Bitcoin Resilience in Market Volatility: Digital Asset’s Market Reaction and Ethereum’s DeFi Power

Nonfarm Payrolls Fall Short, Digital Assets React

Market expectations took a hit on Friday as the latest nonfarm payroll report revealed weaker-than-expected job growth, igniting fears of a potential recession and heightening economic uncertainty. U.S. employers added 142,000 jobs in August, falling short of the projected 160,000, signaling a further cooling in the labor market. To make matters worse, the Labor Department revised down June and July job numbers, cutting a combined 86,000 positions from previous reports.

This mounting economic uncertainty reverberated across financial markets. The S&P 500 dropped 1.7% on Friday and over 4% for the week, the NASDAQ declined 2.5% on Friday and 5% for the week, while the Dow Jones erased recent gains, ending the week down 3%. Digital assets weren't spared either, as Bitcoin dropped 4% and Ethereum tumbled nearly 6% following the disappointing payroll data. On the institutional side, Bitcoin ETFs saw $1.2 billion in outflows over the eight days leading up to Friday before experiencing a modest rebound with net inflows of $28.6 million on September 9.

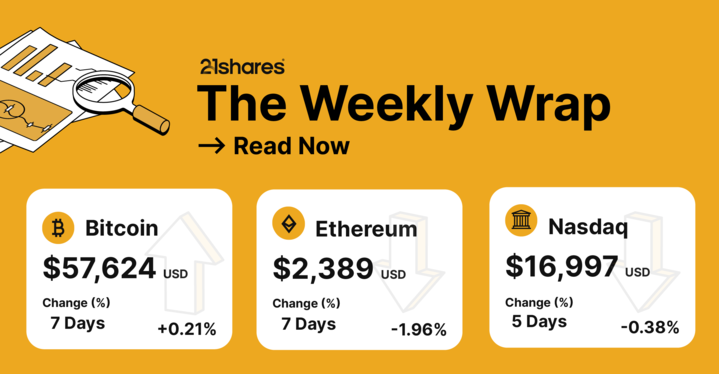

While these initial reactions may seem concerning, the bigger picture offers a more reassuring narrative. Since January 2023, short-term job reports have generally had little lasting impact on Bitcoin's price. Out of 21 nonfarm payroll release dates, Bitcoin posted negative returns on 11 occasions. However, in 8 of those instances, the price rebounded within a week, demonstrating Bitcoin’s resilience. This reflects its role as both a flight-to-quality and flight-to-safety asset during uncertain times.

However, the landscape is shifting. As the Federal Reserve increasingly focuses on economic stability and staving off a recession, employment data is becoming more crucial to market behavior. The Fed’s strategy now heavily relies on labor market performance as a key measure of overall economic health, meaning job reports could have a more pronounced effect moving forward. A weakening labor market may signal deeper economic concerns and heighten fears of a recession, which could lead to increased volatility across both traditional and digital asset markets. This changing dynamic underscores the growing importance of employment data, as both investors and the Fed will likely use it as a guide for future monetary policy decisions—potentially amplifying its impact on Bitcoin and other cryptocurrencies.

Amid this evolving backdrop, a significant rate cut—such as a 50-basis-point reduction—could send shockwaves through the market. While it may signal the Fed’s attempt to jumpstart economic growth, such a drastic move might also fuel fears that the central bank is losing control over inflation and broader economic stability. A rate cut of this magnitude could lead participants to question whether the Fed’s tools are enough to stave off a deeper recession, increasing uncertainty across markets. This uncertainty could lead to heightened volatility in both traditional financial markets and digital assets like Bitcoin, which often act as hedges against economic instability. In this scenario, Bitcoin’s role as a flight-to-quality and flight-to-safety asset may become even more pronounced as investors seek alternatives amid concerns about the Fed’s ability to manage the economic downturn.

Furthermore, as shown in Figure 1, when averaging price returns, Bitcoin has consistently posted positive gains on the day of, the day after, and even a week following nonfarm payroll releases. The data underscores Bitcoin’s evolving role as both a hedge and a flight-to-safety asset during times of uncertainty, further solidifying its position in a diversified portfolio.

Figure 1: Bitcoin’s price return following Nonfarm Payroll release

Source: Yahoo Finance, *9/6/2024-9/10/2024

Nevertheless, despite broader economic turbulence, one crypto-native market has consistently demonstrated resilience: decentralized finance (DeFi). With over $40 billion of assets under management (AUM) in DeFi smart contracts—also known as total value locked (TVL)—on the Ethereum network, DeFi remains a cornerstone of the Ethereum ecosystem and is widely regarded as crypto’s most "killer" use case.

