Market Outlook: Bitcoin vs Coronavirus Impact

.jpg)

Market Outlook - Coronavirus and Bitcoin

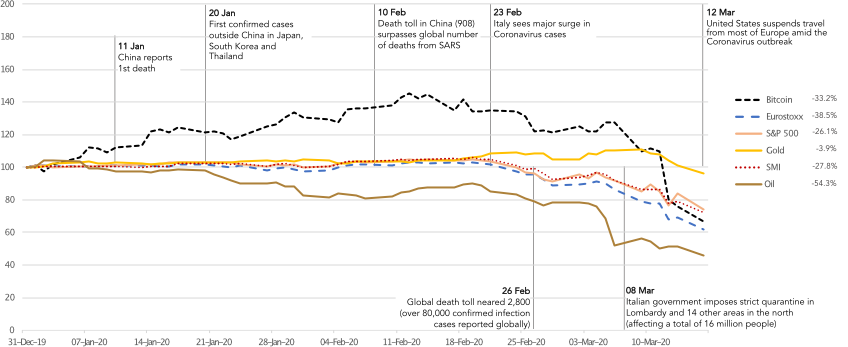

The last two weeks have been extremely difficult for the global economy, governments, communities, and the capital markets. The ongoing spread of the Coronavirus has begun to extract a real human toil whilst at the same time incurring second-order impacts on various parts of the economy — the supply chain, the global energy market, the transport sector, and the hospitality industry. For these reasons it makes sense that both traditional financial assets — equities, commodities, bonds — as well as the crypto asset market have been hit hard.

Since the start of the year Bitcoin is down around 33%, the S&P500 is down over 26% and oil is down nearly 55%. In this research piece we will help demonstrate how the Bitcoin market is likely oversold due to the current flight-to-cash environment we are in. This was exacerbated by the large amount of leverage within the system which deleveraged quickly; further falls will likely be buttressed by continuing strong retail demand for Bitcoin.

Bitcoin suffered its worst day in years last Thursday (12 March), however, we can use fundamental Bitcoin blockchain data to better understand how the market likely oversold — driven by the deleveraging of fund managers and derivative exchanges, as well as miners reaching their short-term cash needs. Bitcoin’s Network-Value-to-Realized-Value (NVRV) ratio measures the ratio between Bitcoin’s current price and its estimated average cost-basis.

Given that investors are seldomly willing to sell an asset at a price lower than that at which they bought it, this ratio rarely stays below 1; in fact, the last time the NVRV ratio was below 1 was at the bottom of the 2019 bear market. As of Monday 16 March, Bitcoin’s NVRV ratio was around 0.9 but, based on historical data, there is good reason to believe that it is unlikely to remain there for long.

One promising feature of Bitcoin’s downturn is the fact that it was likely solely driven by institutional investors. The heightened correlation between Bitcoin and the equity market following particular news events (i.e. Fed Rate tightening) suggests that institutional investors experienced a flight-to-cash where all assets perceived as risky were sold off in the last two weeks. Given that Bitcoin has always been a retail-first asset, demand for the asset can still increase even in a prolonged institutional flight-to-cash environment. The chart below looks at Bitcoin’s blockchain data to highlight periods of time where large amounts of BTC were transferred. We saw clusters of large transactions between last Thursday and Friday driven by whales moving to sell their holdings.

