Current Leaders

Following the election, several key crypto assets are nearing or setting new all-time highs. Bitcoin reached a fresh ATH of approximately $74K on election night, then surged past the $80K mark over the weekend, maintaining its upward momentum. Bitcoin is now trading over $92K. Solana, while not yet at a new price high, is only 20% away after rallying 34% post-election. has broken its previous marke cap all-time high of ~$90 billion and now sits at over $100 billion. While still a ways away from their all-time high, XRP, Cardano (ADA), and Polkadot (DOT) have rallied over 41%, 91%, and 40%, respectively.

Despite several assets already nearing or surpassing ATHs, key indicators suggest there’s still room for growth in this cycle, as post-election rallies often build momentum in the following months.

Institutional demand for Bitcoin surged post-election, driven by the victory of a pro-crypto administration and resulting in substantial inflows into BTC ETFs. In the three days leading up to the election, net outflows totaled $755M as markets de-risked across asset classes. However, once results were announced, inflows rebounded sharply, with nearly $1.5B entering on Thursday alone—the highest single-day inflow of the year and roughly equivalent to all miner rewards issued since the beginning of Q3!

Figure 6 – Bitcoin Price and Net BTC ETF Flows

Source: Glassnode, 21Shares

That said, institutional adoption is still in its early stages, with broader interest on the horizon. The introduction of BTC ETF options enables hedge funds to deploy more sophisticated strategies, boosting market liquidity and accelerating the growth of Bitcoin’s derivatives market—currently only 5% of Bitcoin’s market cap, compared to 10-15x in traditional assets. Additionally, as wirehouses and RIAs complete their one-year due diligence early next year and begin actively allocating client portfolios, Bitcoin could follow a post-election trajectory similar to 2020, as shown in Figure 8.

One reason we may see further capital flowing into Bitcoin is the easing monetary conditions emerging worldwide. Last Thursday, the Fed cut rates by 25bps, following similar moves from the Bank of England, with the ECB likely to follow suit. This rate-cutting trend is driving an expansion in M2 money supply globally, indirectly increasing liquidity in the financial system.

Figure 7 - Bitcoin Performance vs. M2 Supply Growth

Source: 21Shares

Bitcoin acts as a "liquidity sponge," attracting capital during periods of monetary expansion, as shown in Figure 7. When central banks increase M2 through rate cuts or quantitative easing, Bitcoin initially sees speculative inflows as a high-growth asset. As inflation concerns build, its role as an inflation hedge gains traction, creating a dual response to rising liquidity. With looser monetary conditions emerging, similar to 2020, Bitcoin could be primed to push past the six-figure mark.

