Market and Crypto Selloff After Disappointing Jobs Report: Will the Fed's Next Move Stabilize Risk Assets

Market expectations were dashed on Friday as the latest nonfarm payroll report revealed weaker-than-expected job growth. In August, U.S. employers added only 142,000 jobs, missing the projected estimate of 160,000, signaling further cooling in the labor market. Adding to the disappointment, the Labor Department significantly revised down the job numbers for June and July. July’s job numbers were revised downward from 114,000 to 89,000, while June’s figures were adjusted from 179,000 to 118,000—resulting in a combined total of 86,000 fewer jobs than originally reported.

Figure 1: MoM Changes in US Jobs

How Did the Markets React to the Latest Jobs Report?

The markets took a significant hit, with the S&P 500 dropping 1.7% for the day and over 4% for the week. The NASDAQ fared even worse, closing down more than 2.5% on the day and 5% for the week. Meanwhile, the Dow Jones Industrial Average fell by 1%, erasing its gains from the past two weeks and finishing the week down 3%.

Several factors likely contributed to the negative market reaction:

- Slowing Economic Momentum: The lower-than-expected job growth signals that the economy might be losing steam. If businesses are hiring less, it reflects reduced demand and lower confidence in future growth, which can have a negative impact on corporate profits. This makes investors nervous about future earnings and economic stability.

- Increased Recession Risk: A softer labor market heightens fears of an economic downturn. When job growth slows, it can serve as an early indicator of broader economic challenges, leading investors to sell off risk assets in anticipation of reduced consumer spending and slower growth.

- Uncertainty Around Federal Reserve Policy: The weaker jobs report has raised questions about whether the Fed will cut rates by 25 or 50 basis points. While slower job growth may justify a larger cut, inflation concerns could lead the Fed to opt for a more cautious 25 bps reduction. This ongoing uncertainty is adding to market volatility as investors try to gauge the Fed’s next move.

- Market Sentiment: The downward revisions to the June and July job numbers compounded the negative sentiment. Investors were already grappling with economic uncertainties, and the revisions only deepened concerns that the labor market's slowdown could be more persistent than expected.

Overall, the disappointing data fueled concerns about an economic slowdown and heightened uncertainty around future monetary policy, leading to the market’s negative response.

Market participants were highly focused on the latest job data ahead of the Fed’s September 18 meeting, where a rate cut is widely expected. Some argue that the weaker labor market strengthens the case for a larger cut, with advocates pushing for a 50 basis point (bps) reduction to further stimulate the economy. However, others contend that a 25 bps cut would be more appropriate, as the slowdown in job growth isn't significant enough to justify a more aggressive move.

Despite weaker job numbers, pockets of optimism remain in the market. Some interpret the data as signaling a potential "soft landing" for the economy—where growth is decelerating but not coming to a halt. This outlook alleviates recession fears and allows the Federal Reserve to take a more measured approach to monetary policy. According to the CME FedWatch Tool, the market is now pricing in a 73% chance of a 25 bps rate cut, while the probability of a 50 bps cut has fallen to 27%, down from last month’s estimate of 51%.

Looking Ahead: The Next Moves for Markets and the Fed

Attention is now turning to the upcoming Consumer Price Index (CPI) report, which will be crucial in shaping the Federal Reserve’s next move. A lower-than-expected CPI could pave the way for a larger rate cut, offering much-needed relief to the markets. As the CPI tracks changes in the prices of goods and services, it will provide valuable insights into inflationary pressures.

If inflation remains elevated or exceeds expectations, the Fed may have to rethink its approach, potentially delaying rate cuts or even tightening policy further. On the other hand, a softer CPI reading would support the case for a more significant rate cut, signaling that inflation is under control and giving the Fed more flexibility to ease monetary policy without reigniting inflation concerns. This makes the upcoming CPI report a pivotal factor for both policymakers and investors as they assess the future direction of interest rates and the broader economic outlook.

Did This Bleed Over Into Digital Assets?

