How Would Celsius' Liquidation Impact the Crypto Market?

.webp)

This Week in Crypto

What happened in crypto this week? A speculative report about a spot Bitcoin ETF caused some volatility, but that was not the only factor. To pay back its creditors, Celsius has requested to unstake almost 1% of all staked ETH; how will the market respond? Let's dig in.

A Bitcoin-dominated Newscycle

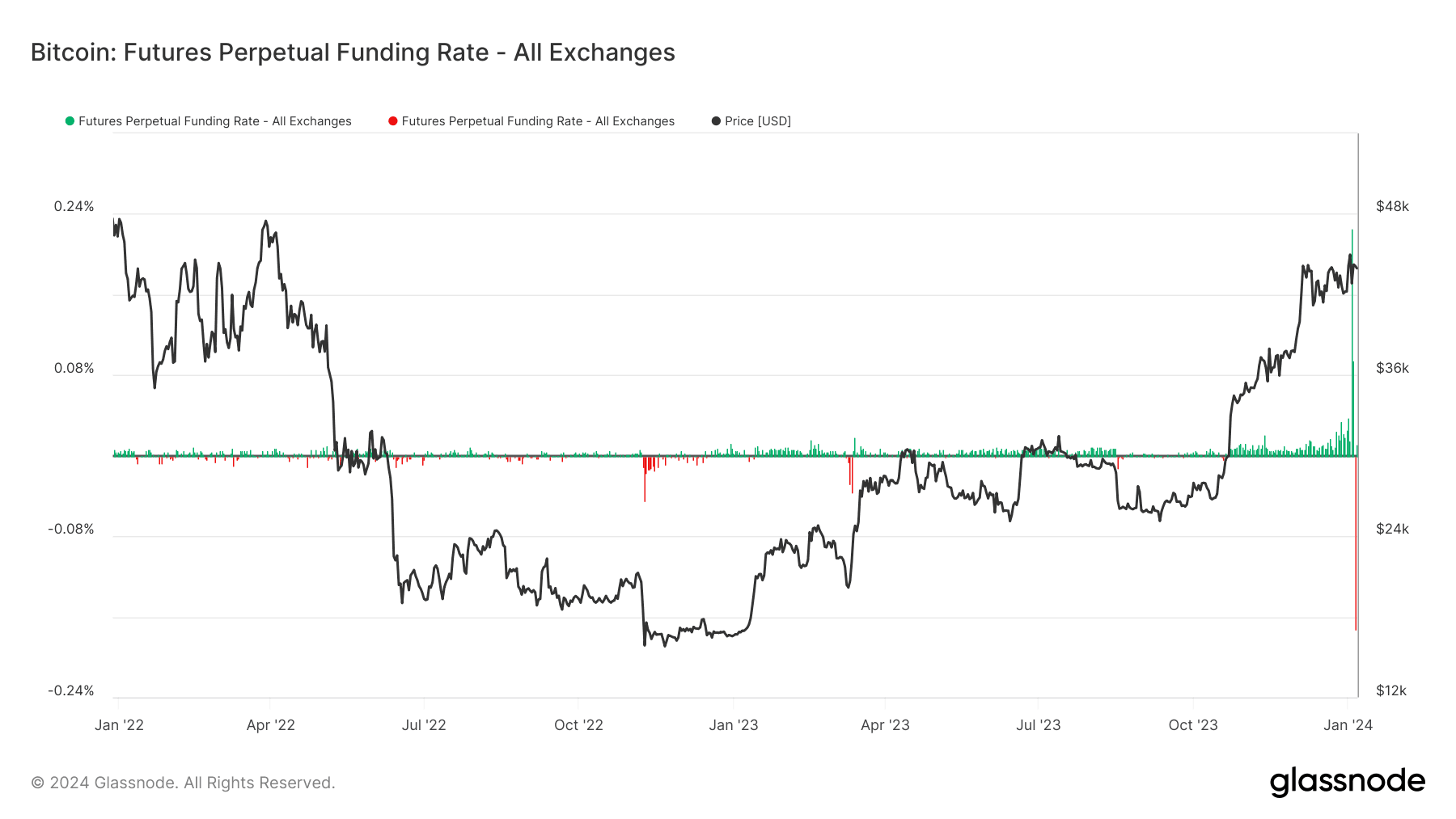

On January 3, crypto-focused financial services platform MatrixPort published a report speculating that the Securities and Exchange Commission (SEC) could reject applications for a spot Bitcoin ETF this month and approve them later in the year because of political headwinds within the agency. Although Bitcoin dropped by 4.8% following the report, the soaring open interest combined with the high funding rate, whose spike can be seen below in Figure 1, also contributed to the short-lived decline. This implied the market was overleveraged and required a corrective flush.

