Bitcoin's Bullish Reversal Hints at Potential Short Squeeze

.webp)

Market Outlook

The total market value has been oscillating with a shy increase in total value by 1.8% week over week. The most important metrics reflecting the state of the Bitcoin market are:

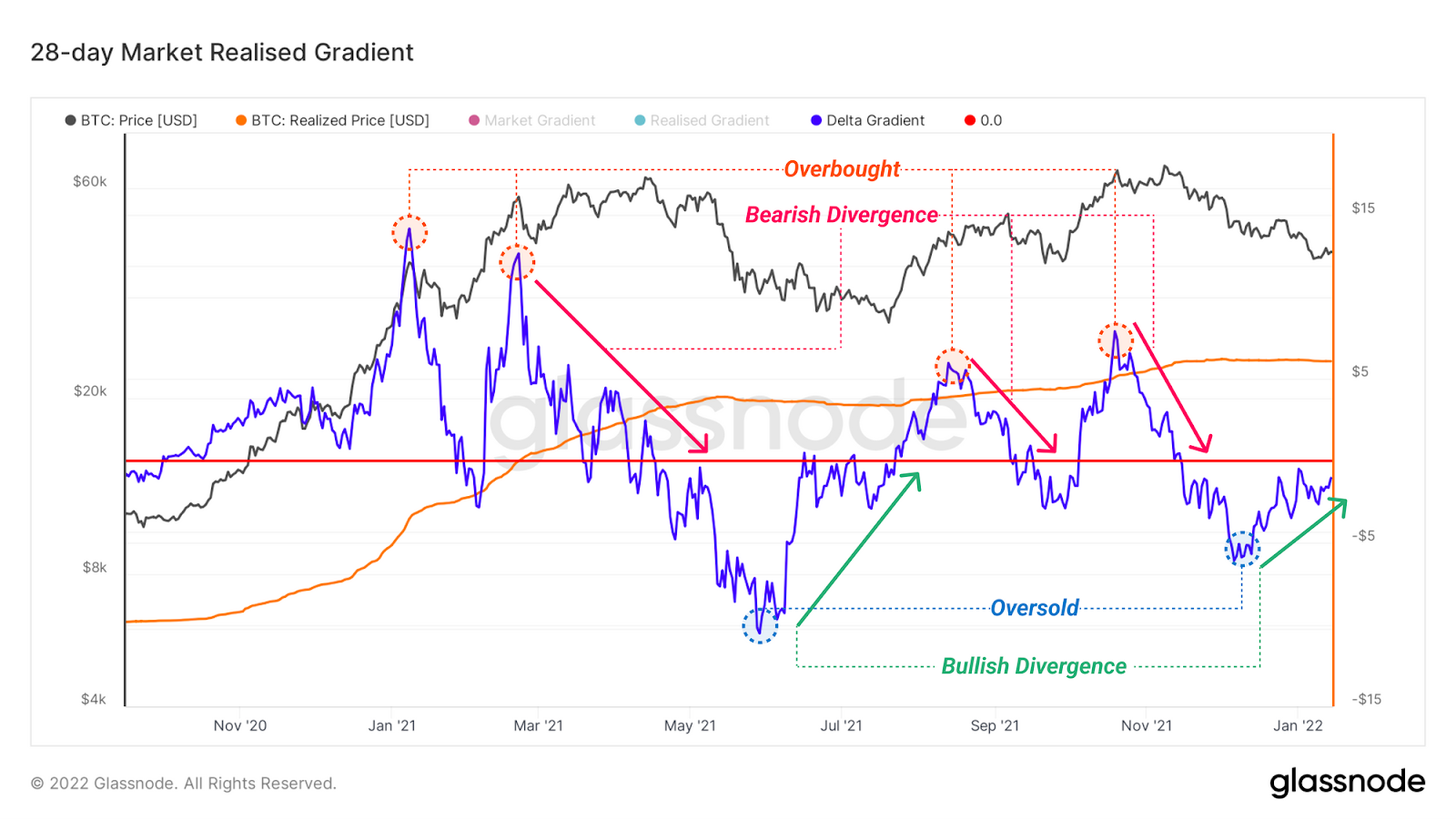

The Market Realised Gradient — comparing the momentum in Market Cap (speculative value) versus the Realized Cap (real on-chain inflows) over a month.

Funding rates on perpetual swaps.

The former indicates that the current downtrend in play will likely be reversed back to an uptrend as on-chain inflows outpace speculation. However, funding rates across derivatives exchanges are currently negative, implying that short-term traders have taken on more short than long positions on Bitcoin futures. If the Market Realized Gradient moves up to the positive territory, it means that an uptrend could cause a deleveraging event and trigger significant short liquidations in the future.

We are optimistic that capital inflows will continue to grow with major milestones in Bitcoin adoption including Rio de Janeiro investing 1% of their treasury in Bitcoin. The city of Miami paved the way for other cities to consider Bitcoin amongst alternative assets in their treasury. It would not be surprising to learn that Rio de Janeiro and other cities could consider earning yields in Bitcoin either via staking with CityCoins or fostering Bitcoin mining powered with solar energy. Solar energy has great potential in Brazil, with the country having one of the highest levels of insolation in the world at 4.25 to 6.5 sun hours per day.

