.png)

Launched in 2020 and founded by the Web3 Foundation alongside Dr. Gavin Wood, a co-founder of Ethereum and the visionary architect behind Ethereum's infrastructure, including its Solidity programming language, Polkadot is a leading Layer 0 (L0) blockchain platform designed for interoperability and scalability. It connects multiple Layer 1 (L1) blockchains, or parachains, within its ecosystem, enabling secure data and asset exchanges through its Cross-Consensus Message Format (XCM) messaging system, providing the foundation for building customizable and collaborative blockchain applications that are interoperable straight out of the box. DOT, its native gas token, is used for transaction fees, governance, network security, and staking - in turn empowering the Polkadot ecosystem. With a rapidly growing ecosystem, Polkadot now supports a community of over 3 million users, underscoring its widespread adoption and influence in the L0 landscape.

Figure 1: Dot Holder Count (1-Year)

Source: 21Shares, Polkadot.subscan

Polkadot's network of parachains, each optimized for specific use cases, operates seamlessly on its shared L0 infrastructure. These parachains are developed using Substrate, an open-source, modular framework that simplifies the creation of interconnected blockchains. With over 150 projects spanning DeFi (Decentralized Finance), gaming, Artificial Intelligence (AI), and beyond, Polkadot has become a thriving hub for blockchain innovation, powered by its native token, DOT, and offering a foundation for building customizable, interoperable, and collaborative blockchain applications.