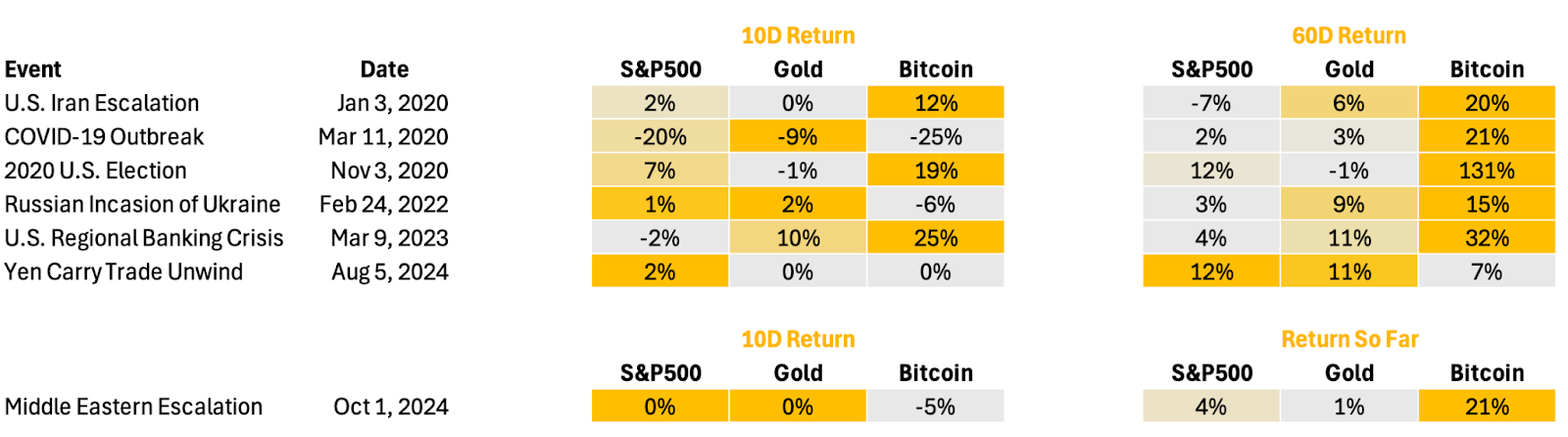

Bitcoin has also shown a strong tendency to rebound in response to market uncertainties, as illustrated in Figure 8 below. While President Trump has demanded a de-escalation of the conflict in the Middle East by January 20, negotiations have stalled, with Qatar suspending its mediation role.

Figure 8 – Bitcoin Price Performance in Face of Macroeconomic Uncertainty

Source: Yahoo Finance,21Shares

This resilience highlights Bitcoin’s appeal as a sovereign, censorship-resistant asset in times of crisis. With Donald Trump pledging to never sell any of the BTC currently held by the US government and supporting U.S.-based mining, Bitcoin’s fundamentals appear well-positioned to sustain upward momentum in this post-election cycle, despite ongoing tensions in the Middle East.