Figure 1: BTC Funding Rate

Source: Glassnode

Conversely, progress seems to prevail as Goldman Sachs is aiming to be an authorized participant for Blackrock and Grayscale, while the SEC met with the NYSE, Nasdaq, and CBOE to discuss amendments triggered in the 11th hour. In addition, multiple asset issuers have also filed 8A forms last week, which could imply that applicants have overcome significant hurdles from the agency’s view. In summary, the outlook for Bitcoin appears robust, with long-term investors—those who have held the asset for over a year—reaching the highest levels (~67%) in Bitcoin's 15-year history, as seen below in Figure 2. This underscores the strong conviction in the asset over the long term

Figure 2: Percentage of BTC supply moved over a year ago

Source: Glassnode

Celsius Begins its Liquidation Procedure

The bankrupt lender submitted a request to unstake 206K ETH, as part of its efforts to pay back creditors. Representing 0.7% of the total staked ETH ($450M), the request could add some selling pressure over the coming weeks. However, it’s worth noting that Celsius will allow in-kind redemptions, meaning that it’ll distribute BTC and ETH holdings to users directly, which means the company won’t have to sell the underlying to meet its obligations. Finally, the decision is also causing a significant surge in the ETH exit validator queue, as shown in Figure 3, which would close to 14 days to fully exit and withdraw now while contributing to an increase in staking yield, bringing it up from ~3.088% to ~3.117%.