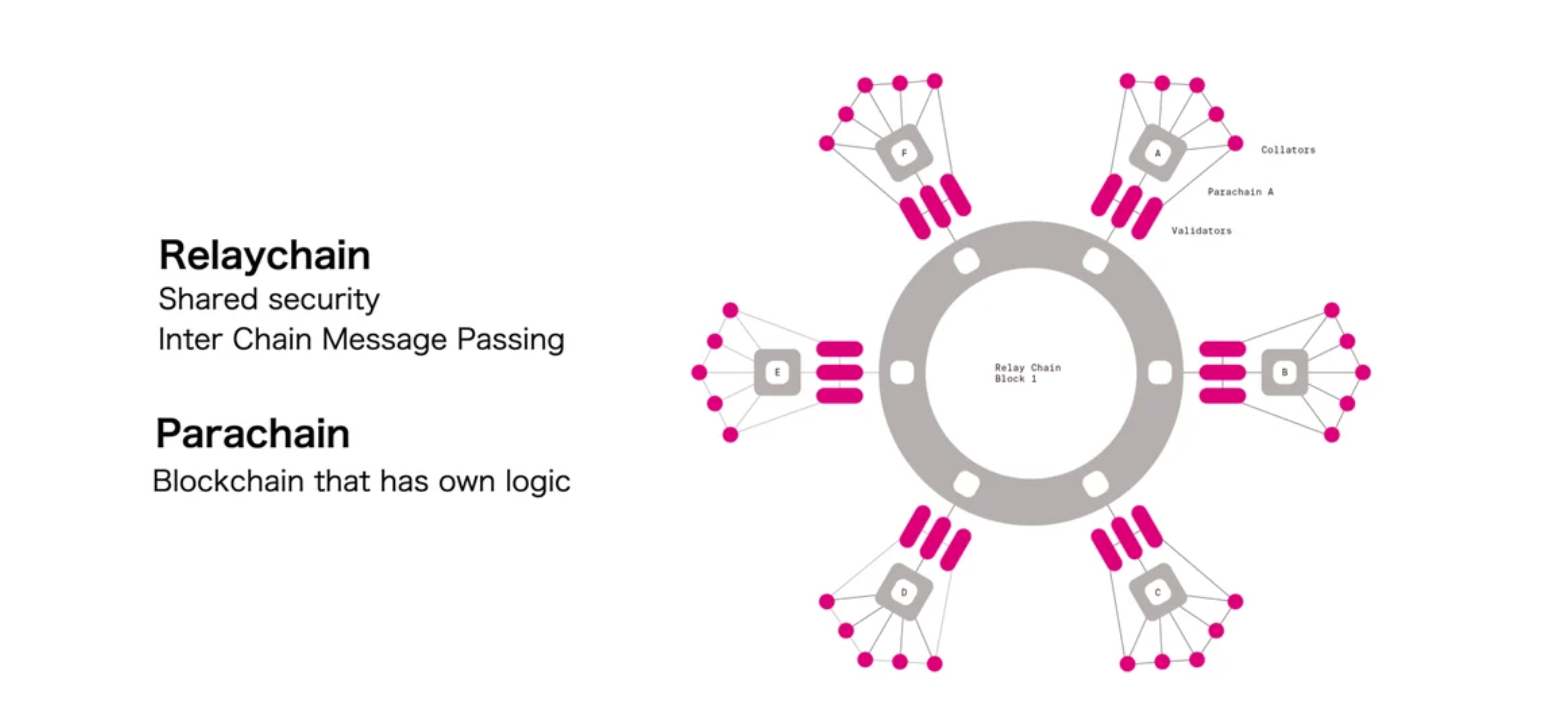

At its core is the Relay Chain, which provides the network's consensus, security, and interoperability, while independent blockchains called Parachains connect to it, leveraging shared security without needing their own consensus mechanisms. Additionally, Parathreads offer a pay-as-you-go model for blockchains that require less continuous connectivity, and bridges facilitate communication with external blockchains like Ethereum or Bitcoin. Polkadot uses a Nominated Proof-of-Stake (NPoS) consensus mechanism, where validators secure the network and nominators stake DOT (Polkadot's native token) to support them. Validators assume the role of producing new blocks, validating parachain blocks, and guaranteeing finality. Nominators can choose to backselect validators with their stake. Nominators can approve candidates that they trust and back them with their tokens.

Through Cross-Chain Message Passing (XCMP), parachains communicate seamlessly, enhancing interoperability, while the parallel processing of parachains and parathreads boosts scalability. Developers can customize parachains for specific use cases such as DeFi, gaming, and AI, benefiting from Polkadot’s energy efficiency, on-chain governance, and robust shared security model. Ultimately, Polkadot serves as a “blockchain of blockchains,” enabling collaboration across networks and fostering innovation across diverse applications.

Before diving deeper into Polkadot, let’s first take a moment to explore what a L0 blockchain is and how it differs from a L1 blockchain.

Figure 2: Polkadot Infrastructure

Source: 21Shares, Polkadot

Layer 0 and Layer 1 Blockchains

A Layer 0 blockchain acts as the foundational infrastructure for building multiple L1 blockchains. It provides essential features such as cross-chain communication, interoperability, and shared security, enabling various L1s to interact and operate more efficiently. In addition, L0 blockchains offer tools and infrastructure straight out of the box, allowing users to customize L1 blockchains for specific purposes or sectors, such as DeFi or AI. They also support the creation of app-specific L1s tailored to the unique requirements of individual applications. Examples of L0 blockchains include Polkadot, Cosmos, and Avalanche, which we will explore in more depth later.

In contrast, a Layer 1 blockchain is the base layer or main network in a blockchain ecosystem. It is the foundational blockchain protocol responsible for processing transactions, maintaining its own ledger, and ensuring the security and decentralization of the network Examples include Bitcoin, Ethereum, and Solana. These blockchains are self-contained and can operate independently, but often require additional infrastructure or protocols to enable cross-chain capabilities.

To put it simply, a L0 is like the internet itself, providing the underlying infrastructure and protocols that connect different websites. A L1 blockchain, on the other hand, is like an individual website or platform that runs on that internet infrastructure, delivering specific services and functionalities.