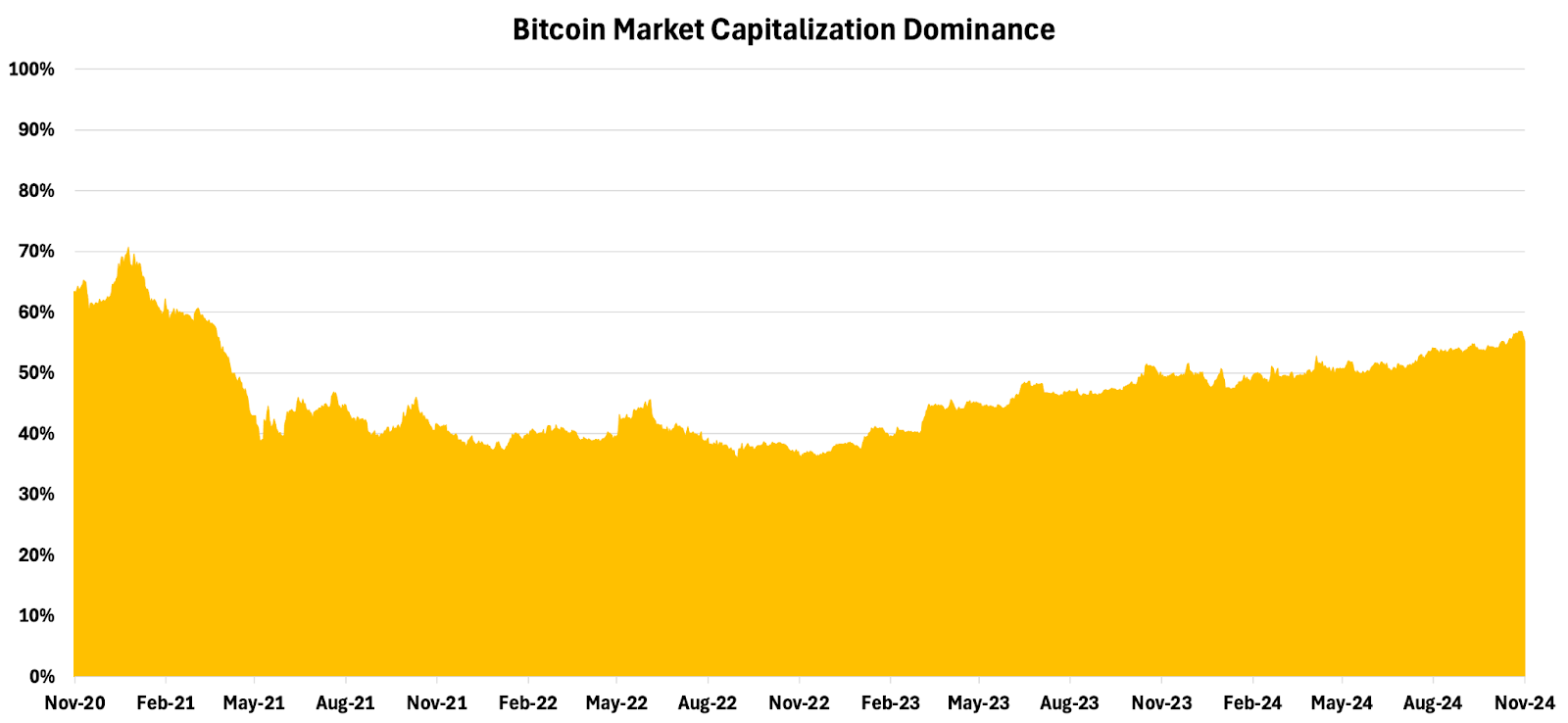

As a result of this year’s events, Bitcoin's market dominance has surged to around 57% as shown in Figure 9, its highest level since March 2021. However, a recent 3% dip over the weekend hints that other assets are beginning to lead the charge, signaling a shift toward broader market diversification as investors start allocating capital across the wider crypto landscape.

Figure 9 - Bitcoin Market Capitalization Dominance

Source: Coingecko, 21Shares

As shown in Figure 10, Solana has been performing exceptionally well this year, with momentum expected to carry through the current cycle. It briefly surpassed the $220 mark, setting a new yearly high. This surge has been driven by strong retail engagement and a vibrant DeFi sector, which initially catalyzed Solana's growth earlier in the year. Now, with a resurgence in SPL-based tokens (Solana Program Library—Solana’s token standard for tokens), Solana’s ecosystem appears poised to continue attracting capital and retail interest, supporting its upward trajectory.

