Big Tech, Liquidations, and an Outage: What happened in crypto last week?

.webp)

This Week in Crypto

Last week, Big Tech dominated the headlines with its earnings for the last quarter of 2023. In this report, we’ll talk about their correlation with crypto and how other macroeconomic indicators come into play. We’ll also shed light on liquidations the market is anticipating on the back of some bankruptcy proceedings. Finally, we’ll walk you through what we know about the Solana mainnet outage.

Earnings Week Spurs Optimism

Following the latest macroeconomic data, the Federal Reserve has opted to maintain interest rates within the range of 5.25% to 5.5%. In its recent statement, the central bank underscored the necessity for additional reassuring data before considering any reduction in borrowing costs. However, there are encouraging signs suggesting the U.S. economy is surpassing expectations. Notably, January witnessed robust job creation, with ~353K new positions added, exceeding the anticipated ~185K, holding the unemployment rate steady at 3.7% against the projected 3.8%. Moreover, wage growth surged annually to 4.5%, the highest increase in two years, while the U.S. manufacturing sector exhibited resilience and momentum, with the PMI index climbing from 47.1% to 49.1%.

Additionally, the U.S. economy experienced significant growth in the last quarter, expanding by 3.3% compared to an estimated 2%. Further, strong earnings reports from major companies like Meta and Amazon also bolstered confidence, with growth estimates surpassing expectations at 7.8% versus 6.4%, leading the SP500 to hit an ATH. Despite these positive indicators highlighting the U.S. economy's resilience relative to others, the data suggests limited prospects for a Fed interest rate cut in March. Chairman Jerome Powell echoed this, emphasizing that “it is probably not the most likely case or the base case” for a March cut. Given Bitcoin's recent mild recovery in correlation with the S&P 500 and Nasdaq, shown below in Figure 1, it's imperative to monitor economic indicators closely to gauge the potential spillover effects on the emerging asset. It’s also equally important to assess when the FED will cut interest rates as it’ll impact risk-on asset classes such as crypto since Quantitative Easing (QE) policies inject more capital and liquidity into the market while increasing investors’ risk appetite.

Figure 1: Bitcoin's Correlation with Nasdaq and S&P 500

Source: TheBlock

Liquidations Anticipated as Part of Bankruptcy Proceedings of FTX and Genesis

After months of uncertainty, FTX will not relaunch its collapsed exchange and plans to pay its customers in total, which will be based on the prices of November 2022, when Bitcoin was priced at less than $17K as a consequence of the bankruptcy dollarization process. So far, FTX has recovered at least $7 billion in assets, which they are planning to liquidate to make their customers whole, which could take a toll on the market, similar to when FTX sold GBTC shares shortly following the approval of the spot Bitcoin exchange-traded funds (ETFs) in the U.S.

Additionally, Genesis is seeking court approval to sell $1.6 billion of its Grayscale Trust assets following a $21 million settlement agreement with the Securities and Exchange Commission (SEC). Users of FTX and Genesis form the two most significant headwinds along Mt. Gox creditors. Thus, It’s essential to realize any source of external selling pressure that could impact the market.

Funds Marked Safe Amid Solana’s Outage

After a year of stability, Solana experienced an outage lasting five hours on February 6 at 09:53 UTC. While over $3B in assets under management were reported safe, the outage only resulted in failed transactions. Engineers from across the ecosystem released a new validator software that includes a patch to address an issue that caused the cluster to halt. Validator operators were asked to upgrade to restart the network. Block production on Solana mainnet beta resumed at 14:57 UTC, following a successful upgrade to v1.17.20 and a cluster restart by validator operators. Solana announced that its engineers are monitoring the network’s performance as operations are restored. A post-mortem report on the root cause of the outage is also underway, which will be made available on Solana’s channels once complete.