Relay Chain (Layer 0) and Parachains (Layer 1 Blockchains Powered by Polkadot's Infrastructure)

The relay chain serves as the central backbone of the Polkadot network and can be seen as the L0, serving as the hub that ensures security, consensus, and interoperability among its connected parachains. Designed for simplicity, the relay chain supports only a limited set of transaction types, such as those related to governance and participation in Polkadot's NPoS mechanism. All validators are staked in DOT on the relay chain and work to validate its transactions. The relay chain’s primary role is the ecosystem coordinating the overall system. More specialized tasks are handled by parachains, which are designed with diverse implementations and unique features to complement the relay chain's minimalistic approach.

Parachains are specialized L1 blockchains built on Polkadot’s L0 infrastructure, designed to operate seamlessly within the network’s ecosystem. These parachains run in parallel to the relay chain and are tailored for specific use cases or industries, such as DeFi, gaming, or AI. Parachains leverage Polkadot’s shared security model, cross-chain interoperability, and scalability, enabling them to focus on their unique functionalities while benefiting from the broader network's stability and connectivity. The relay chain places no constraints over what parachains can do; besides that, they must be able to generate a proof that can be validated by the validators assigned to the parachain. This modular approach allows developers to create app-specific or sector-specific blockchains optimized for their needs without having to build the foundational infrastructure from scratch.

In short, the relay chain in Polkadot is like the main hub of a train network—it keeps everything organized and running on schedule. Parachains are like individual train lines, each designed for specific routes and purposes, while the hub focuses on coordinating the entire system.

Ecosystem

Polkadot boasts a vast and dynamic ecosystem, with over 150 projects leveraging its L0 technology to develop their own L1 blockchains. Here are some of the most innovative projects harnessing the Polkadot tech stack.

Figure 3: Polkadot Ecosystem

Source: Polkadot Insider

NueroWeb

NeuroWeb is a L1 blockchain built as a parachain on Polkadot, designed to advance decentralized AI through its unique Decentralized Knowledge Graph (DKG). Evolving from OriginTrail’s Ethereum-based technology, NeuroWeb is now optimized for Polkadot’s ecosystem to leverage shared security, scalability, and interoperability. It aims to establish a trustless, verifiable data infrastructure for AI, addressing critical challenges like misinformation, data integrity, and ethical AI usage. At its core, NeuroWeb incentivizes "Knowledge Mining," where participants contribute verified data—termed "Knowledge Assets"—and earn its native token, NEURO (formerly TRAC from OriginTrail). These assets form an interconnected graph of trustworthy data points, ensuring AI models operate with transparency and provenance. The project has strong real-world applications, from combating deepfakes and protecting intellectual property to enhancing online safety by "fingerprinting" digital content at scale.

By integrating with Polkadot, NeuroWeb benefits from Relay Chain security, cost-efficient scaling, and cross-chain interoperability through Polkadot’s XCM format, allowing seamless connectivity with other parachains and external networks. Built on Substrate, it inherits flexibility and modularity, tailoring its consensus mechanism—a hybrid of Proof-of-Authority transitioning to Nominated Proof-of-Stake—to suit its AI-driven use case. This strategic alignment with Polkadot positions NeuroWeb as a pioneering force in decentralized AI, bridging the gap between blockchain technology and verifiable, trustworthy AI systems.

Hydration

Hydration, previously HydraDX, is a decentralized exchange (DEX) and DeFi protocol built as a parachain on Polkadot, harnessing its interoperability and scalability. Its flagship innovation, the Omnipool, consolidates all supported assets into a single liquidity pool, minimizing slippage and enabling single-sided liquidity provision—users can deposit one token and earn rewards without pairing, making it highly accessible. Built on Polkadot’s Substrate framework, Hydration leverages the relay chain’s security and XCM for seamless cross-chain support of assets like DOT and USDC, with its HDX token powering governance and incentives. This unified pool design sets it apart from traditional DEXs, optimizing trading efficiency and flexibility.