DeFi: Ethereum’s Killer Use Case

DeFi is a financial ecosystem built on blockchain technology that enables individuals to access services without the need for trusted intermediaries. Using smart contracts—self-executing agreements written in code—DeFi allows users to lend, borrow, trade, and earn interest on assets in a secure, transparent, and efficient manner. This decentralized approach not only makes financial services more accessible to anyone with an internet connection, but also reduces costs by eliminating middlemen and ensuring transparency, with all transactions recorded on a public ledger. Operating 24/7, DeFi offers continuous access to financial services, unlike traditional systems bound by business hours, holidays, or geographic restrictions. Its round-the-clock availability supports real-time transactions and broader global participation. Additionally, DeFi provides access to services like stablecoins—tokenized versions of fiat currencies such as the U.S. dollar—which are useful for cross-border payments, remittances, and hedging against volatility. This flexibility gives users greater financial autonomy and opportunities beyond those offered by conventional financial systems.

Some of the use cases of DeFi include:

- Lending and borrowing: Platforms like Aave allow users to lend their assets and earn interest or borrow against collateral, much like traditional bank loans but without intermediaries.

- Trading: Enable users to trade a wide range of cryptocurrencies in a decentralized manner, without the need for centralized intermediaries. Automated market-making (AMM) systems—pioneered by Uniswap—facilitate trades between crypto pairs. In addition to spot trading, many DeFi platforms now offer derivatives trading, allowing users to trade futures, options, and other advanced financial instruments, expanding the range of investment opportunities.

- Stablecoins: Stablecoins such as USDT, USDC, and Maker’s DAI are designed to maintain a stable value by being pegged to assets like the U.S. dollar. These stablecoins provide a reliable way to store and transfer value within the DeFi ecosystem without the volatility associated with traditional cryptocurrencies. They are often used for cross-border transactions, savings, and as collateral in DeFi.

- Prediction Markets: Users can permissionlessly bet on the outcome of real-world events, such as elections, economic reports, or sports, by leveraging the collective knowledge of participants on platforms such as Polymarket. These decentralized markets provide a way to gauge public sentiment and assign probabilities to future events, offering valuable insights for both speculators and analysts.

Why are we talking about them now?

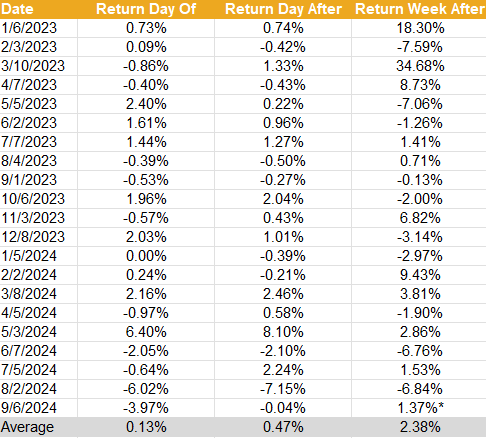

During market downturns and bearish periods, it's essential to take a step back and evaluate which businesses have true fundamental value versus those driven by hype. For instance, DeFi has shown relative resilience compared to other crypto sectors. When analyzing revenue generation across the industry, DeFi protocols consistently stand out, as illustrated below in Figure 2.

Figure 2 – Top 10 Revenue-generating protocols, excluding smart-contracts platforms