Despite major developments in the Bitcoin market, the current market narratives continue to lean towards emerging developments outside Ethereum and Bitcoin, namely Ethereum competitors, scaling solutions, and OpenSea alternatives. The outliers of this past week were predominantly:

Ethereum Competitors:

Cardano (31.9%) will have its first functional app with the beta launch of its first functional decentralized exchange, SundaeSwap. The ramp-up is also attributed to the need to buy ADA to earn yield in the exchange’s token.

Fantom (23.4%) will soon have a new automated market maker (AMM) design launched by two prominent developers in this space, Andre Cronje behind the DeFi-blue chip Yearn Finance and Daniele Sesta from Wonderland.

Secret (57%), the first blockchain with smart contracts with data privacy by default capable of interoperability with a range of networks using the Cosmos InterBlockchain Communication protocol (IBC).

Code Vulnerabilities:

One last note from this week as we step into a multi-chain future with a plethora of Ethereum competitors, Vitalik Buterin warned about growing risks in attack vectors for standalone cross-chain applications called bridges. This opens up a significant opportunity for interoperability protocols like Cosmos and Polkadot for seamless and more secure cross-chain transfers.

The current solutions offered from third-party cross-chain liquidity bridges leave users to trust the protocol’s security assumptions, essentially forcing developers and users to depend on a single bridge and its supported version of wrapped assets. For applications building on top of cross-chain liquidity bridges, this puts them under unnecessary risk if the liquidity bridge suffers from a vulnerability, congestion, poorly distributed liquidity or reliability issues. As a matter of fact, on January 17th this year, Multichain (previously Anyswap), a leading cross-chain bridge, announced the discovery of a critical vulnerability affecting 6 cross-chain tokens reported by security firm Dedaub and fixed by the Multichain team.

Weekly Returns

The returns of the top five crypto assets over the last week were as follows — BTC (-1.11%), ETH (-0.91%), BNB (2.79%), SOL (-0.14%), and ADA (33.61%).

Net Inflows per 21Shares ETP

The net Inflows of our ETPs amounted to $19.3M in the past week. Find the breakdown of the inflows and outflows per ETP below.

Media Coverage

We are very excited to have launched the World’s first Terra ETP last week, you can read our primer written by our very own Research Associate Zoe. The news was picked up and featured on ETF Stream, Crypto Valley Journal (link in German), and La Stampa (link in Italian).

“With Terra, we strengthen our range which goes to 14 individual cryptocurrency ETPs, 7 diversified ETPs and 1 short ETP; the most comprehensive cryptocurrency ETP platform in the world,” La Stampa quoted Massimo Siano, Head of Southern Europe at 21Shares.

Our very own Research Lead Eli Ndinga was also featured on Business Insider, talking about the metaverse and DeFi this time around. “Crypto is a narrative-driven industry — especially in the short run, which causes discrepancies between fundamentals and price developments. DeFi was the archetype in 2021 with the rise of NFTs,” Eli says. “One example of this differential is Curve (CRV), the largest DEX in the world with ~$23 billion in AUM (or TVL) grew its assets by 1,562% last year, while the token traded down 90% from its all-time high,” he explains further.

Beate Lamer from Die Presse had an interview with 21Shares’ Head of Northern Europe Bernhard Wenger about his views on regulating crypto, especially Bitcoin, and how they reflect on the price charts. You can read the full interview (in German) here.

In other news, our last newsletter got featured on the German Aktien Check, celebrating our Terra ETP and discussing what a Chinese CBDC can mean to US-pegged digital currencies.

News - Congress Introduces Bill Preventing Unilateral Fed Control of a US CBDC

What happened?

Congressman Tom Emmer introduced a bill on January 12, prohibiting the Federal Reserve from issuing a central bank digital currency (CBDC) directly to individuals. This comes promptly after China announced it will be piloting its digital Yuan in the Beijing Winter Olympics as previously covered in our last newsletter. Emmer argues that a CBDC issued by the Federal Reserve would not only centralize Americans’ financial information, leaving it vulnerable to attack, but it could also be used as a surveillance tool.

Why does it matter?

The Federal Reserve has been evaluating CBDCs for some time now and has been cautiously releasing statements on the matter without giving away any substantial verdict. The Fed was expected to publish an extensive report about the risks and opportunities that come with issuing a digital currency in the summer of last year, but this report still hasn’t seen the light. As it stands, the Fed does not have the authority to offer retail bank accounts. For the Fed to issue a CBDC, they’ll need authorization from Congress. Emmer argues that having to open up an account at the Fed to access a US CBDC would put the Fed on an insidious path akin to China’s digital authoritarianism.

“In order to maintain the dollar’s status as the world’s reserve currency in a digital age, it is important that the United States lead with a posture that prioritizes innovation and does not aim to compete with the private sector,” Emmer said in a statement. This also comes at a time where US-pegged stablecoins, namely USDC, are becoming more and more dominant in the DeFi space. The emergence of CBDCs, whether in China or the US, would ultimately pose a challenge for their crypto counterpart, with stablecoins more prone to face stringent regulations. With this bill in Capitol Hill, at 21Shares we expect to see more conversations taking place on the topic of a US CBDC that is accessible to all, transacts on a blockchain that is transparent to all and maintains the privacy elements of cash.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)