Beyond swaps, Hydration integrates advanced features like lending and the Hollar stablecoin, evolving into a comprehensive DeFi appchain. Its November 2024 borrowing platform introduces over-collateralized loans with on-chain prioritized liquidations, reducing risks during market swings. With trading volume approaching $1 billion as of March 2025, and features like direct stablecoin deposits from centralized exchanges such as Binance, Hydration’s adoption is accelerating—weekly volumes have tripled since 2024. It stands as a key liquidity hub on Polkadot, driving DeFi innovation with cutting-edge, user-centric solutions.

Peaq Network

Going live earlier this year, the Peaq Network is a decentralized infrastructure tailored for the Decentralized Physical Infrastructure Networks (DePIN) ecosystem, enabling machines and devices to autonomously operate, transact, and generate value. Built on the Polkadot ecosystem, Peaq provides a scalable and interoperable framework for creating decentralized applications (dApps) and integrating machine identities, fostering secure and trustless interactions. By aligning tokenomics with the incentivization of building and maintaining physical infrastructure, Peaq empowers contributors to monetize their efforts in areas like mobility, energy grids, and other decentralized services. Its focus on DePIN positions it as a critical enabler for a future of autonomous and collaborative physical networks.

Expanding the Polkadot Ecosystem: External Projects Adopting Its SDK

Beyond the Polkadot ecosystem, innovative projects like Avail and Cardano Midnight are leveraging Polkadot's robust technology to enhance their own frameworks, demonstrating the versatility of Polkadot’s infrastructure Avail, an Ethereum Virtual Machine (EVM) native project, functions as a data availability bridge for Ethereum rollups, leveraging Polkadot’s modular Substrate framework to deliver scalable and secure data management beyond the traditional parachain structure.

Similarly, Cardano Midnight, a privacy-focused sidechain within the Cardano ecosystem, builds on Polkadot’s Substrate to enable secure, regulation-friendly smart contracts powered by advanced zero-knowledge proofs. This allows it to interoperate seamlessly with chains like Bitcoin and Ethereum. These projects highlight how Polkadot’s technology transcends its native ecosystem, empowering external blockchains to address scalability, privacy, and interoperability challenges effectively.

Competitor Landscape

The L0 blockchain landscape has become increasingly competitive as projects vie to provide the most robust solutions for interoperability and scalability. The leading L0 blockchains currently are Polkadot, Avalanche, and Cosmos.

Figure 4: Layer 0 Market Caps, DOT vs AVAX vs ATOM

Source: 21Shares

Avalanche

Launched in September 2020, Avalanche is a high-performance blockchain platform designed to tackle scalability, speed, and decentralization challenges through its unique Avalanche Consensus, enabling near-instant finality with strong security. Its modular design allows for customizable subnets, letting developers create blockchains tailored to specific use cases such as DeFi, gaming, and enterprise applications. The network comprises three specialized chains: the Exchange Chain (X-Chain) for asset exchange, the Platform Chain (P-Chain) for staking, and the Contract Chain (C-Chain) for smart contracts. Avalanche's native token, AVAX, is central to staking, fees, and governance, while its EVM compatibility has facilitated the migration of Ethereum-based dApps to its faster and more cost-efficient ecosystem.

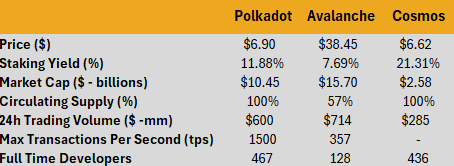

Polkadot, in contrast, focuses on interoperability and shared security through its Relay Chain and a network of independent parachains. These parachains rely on Polkadot’s shared validator pool, reducing resource requirements while enabling seamless cross-chain communication. Polkadot’s architecture encourages innovation by allowing parachains to operate independently while benefiting from the security and connectivity of the broader network. While Avalanche prioritizes throughput and flexibility via subnets, Polkadot excels at fostering collaboration and resource efficiency, making both platforms complementary yet distinct in their approaches to addressing blockchain challenges. Furthermore, it should be noted that Polkadot actually has a higher max throughput than Avalanche, with Polkadot clocking in at 1500 transactions per second (TPS) vs Avalanche’s 357.