Source: DeFiLlama, 21Shares

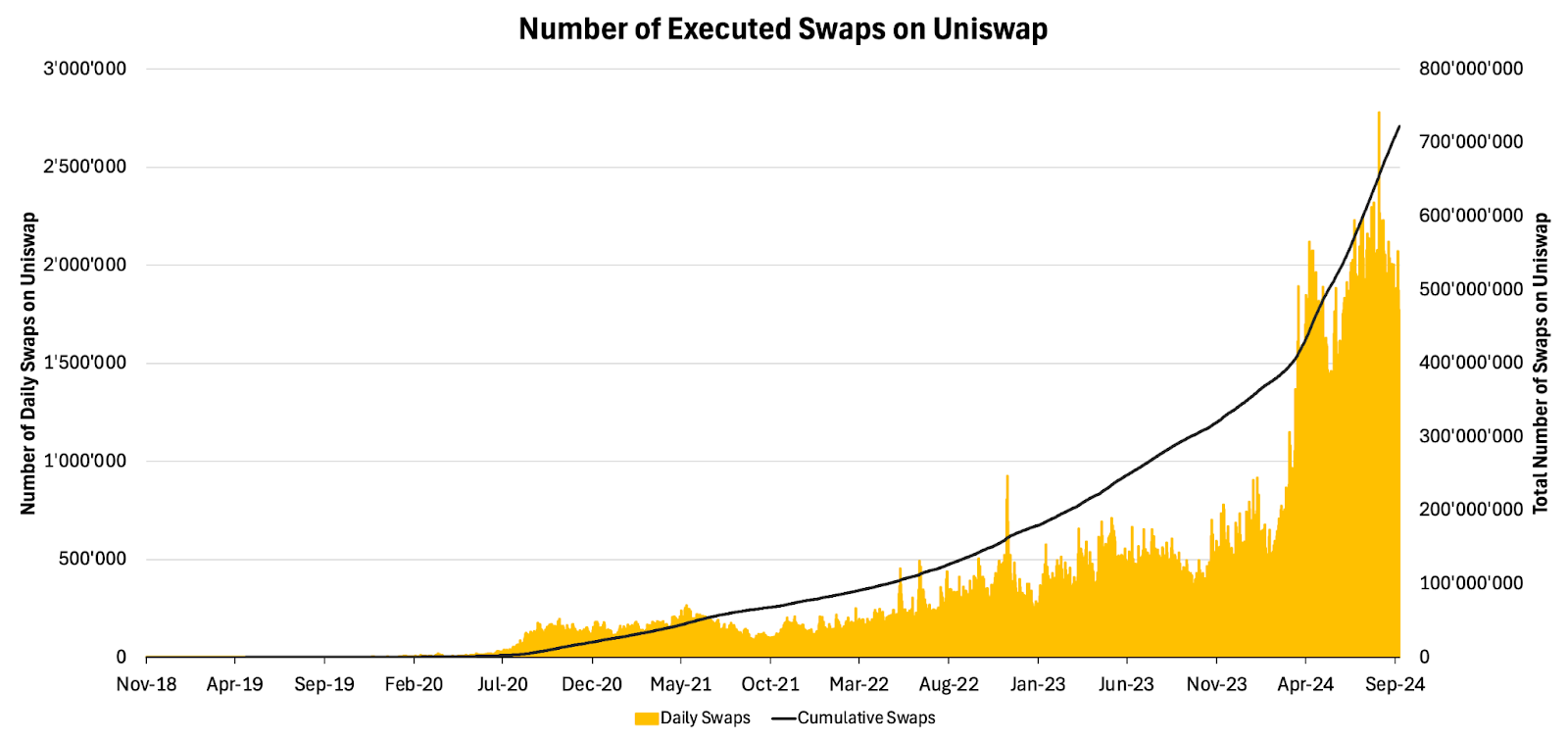

Delving deeper into DeFi, the sector’s growth is best measured by analyzing exchange activity, particularly swap transactions. As exchanges are the primary gateway into DeFi, transaction volume provides a key indicator of the sector's utilization. Currently, users are executing nearly 2 million swap transactions on average, a 10x increase on Uniswap since the digital asset market peak in late 2021.

Figure 3 – Total Number of Swaps/Traded Executed via the Different Iterations of Uniswap