Figure 10 - Solana Performance

Source: Coingecko, 21Shares

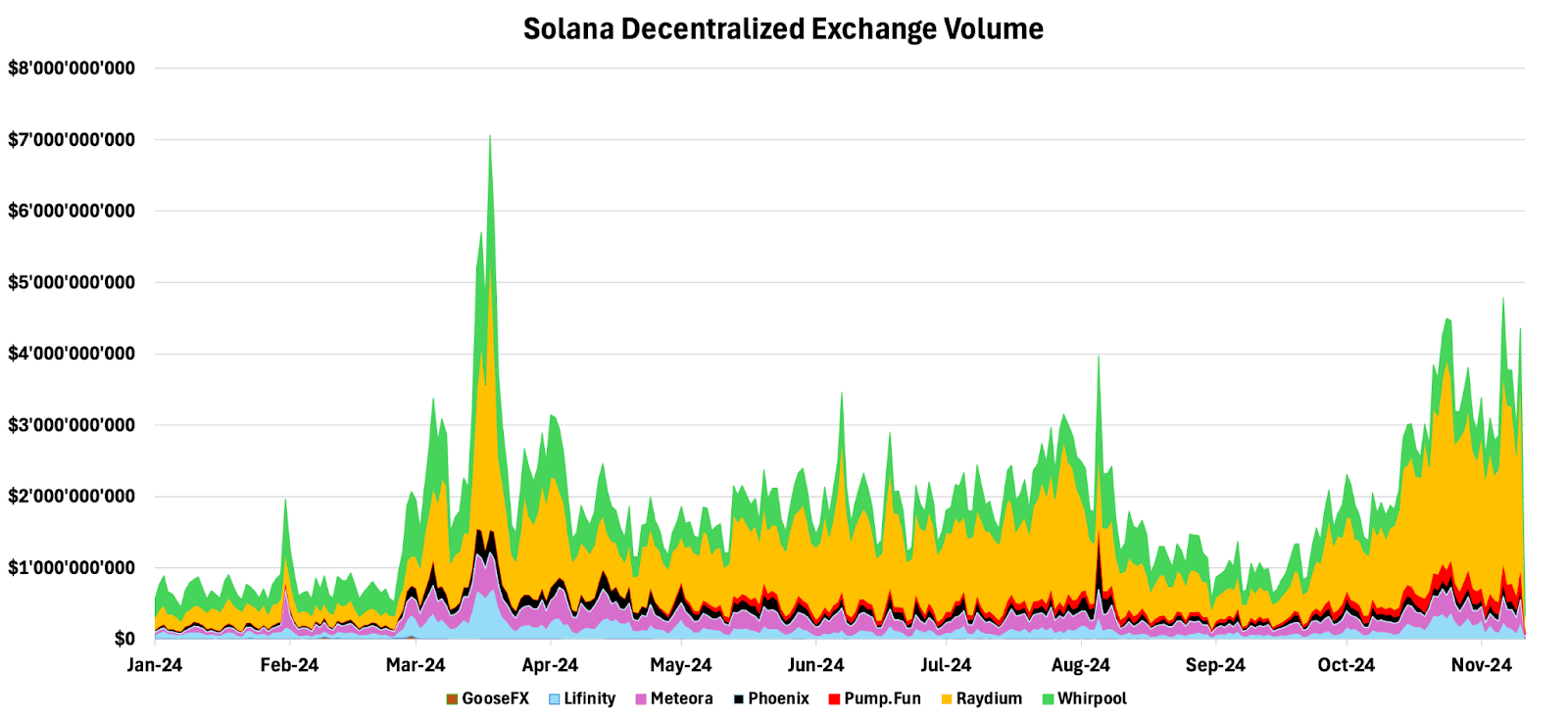

Memecoins have proven to be an effective gateway for onboarding retail investors, with much of this activity centered on the Solana blockchain. Their recent surge has pushed Solana’s DeFi sector to new heights, as many of these tokens are actively traded on decentralized exchanges like Raydium. In November, Solana’s DEXs collectively surpassed $34B in trading volume—nearly double that of Ethereum’s DEXs. Raydium alone has outperformed Uniswap in both transaction volume and fee generation, underscoring Solana’s growing dominance in DeFi and the strong appeal for SPL-based tokens among retail traders. This momentum also highlights the increased interest in DeFi and retail-driven segments following the recent election.

Figure 11 - Solana Decentralized Exchange Volume

Source: Dune, 21Shares

The recent election has sparked a significant rally across DeFi tokens, particularly for Raydium, which has been boosted by the aforementioned rise in SPL token activity, as shown in Figure 12 below. This momentum reflects the anticipation of clearer, more favorable regulatory conditions ahead. According to data from StandWithCrypto:

- In the House of Representatives, 268 pro-crypto candidates vs. 122 anti-crypto candidates

- In the Senate, 19 pro-crypto candidates vs. 12 anti-crypto candidates.

This shift toward a pro-crypto legislative body is expected to be a tailwind for DeFi, alleviating past regulatory pressures faced by projects like Uniswap, which had faced an extended bear-period having been previously targeted by the SEC. Additionally, former President Trump’s DeFi initiative, World Liberty Financial, built on Aave,

signals potential political support that could reduce legal risks for DeFi and create a more supportive regulatory environment for innovation across the sector.

Figure 12 – DeFi Related Projects Performance During Q3Source: Coingecko, 21Shares

Benefiting from more favorable conditions, several DeFi projects are on the verge of transformative changes. For example, Uniswap’s upcoming launch of its DeFi-focused chain, Unichain, is expected to reshape UNI’s investment case by allowing token holders to capture revenue that has historically gone to Ethereum—totaling over $3.5B since inception.

Market Dynamics Post U.S. Election: Current Laggers

Several cryptoassets remain well below their all-time highs, with Ethereum down approximately 35%. Yet, ETH has rallied an impressive amount since the election—in fact, no major cryptoasset has declined since Election Day. Ethereum crossed the $3K mark for the first time since August. This recent momentum suggests that market laggards—especially Ethereum and Cardano, which have faced challenges this year—are finally benefiting from a “catch-up trade.”

Ethereum has struggled to keep pace with Bitcoin this year, particularly as Bitcoin has crossed the $70K mark multiple times, with Ethereum lagging each time. This underperformance reflects Ethereum’s challenging transition as it adapts to a new business model where much of its activity is offloaded to Layer 2 (L2) networks. These networks rely on Ethereum for security but handle transactions off-chain, reducing both fees and congestion on Ethereum’s mainnet. However, this efficiency comes at a cost: L2s pay minimal fees to Ethereum, raising concerns about the mainnet's long-term economic sustainability.