Cosmos

Cosmos, launched in March 2019, often referred to as the "Internet of Blockchains," is a decentralized network that enables interoperability between independent blockchains. Its architecture is built around the Cosmos Hub and interconnected zones, each operating as a sovereign blockchain tailored to specific applications. The Tendermint Byzantine Fault Tolerance (BFT) consensus algorithm underpins the network, ensuring high performance and security. Developers can utilize the Cosmos Software Development Kit (SDK) to create custom blockchains, while the Inter-Blockchain Communication (IBC) protocol facilitates seamless communication and token transfers between these chains.

While both Cosmos and Polkadot aim to create interconnected blockchain ecosystems, their approaches differ. Cosmos emphasizes sovereignty and modularity with its hub-and-zone model, allowing blockchains to maintain independence. Polkadot, in contrast, focuses on shared security and scalability through its sharded design, making the choice between the two dependent on specific project needs, such as independent governance or unified security.

Figure 5: Polkadot Metrics

Source: 21Shares, Chainspect, Token Terminal

Polkadot stands out as a formidable L0 blockchain due to its unique combination of shared security, scalability, and interoperability. Unlike Avalanche, which emphasizes customizable subnets, Polkadot’s architecture uses a central Relay Chain to provide unified security to all connected parachains, reducing resource requirements and enhancing the overall network's resilience. Additionally, while Cosmos prioritizes sovereignty with its hub-and-zone model, Polkadot offers seamless cross-chain communication through its built-in interoperability features, enabling parachains to collaborate efficiently without sacrificing security or scalability.

Polkadot further distinguishes itself by offering a higher staking yield than Avalanche (11.88% vs. 7.69% as seen in figure 5 above) while maintaining a sustainable tokenomics model, avoiding the hyperinflationary tendencies seen in Cosmos. With a maximum throughput of 1,500 transactions per second (TPS), Polkadot surpasses the performance of Avalanche and Cosmos, delivering unmatched throughput and scalability amongst L0 chains. Its robust developer community continually enhances the ecosystem, while its deep liquidity attracts projects and investors alike, creating a vibrant, interconnected network. Coupled with its robust governance framework and the ability to integrate with external networks via bridges, Polkadot is an all-encompassing solution for projects requiring scalability, security, and interoperability, making it a clear standout among L0 blockchains.

Valuation Metric

Valuing L0 blockchains is particularly challenging due to their foundational role in the blockchain ecosystem. L1 blockchains are often seen as the "picks and shovels" of crypto, providing the infrastructure for dApps much like the tools enabling a gold rush. By extension, L0 blockchains can be thought of as the "picks and shovels of the picks and shovels," supplying the infrastructure that supports L1s, which adds an additional layer of complexity to their valuation.

A parallel can also be drawn to traditional finance: L1 blockchains are comparable to ETF products like QQQ or XLK, representing growth and tech sectors, where dApps are akin to individual companies within the ETF. In this analogy, L0s act as a "fund of funds" for growth and tech ETFs, aggregating the value and functionality of multiple L1s, just as a fund of funds invests in multiple ETFs. Given this layered dependency, a relative value comparison framework becomes essential to effectively assess the worth of L0 blockchains.

Layer 0 Relative Valuation

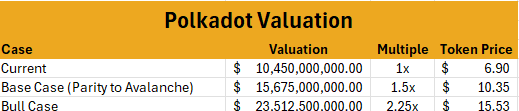

Unlike L1 blockchains, which have an established "gold standard" in Ethereum, L0 blockchains lack a clear benchmark, making relative comparisons between L0s a practical approach. Among the leading L0s, Polkadot and Avalanche stand out based on market metrics such as market capitalization and trading volume, as well as fundamental metrics like chain activity and ecosystem development. Currently, Avalanche is valued at 1.5 times Polkadot’s market cap, offering a basis for comparison.