Digital assets were not spared from the broader selloff, with Bitcoin (BTC) closing down 4% and Ethereum (ETH) falling nearly 6%. This reaction underscores growing concerns about the health of the U.S. economy and its potential impact on risk assets. When job growth falls short of expectations and economic data points to a slowdown, investors often shift away from higher-risk assets. As a result, assets further down the risk spectrum, like BTC and ETH, are typically among the first to be sold off in favor of safer alternatives such as bonds or cash. However, these sell-offs are usually short-lived.

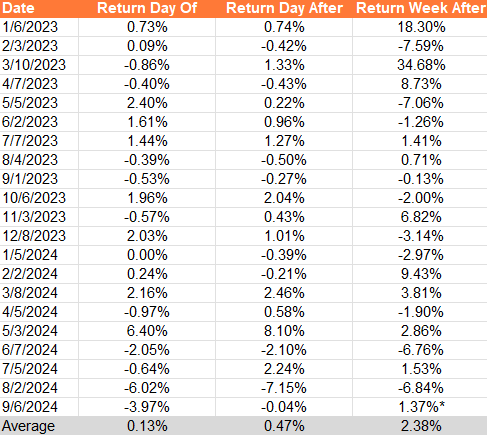

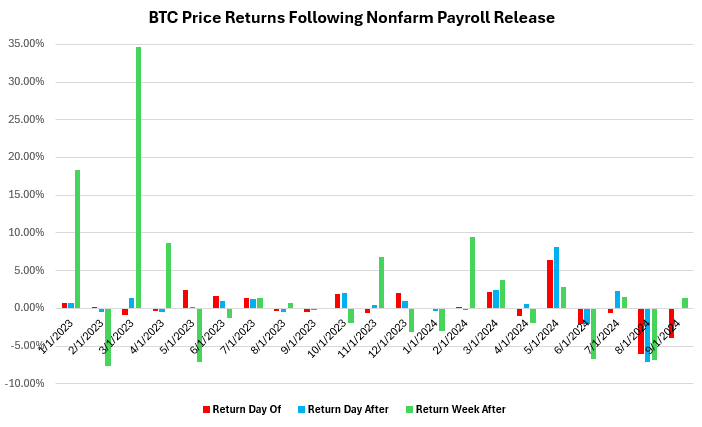

Figure 2: Bitcoin’s Price Return With Respect to Nonfarm Payroll Release

While initial reactions may seem concerning, the bigger picture tells a different story. Looking at nonfarm payroll data since January 2023, short-term job reports tend to have little lasting impact on Bitcoin's price. Out of 21 nonfarm payroll release dates, Bitcoin posted negative returns on 11 occasions. However, in 8 of those instances, the price recovered within a week, demonstrating Bitcoin’s resilience. This behavior reflects its role as both a flight-to-quality and a flight-to-safety asset during uncertain times. Furthermore, as shown in Figure 2, when averaging price returns, Bitcoin has consistently posted positive gains on the day of, the day after, and even a week following nonfarm payroll releases. This reinforces Bitcoin’s growing reputation as a hedge during times of uncertainty. As seen in Figure 3, Bitcoin posted double-digit outsized gains a week after the January and March 2023 payroll releases—events tied to the bear market bottom in January and the regional bank crash in March, when Bitcoin surged as an appealing alternative to traditional banks.

As the latest nonfarm payroll data sparks concerns about a cooling labor market and fuels a broader market selloff, Bitcoin’s performance provides a contrasting narrative. Historically, Bitcoin has demonstrated resilience in the face of short-term economic fluctuations, often recovering quickly from initial sell-offs. The data underscores Bitcoin’s evolving role as both a hedge and a flight-to-safety asset during times of uncertainty, further solidifying its position in the financial landscape and in a diversified portfolio. As investors weigh the potential for future rate cuts and monitor upcoming economic indicators like the CPI report, Bitcoin remains a compelling alternative, particularly in periods of heightened market volatility and economic stress.

Figure 3: Histogram of Bitcoin’s Price Return With Respect to Nonfarm Payroll Release

.svg)

_logo.svg)

.svg.png)