Nevertheless, Ethereum’s recent rally to $3.3K suggests it may have found new tailwinds. Following the election, the BTC-to-ETH ratio hit a new high for the year, indicating that Bitcoin had significantly outpaced Ethereum. As shown in Figure 14, this ratio has started to decline, signaling a potential shift in capital from Bitcoin toward Ethereum and other alternatives.

Figure 13 - Bitcoin to Ethereum Ratio

Source: Coingecko, 21Shares

We expect Ethereum’s growth to continue its momentum through next year, despite recent challenges. Ethereum may implement revenue-sharing agreements with L2s, establishing minimum fees that L2s pay back to the mainnet—thereby strengthening the contributions to Ethereum’s core ecosystem. Additionally, more Layer 1s, like Celo, are shifting to operate as Ethereum L2s, which will increase demand for Ethereum’s block space and further boost mainnet activity.

Meanwhile, traditional financial and crypto-native firms are accelerating their L2 adoption, bringing new users and capital onto Ethereum. Coinbase’s L2, Base, has been highly successful, amassing nearly $3B in TVL and over 1M users, with Kraken recently following suit. Sony, the electronics ultinational conglomerate, is launching its own L2, Soneium. These initiatives unlock consumer-facing applications, help address Ethereum’s disjointed ecosystem, and could spark renewed interest from both crypto and traditional players throughout the upcoming cycle.

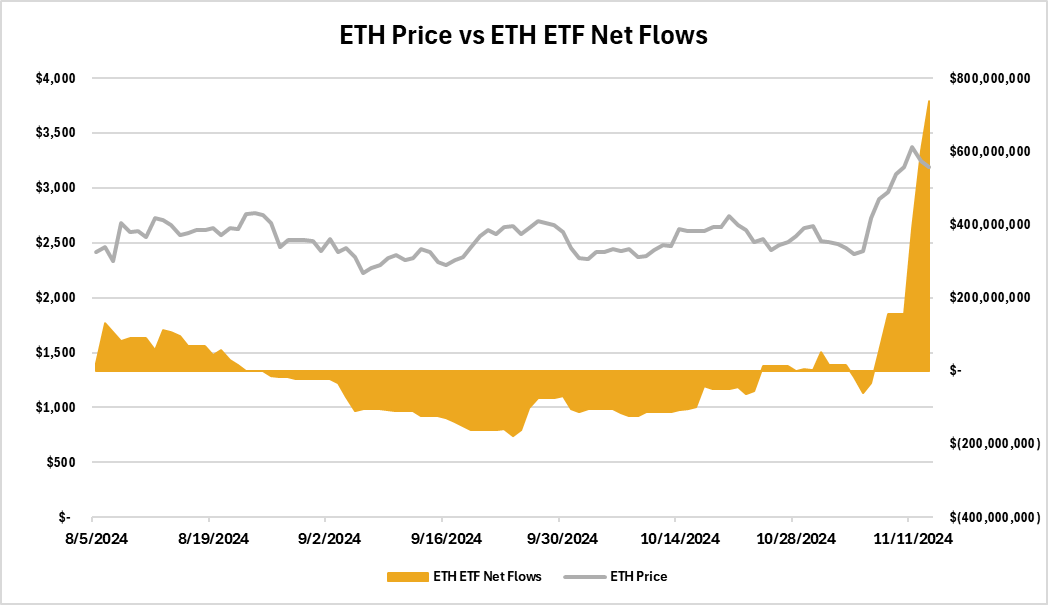

Despite the recent launch of Ethereum ETFs, institutional inflows have significantly lagged behind Bitcoin’s. Net flows into Ethereum ETFs total just $737M, a stark contrast to Bitcoin's $28B. This discrepancy is partly due to Ethereum’s more complex value proposition as a platform for decentralized applications, which may take longer for investors to fully embrace. Additionally, staking has yet to be activated within these ETFs, limiting their appeal to investors interested in yield-generating assets.

However, recent signs indicate growing institutional interest in Ethereum. Since Election Day, Ethereum has seen net inflows of $754M, bringing its cumulative ETF flows into positive territory since launch, as shown in Figure 15. With anticipated regulatory clarity and TradFi integrations on the horizon, as well as potential improvements to Ethereum’s mainnet revenue model, Ethereum could be poised for a revival next year.