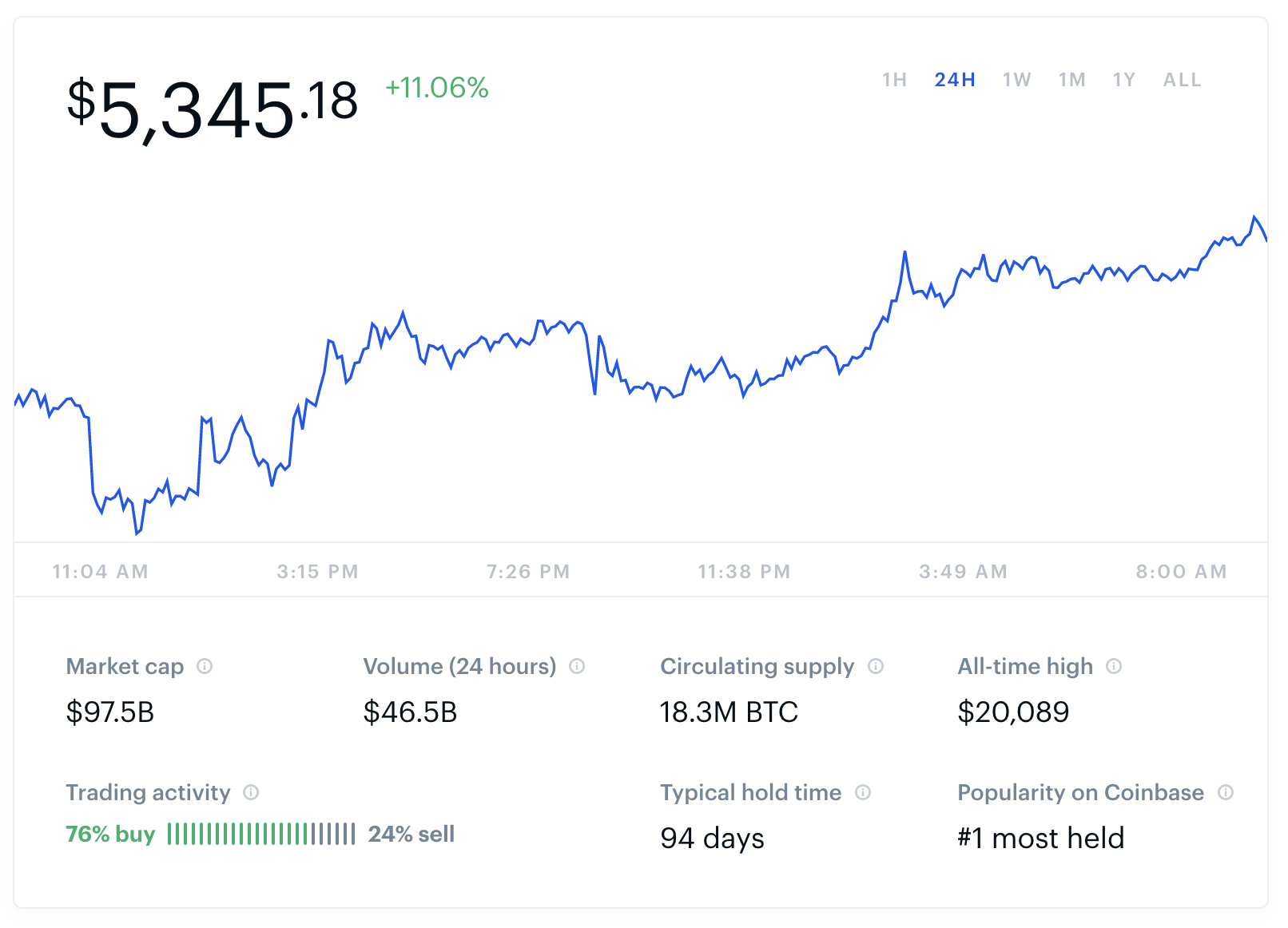

Coinbase’s trading activity data suggests that there is still retail demand for Bitcoin. According to Coinbase, 76% of Coinbase’s customers increased their net position in BTC over the last 24 hours of trading. As Coinbase’s online platform is overwhelmingly retail-focused, this suggests that retail investors are more bullish than bearish despite the recent downward price movement. While these factors do not necessarily mean that Bitcoin will perform well over the next few weeks they do signal that there has not been an existential shift in investors’ perception of the asset as digital gold and an alternative store of value asset. We believe that, while the next few months are likely to be difficult for all asset classes, the long term implications of the economic crisis — such as the continued excessive use of quantitative easing — will help improve the value proposition of Bitcoin in the long term.

The top five crypto assets performed as follows: BTC (-36.62%), ETH (-45.06%), XRP (-33.71%), BCH (-37.47%), and LTC (-34.85%).

The average on-chain transaction volume for the top-five crypto assets is as follows: BTC ($1.89B), ETH ($439M), XRP ($234M), BCH ($108M), and LTC ($28.1M). On average the total daily on-chain transaction volume number was down from $2.60B to $2.70B.

News - Bakkt Raises $300M Series B from Microsoft, Pantera, and Others - CoinDesk

What Happened?

Crypto derivatives provider Bakkt closed a $300 million Series B fundraising round and shared additional details about its upcoming mobile application in a blog post Monday.

According to the post, authored by CEO Mike Blandina, Microsoft's M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital, Pantera Capital and Bakkt parent firm Intercontinental Exchange (ICE) all participated in the funding round.

Why Does It Matter?

While the headline from this announcement will be the large sum of money raised — which stands out as one of the largest fundraises within the crypto asset industry. It is also important to note that the announcement also seems to have signalled a pivot by Bakkt to focus more on its mobile application — a platform for the exchange and custody of digital assets, ranging from loyalty points to crypto assets — as opposed to the crypto futures aspect of their businesses.

This pivot has been hinted at in the past and the company website's focus on its consumer mobile application are indicative of this change. It'll be interesting to see how Bakkt's launch of its mobile app affects Bitcoin, given that the company is no longer solely crypto-focused. It is possible that it will act as an onramp for millions to the concept of digital assets, but it remains to be seen how popular such an application will be.

Learn more here.

Disclamer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)