Source: Dune Analytics, 21Shares

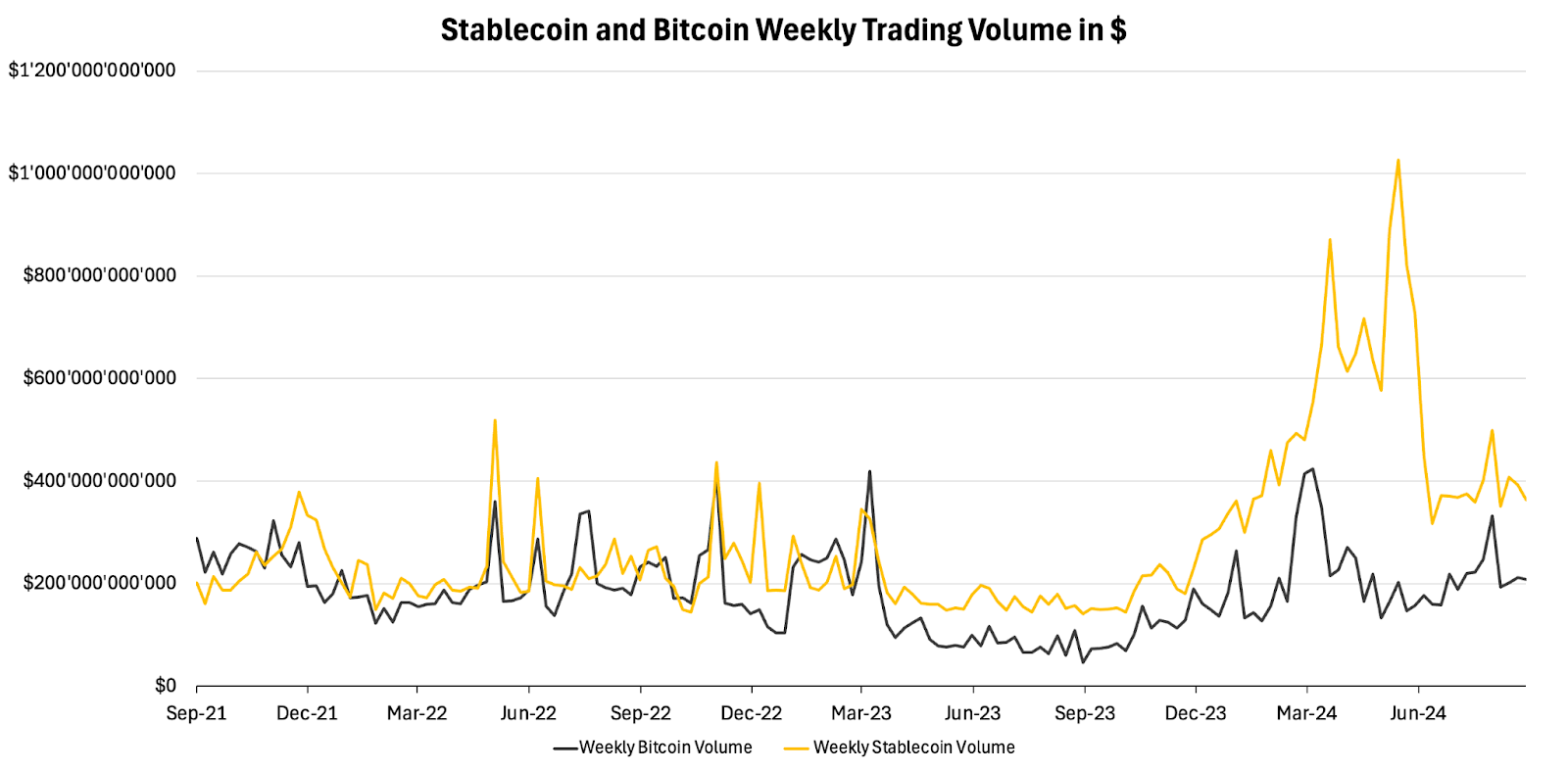

Stablecoins have become the bedrock of the DeFi ecosystem, providing a volatility-free safe haven for crypto capital. Their importance within the space warrants a more in-depth analysis, but for now, let's focus on their impressive growth since the Luna collapse. In Q2 of 2024, for example, Tron processed up to one-third of Visa's annual settlement volume, equivalent to $1.25 trillion.

To put this in perspective, the total stablecoin market capitalization is nearing its all-time high (ATH), surging by approximately 38% from its July 2023 lows to reach $170 billion. Additionally, stablecoins now consistently surpass Bitcoin in daily transaction volume, as highlighted in Figure 4, emphasizing their critical role in enabling efficient, low-cost payments. This utility extends beyond the crypto realm, as seen in their integration with major platforms like Visa, Stripe, and Shopify.

Figure 4 – Weekly Volume of Stablecoins and Bitcoin (USD)

Source: Artemis, 21Shares

DeFi is even drawing the attention of our regulators. On September 10, 2024, the U.S. House Financial Services Committee held its first-ever hearing on decentralized finance (DeFi), titled "Decoding DeFi: Breaking Down the Future of Decentralized Finance." The hearing showcased a deep political divide over the regulation of DeFi. Republicans, led by French Hill, championed DeFi's potential to remove financial intermediaries and create a peer-to-peer financial system, seeing it as a way to protect individual freedoms. In contrast, Democrats, including Brad Sherman and Maxine Waters, raised concerns about DeFi being used for tax evasion, scams, and criminal activities. They highlighted risks such as inadequate consumer protections and regulatory oversight.

Expert witnesses offered a range of views on the future of DeFi. Peter Van Valkenburgh from Coin Center emphasized that regulators have not provided sufficient guidance for the industry, while Amanda Tuminelli from the DeFi Education Fund praised DeFi’s potential to increase financial inclusion by allowing anyone with internet access to participate. The hearing highlighted the urgent need for clear, consistent regulation of DeFi as the industry grows and matures.

The U.S. congressional panel overseeing securities and financial products has a busy September agenda focused on crypto-related issues. Notable events include hearings on SEC enforcement practices and crypto-related scams on September 18, followed by a full committee hearing on September 23, where SEC Chair Gary Gensler and the entire commission are expected to testify. These hearings could have significant implications for the future of crypto regulation in the U.S.