Figure 14 - Ethereum ETF Net Flows

Source: Glassnode, 21Shares

Moving from Ethereum to another lagging asset, Cardano has seen renewed interest as it enters its Voltaire era, following the Chang Hard Fork (covered here). Announced in late October, Cardano is pivoting to also become a Bitcoin L2, this shift aims to leverage Cardano’s smart contract capabilities to enhance Bitcoin’s functionality. Under this setup, Cardano maintains its Layer 1 independence but works alongside Bitcoin, enabling both networks to capitalize on their convergence.

Additionally, Cardano has recently rallied on news that founder Charles Hoskinson plans to assist the new administration in developing crypto-friendly policies in the U.S. With Input Output, Cardano's development company, setting up a policy office in Washington, Cardano’s position in U.S. regulatory discussions is potentially set to strengthen. At over 80% below its ATH, Cardano presents a strategic entry opportunity for investors, given its recent pivot to integrate with Bitcoin as a Layer 2 solution and Hoskinson’s potential role in shaping upcoming crypto policy.

Polkadot (DOT) and XRP have recently experienced important catalysts that may help these two prominent projects narrow the gap with BTC and SOL.

DOT: Polkadot's “Agile Coretime” a pivotal upgrade in the Polkadot 2.0 journey that transforms resource management by enabling flexible, on-demand access to blockspace. This feature replaces the old auction system, making it easier and more affordable for projects to build and scale on Polkadot. Agile Coretime aligns resource allocation with actual demand, reducing waste during low-activity periods and preventing congestion at peak times, ideal for projects with varying needs. By lowering entry barriers, it fosters innovation and growth within the ecosystem, offering developers a choice between on-demand and bulk purchases to match their specific resource needs.

XRP: With prominent crypto ETF providers filing S-1 forms for an XRP ETF and Ripple securing key legal victories against the SEC, XRP's price momentum is building as investors anticipate a potential approval. These ETF filings are seen as a pivotal step that could legitimize XRP further in traditional finance, making it more accessible to institutional investors. Additionally, XRP's global footprint continues to expand as nation-states adopt the XRP Ledger for cross-border payment infrastructure, and new projects are increasingly building on the ledger, bolstering its use cases. Together, these developments create a strong foundation for XRP’s growth, potentially positioning it as a leader in blockchain-based financial solutions and a catalyst for further adoption.

Post-election, several leading crypto assets are approaching new all-time highs, while others remain far from their peaks, presenting intriguing opportunities. Bitcoin reached $93K over the course of this week, while Solana has surged significantly. However, Ethereum, Cardano, XRP, and DOT—still well below their all-time highs—have shown impressive rallies, signaling potential growth as capital rotates into these lagging assets.

Fear and Greed Index

A glance at the Fear & Greed Index, a multifactorial tool that analyzes crypto market sentiment, shows a shift towards greed this week with a reading of 88. This indicates a strong optimistic outlook, as investors are increasingly willing to take plenty of risk. A reading of 88 reflects robust confidence in the market, suggesting that traders continue to anticipate upward momentum in Bitcoin and other assets. However, this high level of enthusiasm could also bring about higher volatility, as increased demand often leads to price swings. Investors should remain cautious and balanced in their strategies as market sentiment continues to heat up.