Polkadot, however, boasts an ecosystem that is arguably as robust as Avalanche's, alongside a larger and more active developer community. With the upcoming Polkadot 2.0 upgrades poised to significantly enhance its technological capabilities, a bullish case can be made for Polkadot achieving a valuation 1.5x that of Avalanche, or a 2.25x of Polkadot’s current valuation. In a more conservative scenario or a base case, a 1:1 valuation parity with Avalanche could also be justified. These valuation multiples are illustrated in the graph below

Figure 6: Polkadot-Avalanche Comps

Source: 21Shares

Layer 1 Relative Valuation

While comparing the value of L0 blockchains to L1 blockchains isn’t a perfect 1:1 comparison, it provides a useful framework for understanding their potential scope. The combined valuation of the top five L1 blockchains, excluding Bitcoin, stands at approximately $640 billion. While we are not suggesting that Polkadot will reach this level, a relative valuation approach can still be applied. For instance, using the lowest market cap among the top five L1s—Tron, at $21 billion—a modest 2x multiple would value Polkadot at $21 billion, translating to roughly $14 per DOT.

Previous Levels

When estimating the potential value of a blockchain network if its token were to reach its previous all-time high, it’s important to account for factors that can significantly affect its market dynamics. A common mistake is to simply take a multiple of the token's previous market capitalization and assume the same price per token. However, this approach overlooks critical factors like token dilution, staking yields, and incentive programs, all of which can impact a token’s circulating supply and value over time.

Therefore, when analyzing a token’s potential future value, it’s essential to factor in these mechanisms and their effects on the token's supply and price dynamics. Simply assuming a return to the previous market cap without adjusting for dilution would lead to unrealistic price expectations, as the value is now distributed across a larger number of tokens.

Previous Market Cap All-Time High: Polkadot’s previous all-time high valuation reached $56 billion, representing approximately a 5.5x increase from its current valuation. At this multiple, the price of DOT would equate to roughly $38 per token, notably lower than its previous all-time high price of $56 per token due to factors like token dilution and changes in the circulating supply as stated above.

Previous DOT Token All-Time High: DOT’s previous all-time high price was $55, representing roughly an 8x increase from its current value. At this price, the Polkadot network would reach a total market cap of $88 billion—a significant increase compared to its previous all-time high market cap of $56 billion. This valuation would place Polkadot in a league similar to Solana, Cardano, and Binance Smart Chain during the peak of the 2021 bull run, reflecting the impact of factors like token dilution and increased circulating supply over time.

Investment Case

DOT stands out as a unique investment opportunity in the cryptocurrency space, offering diversification benefits, compelling staking rewards, and long-term resilience.

Its relatively low correlation to traditional and crypto assets—0.16 with the S&P 500, -0.34 with Bitcoin, and 0.41 with Ethereum—suggests that DOT can act as a portfolio diversifier, reducing exposure to broader market trends. Additionally, Polkadot provides an attractive staking yield of 11.88%, though its 30-day lockup period poses a liquidity risk unless mitigated with strategies like hedging through DOT-USD(T) perpetual contracts. Only if DOT were to hit its previous all-time high, the current staking yield of 11.88% could, in theory, translate to an effective 100% return on an APR basis if staked at today’s prices and later sold at the peak, showcasing the substantial upside potential.

As a leading L0 blockchain focused on interoperability and scalability, Polkadot offers exposure to the growing demand for cross-chain solutions, making it a key player in the L0 diversification thesis. Having been through multiple market cycles since its launch in 2020, Polkadot has demonstrated resilience and adaptability, establishing itself as a staple in the crypto ecosystem. With its current price sitting roughly 9x below its previous all-time high, DOT presents significant potential upside as the market matures and its ecosystem continues to expand.

Figure 7: 30-Day Rolling Correlation, DOT vs BTC, DOT vs ETH, DOT vs SPX

Source: 21Shares, Yahoo Finance, Coingecko

.svg)

_logo.svg)

.svg.png)