Figure 3: Ethereum Validator Queue

Source: Ethereum Validator Queue

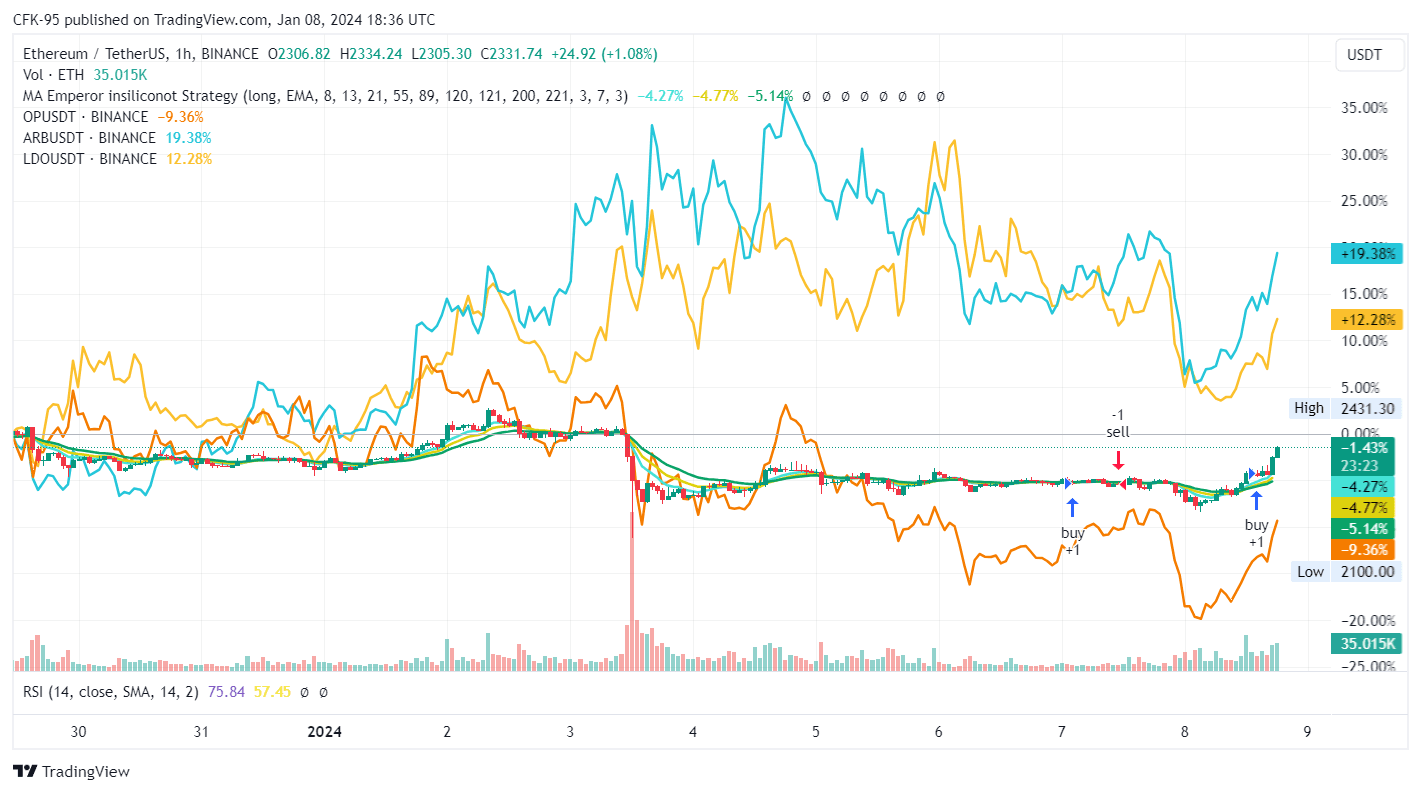

Arbitrum Enhancing Customization Options

Arbitrum has announced that its custom blockchain development solution, Orbit, will allow networks building on top of it to designate their tokens as gas currencies instead of ETH, once they meet specific criteria. The upgrade ensures that networks built on top of Orbit can create utility for their token while offering advanced features like gas subsidy. This level of flexibility puts Arbitrum on par with Cosmos, which makes it a more favorable option amongst developers. However, with the announcement of Arbitrum's optimized architecture and the forthcoming implementation of Ethereum's Dencun upgrade expected in February, there has been a resurgence of interest in Arbitrum, as well as other high-beta plays on the Ethereum network, such as Optimism and Lido, seen below in figure 4. Thus, we expect the aforementioned assets to perform well leading into the upgrade.

Figure 4: Price Action of ETH vs ETH Beta(s) vs SOL

Source: TradingView

This Week’s Calendar

Disclaimer

The information included herein is the express opinion and experience of 21Shares and is provided for discussion purposes only. Past performance is not indicative of future results. Investors should consult with their own advisors for legal, tax, regulatory, financial, accounting, and other aspects relevant to the investment's suitability and potential consequences.

This presentation is for informational and discussion purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security. The information set forth herein does not claim to be complete and is subject to change. This presentation does not constitute a part of any document of any fund and should not be construed as an advertisement or marketing material for any fund.

Certain statements contained in this presentation are based on the expectations, estimates, projections, and opinions of 21Shares. Such statements involve known and unknown risks, uncertainties, and other factors, and reliance should not be placed thereon. This presentation contains “forward-looking statements,” the outcome of which may differ materially from those reflected or contemplated herein.

Certain economic, market, financial, and other information contained herein has been obtained from managers, service partners, and other parties besides 21Shares. While such sources are believed to be reliable, none of 21Shares or any of their respective affiliates or employees assumes any responsibility for the accuracy or completeness of the information contained in this presentation or to update any information contained herein.

Investing in crypto assets, including cryptocurrencies and crypto tokens, carries inherent risks. These assets are considered highly speculative due to their limited history and new technological nature. Future regulatory actions may impact the usability and tradability of crypto assets. The price of crypto assets can be influenced by a small number of holders and may decline in popularity or acceptance, affecting their value.

None of 21Shares nor any of its affiliates have made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and expressly disclaim any responsibility or liability relating thereto.

.jpg)

.svg)

_logo.svg)

.svg.png)