The outcome of these meetings could shape the regulatory landscape for the crypto industry. Key topics like SEC enforcement, DeFi, and crypto scams will be at the forefront of discussions, potentially leading to stricter oversight, clearer rules, and enhanced investor protections. With SEC Chair Gensler and his commission involved, the decisions made during these sessions may directly influence how crypto companies operate and how digital assets are regulated moving forward.

With DeFi showcasing strong fundamentals and garnering mainstream attention, a new catalyst could be emerging that has the potential to positively impact both DeFi and the broader crypto markets.

…Enter Vice President Kamala Harris and former President Trump!

The market is now turning its attention to the upcoming U.S. presidential election. While the economy remains a focal point, the candidates’ positions on crypto could significantly shape the future of DeFi and digital assets. Vice President Harris’s stance on crypto remains unclear, but former President Trump has been a vocal supporter of DeFi and the broader crypto space. Former President Trump announced his plans for a strategic bitcoin reserve earlier this year at the Bitcoin Conference, and his family’s involvement in a borrow-lending DeFi project called World Liberty Financial further underscores his commitment to the sector.

All eyes were on last night’s debate between Vice President Kamala Harris and former President Trump. Trump began with a 7% lead over Harris on Polymarket, a crypto prediction platform with over $870 million wagered on the election outcome. However, as the debate unfolded, Trump’s lead quickly eroded. By the end, Harris had overtaken him, and Trump ended the night 3% lower than where he started.

As illustrated in Figure 5, Bitcoin's price movements closely mirrored the shifting Polymarket odds, responding in real-time to changes in the perception of Trump’s chances of victory. At the start of the debate, Trump held a lead with odds at 52%, while Bitcoin was priced at $57,616. As the debate unfolded, Trump's odds steadily declined to 48.6%, while Bitcoin experienced a corresponding dip, reaching a low of $56,731. Meanwhile, Kamala Harris, who began the night with odds of 46.%, saw her chances improve to 49.3%, reflecting a shift in market sentiment. This parallel movement between the odds and Bitcoin's price underscores how closely the crypto market tracks political developments, especially during key events that could influence future regulation or economic policy.

Bitcoin, often viewed as a hedge against political instability and currency debasement, reacted dynamically to the changing odds. While it is a neutral, bipartisan asset in the long term, Bitcoin’s short-term volatility often reflects market sentiment during periods of uncertainty. The debate created an environment where traders and investors were closely watching both political and market outcomes, and Bitcoin’s price fluctuations during the event were a clear response to the evolving predictions. This highlights the growing role of crypto in reacting to geopolitical events, reinforcing its position as a sensitive indicator of broader economic and political risks.

Figure 5 – Polymarket Odds (Left) and Bitcoin Price (Right): 10-Minute Intervals from One Hour Before to 1.5 Hours After the Trump vs. Kamala Debate

Source: Polymarket

Although Bitcoin may show short-term reactions to specific events, it remains a neutral, bipartisan asset, serving as a hedge against currency debasement and political instability. Its ability to respond to political moments like the debate underscores its sensitivity to market sentiment, yet Bitcoin's true strength lies in its role as a long-term safeguard against broader systemic risks and uncertain times. Bitcoin is increasingly viewed as both a flight-to-quality and flight-to-safety asset during uncertain times, as demonstrated during the regional banking crisis in March 2023, when investors turned to Bitcoin as a hedge against traditional financial system risks and instability. Regardless of the political outcome, Bitcoin's value proposition remains compelling, making it a valuable addition to a diversified portfolio due to its unique properties and resilience.

Market Sentiment Gauge: Fear and Greed Index

A glance at the Fear & Greed Index, a multifactorial tool that analyzes crypto market sentiment, shows the market is currently in a state of fear, with a reading of 37. While still reflecting caution, this marks an improvement from last week's value of 27, which was bordering on extreme fear. As Warren Buffett famously advised, “Be fearful when others are greedy and greedy when others are fearful,” a reminder that fear in the market can present opportunities.

Figure 6: Crypto Market Fear & Greed Index

Source: Alternative.me

What’s happening this week?

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof. All content provided by 21Shares is intended for informational and educational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Investments associated with crypto assets, such as cryptocurrencies and crypto tokens, involve risk. These assets are considered highly speculative due to their limited history and new technological nature. Future regulatory actions may impact the usability and tradability of crypto assets. The price of crypto assets can be influenced by a small number of holders and may decline in popularity or acceptance, affecting their value. For full disclosures, please visit our Disclaimers and Terms &Conditions pages.

.jpg)

.svg)

_logo.svg)

.svg.png)