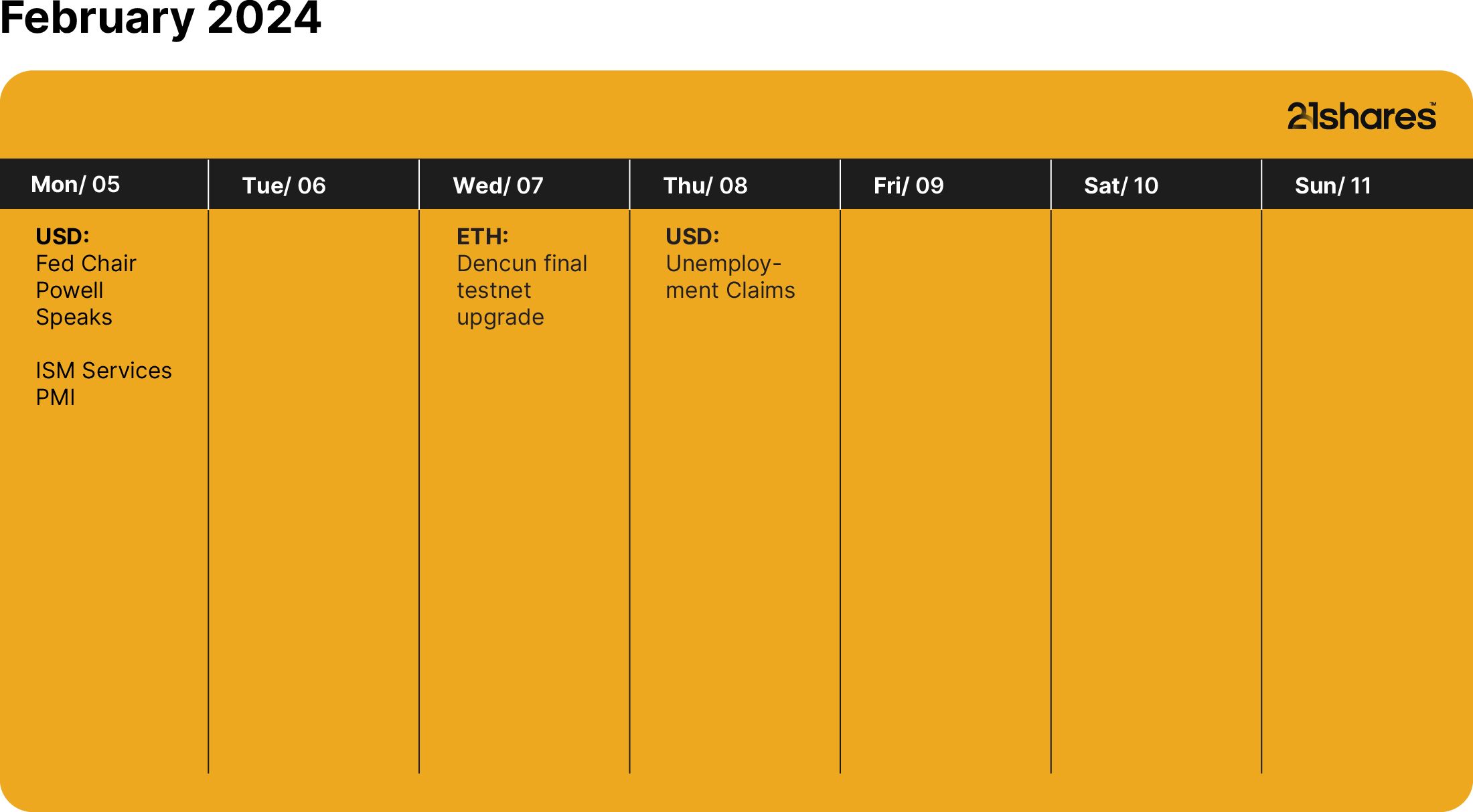

This Week’s Calendar

Source: Forex Factory

Disclaimer

The information included herein is the express opinion and experience of 21Shares and is provided for discussion purposes only. Past performance is not indicative of future results. Investors should consult with their own advisors for legal, tax, regulatory, financial, accounting, and other aspects relevant to the investment's suitability and potential consequences.

This presentation is for informational and discussion purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security. The information set forth herein does not claim to be complete and is subject to change. This presentation does not constitute a part of any document of any fund and should not be construed as an advertisement or marketing material for any fund.

Certain statements contained in this presentation are based on the expectations, estimates, projections, and opinions of 21Shares. Such statements involve known and unknown risks, uncertainties, and other factors, and reliance should not be placed thereon. This presentation contains “forward-looking statements,” the outcome of which may differ materially from those reflected or contemplated herein.

Certain economic, market, financial, and other information contained herein has been obtained from managers, service partners, and other parties besides 21Shares. While such sources are believed to be reliable, none of 21Shares or any of their respective affiliates or employees assumes any responsibility for the accuracy or completeness of the information contained in this presentation or to update any information contained herein.

Investing in crypto assets, including cryptocurrencies and crypto tokens, carries inherent risks. These assets are considered highly speculative due to their limited history and new technological nature. Future regulatory actions may impact the usability and tradability of crypto assets. The price of crypto assets can be influenced by a small number of holders and may decline in popularity or acceptance, affecting their value.

None of 21Shares nor any of its affiliates have made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and expressly disclaim any responsibility or liability relating thereto.

.jpg)

.svg)

_logo.svg)

.svg.png)