Figure 15 - Fear and Greed Index

Source: alternative.me

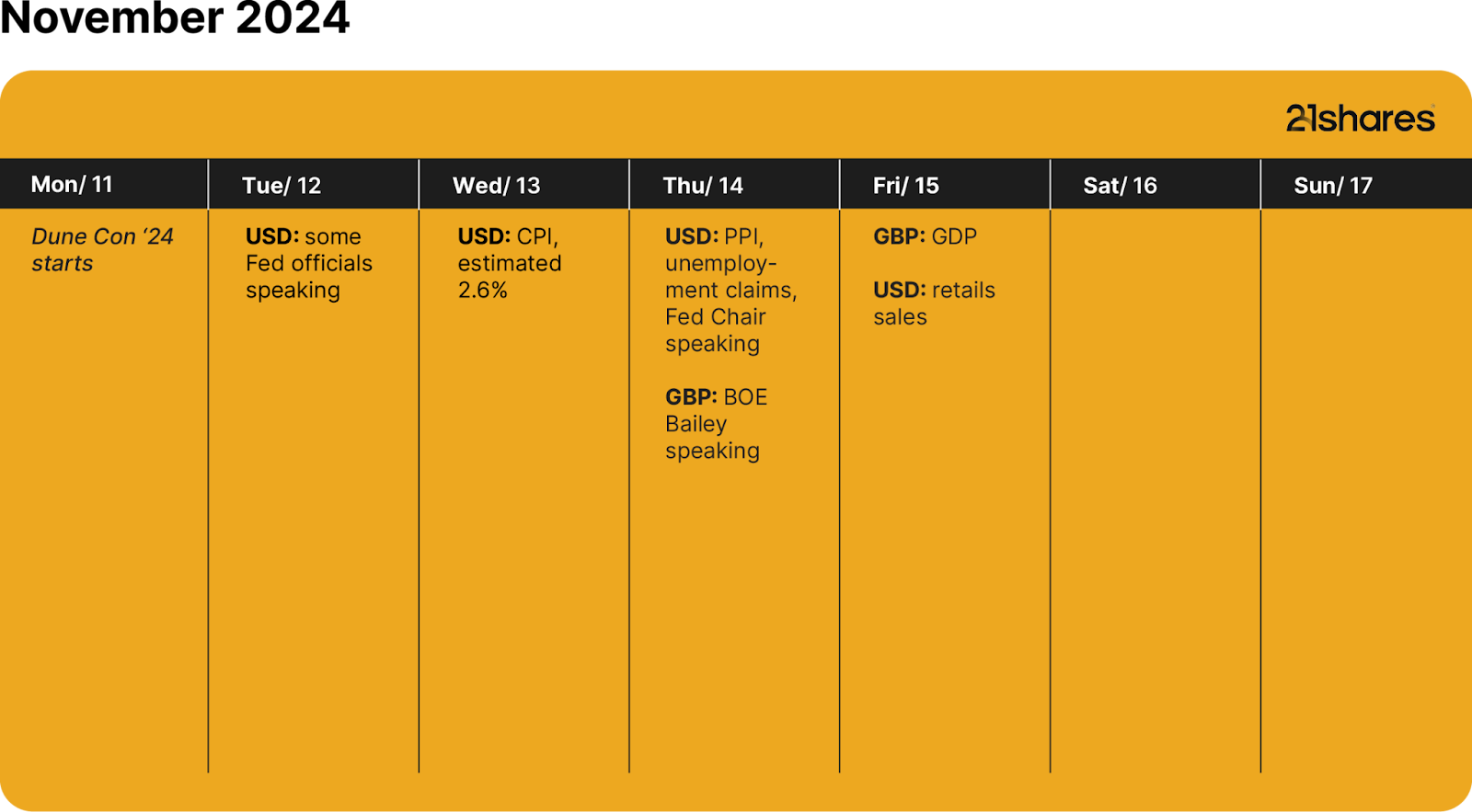

What’s also happening this week?

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG in any jurisdiction. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever or for any other purpose in any jurisdiction. Nothing in this document should be considered investment advice.

This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.

This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States. Neither the US Securities and Exchange Commission nor any securities regulatory authority of any state or other jurisdiction of the United States has approved or disapproved of an investment in the securities or passed on the accuracy or adequacy of the contents of this presentation. Any representation to the contrary is a criminal offence in the United States.

Within the United Kingdom, this document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) persons who fall within Article 43(2) of the Order, including existing members and creditors of the Company or (iv) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Exclusively for potential investors in any EEA Member State that has implemented the Prospectus Regulation (EU) 2017/1129 the Issuer’s Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.

The approval of the Issuer’s Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the Issuer’s Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.

This document constitutes advertisement within the meaning of the Prospectus Regulation (EU) 2017/1129 and the Swiss Financial Services Act (the “FinSA”) and not a prospectus. The 2023 Base Prospectus of 21Shares AG has been deposited pursuant to article 54(2) FinSA with SIX Exchange Regulation AG in its function as Swiss prospectus review body within the meaning of article 52 FinSA. The 2023 Base Prospectus and the key information document for any products may be obtained at 21Shares AG's website (https://21shares.com/ir/prospectus or https://21shares.com/ir/kids).

.jpg)

.svg)

_logo.svg)

.svg.png)