Bitcoin Surges Above $9,000; Crypto Market Insights

.jpg)

Market Outlook

Today Bitcoin broke above $9,000 again after a consolidatory week where the crypto asset industry suffered a mid-week downturn. We expect Bitcoin to continue to hover around the $9,000 mark as long as there aren't large unexpected industry-specific events or geopolitical issues that take the turn for the worse. The performance of the top five crypto assets is as follows — BTC (1.96%), ETH (0.45%), XRP (-2.72%), BCH (5.25%), and LTC (1.78%).

Average adjusted transaction volumes reversed their usual January week-on-week rise as they fell from an average daily total of $2.76B to $1.94B — BTC ($1.54B), ETH ($156M), XRP ($81.1M), BCH ($132M), and LTC ($21M).

Research - 21Shares' State of Crypto Quarterly Report - Q4 2019

This report provides an in-depth overview of the state of crypto in the fourth quarter of 2019, from 1 October to 31 December — offering 21Shares’s own view on the industry, a recap of the most important news items of the quarter, a look at the key data points of the most important crypto assets, and an overview of our current products. In addition, we have included two of our research reports: our investment theses for both BNB and Tezos.

It almost goes without saying that the fourth quarter of this year has been a uniquely eventful one for the industry and we hope this report will help you understand it better.

Product Launch - 21Shares Launches Inverse Bitcoin ETP

We are proud to continue our mission of innovating within the crypto market by launching the 21Shares Short Bitcoin ETP (SBTC) by 21Shares on the Swiss Stock Exchange (SIX), which tracks the opposite performance of Bitcoin to give investors an easy, cost effective and convenient way to gain exposure in both directions of the Bitcoin price movements.

The SBTC tracker is the first short or inverse product of its kind using a digital asset as the underlying for an ETP structure (Exchange Traded Products - ETP). It enables investors to capture falling price movements in Bitcoin BTC via their traditional broker or bank. In contrast to shorting, which is usually associated with high lending costs (or margin calls), the inverse ETP is reset at the end of each day and the performance is not rolled over to the next day. Thus, it is ideally suited to capture short term price movements of Bitcoin for a short recommended period. With the SBTC tracker, investors can immediately and securely capitalize on falling adverse price movements of the largest and most liquid digital asset.

Our CEO Hany Rashwan was quoted as saying: “We have worked hard to be in a position to launch the first inverse Bitcoin ETP on a regulated trading venue here in Switzerland. 21Shares offers an existing suite of long investment products for a variety of crypto assets, however, the one missing puzzle was to deliver a product to capitalize on negative price movements.”

Learn more about the product here.

News - Ripple’s Brad Garlinghouse Hints Firm May Seek IPO Within 12 Months | CoinDesk

What happened?

Ripple CEO Brad Garlinghouse said an initial public offering (IPO) is seen as the “natural evolution for the company,” perhaps even this year. “I think over the next 12 months you’re definitely going to see IPOs in the crypto, blockchain space. I’m not sure we want to be first but we certainly don’t want to be last either, so I expect we’ll be on the leading side of that, not the lagging side,” Garlinghouse said.

He also said his cross-border payments company has been in communication with the U.S. Securities and Exchange Commission (SEC) about the regulatory status of the cryptocurrency XRP. “We have been talking to the SEC for some period of time,” he said. “I feel like educating regulators is part of my job and I think that’s been a really constructive process.”

Why does this matter?

It's important to not look too deeply into Garlinghouse's statement of a potential Ripple IPO given how early the firm is likely into any potential process. This claim is especially interesting given some of the reports around the regulatory scrutiny Ripple has faced; for example, a lawsuit was filed against Ripple Labs and its CEO in August by Bradley Sostack on behalf of "all XRP investors" claiming that XRP is an unregistered security and was sold "to retail investors in violation of the registration provisions of federal and state securities laws".

If Ripple's IPO ambitions are credible then this would likely be a further impetus for bringing concerns around the regulatory status (in the United States) of XRP directly within the purview of the SEC — making this an especially interesting story to track over the next year.

Learn more here.

News - 10% of Central Banks Surveyed Close to Issuing Digital Currencies: BIS | CoinDesk

What happened?

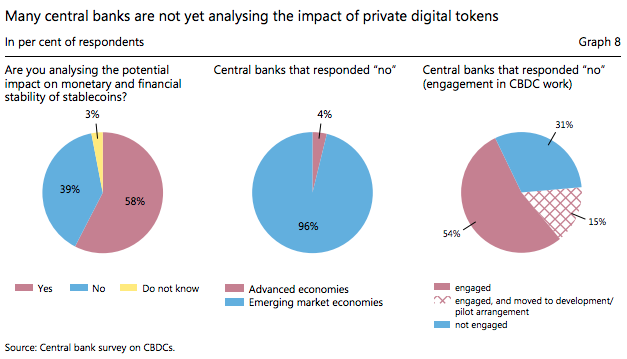

A fifth of the world's population may well have access to a central bank digital currency (CBDC) in as little as three years, according to a new survey. An annual study carried out by the Bank for International Settlements (BIS) asked 66 central banks if they were working on CBDCs and, if so, what type and how far along they were.

Released Thursday, the report found 80 percent of the 66 banks surveyed were engaged in some form of work surrounding CBDCs, with nearly 40 percent having moved to experiments and developing proofs of concept. Overall, the number of banks working on some form of CBDC project increased 10 percent from BIS' 2018 survey.

Why does this matter?

News of various central banks' interest in developing their own digital currency project was a permanent fixture of the latter part of 2019 — as was obvious within our State of Crypto report — and is likely to be the dominant narrative of 2020.

This BIS report goes a long way to show that the concept of a CBDC has caught on in the mind of many central bankers and is unlikely to lose steam soon. However, it is important to remember that — like the "Blockchain not Bitcoin" craze of 2016 — proofs of concept and research efforts are very different from working products that serve useful functions. It seems likely that the roll-out of China's CDBC, which seems to be the most developed, will act as a lightning rod for future efforts from other nations going forward; but this is undoubtedly worrying given the Chinese's governments tenuous record on privacy, surveillance, and violations of freedom.

Despite the increasing interest in CDBC projects, however, there are still a number of banks that have not yet made an effort to engage with the idea — as the charts below show.

Learn more here.

News - Bad Actors Rent Hashing Power to Hit Bitcoin Gold With New 51% Attacks | CoinDesk

What happened?

Bitcoin gold, a cryptocurrency that forked from bitcoin in 2017, has again been hit by 51 percent attacks. Occurring Thursday, according to tweets from the bitcoin gold team, two deep blockchain reorganizations (or reorgs) resulted in double spends of 1,900 BTG and 5,267 BTG, respectively. The losses amount to around $87,500 at current prices.

"We do not know if they successfully extracted any value from an exchange. Advanced risk control systems in exchanges make it likely one or both attacks failed," they wrote. "Evidence" suggests the attacks used mining power obtained through mining power marketplace NiceHash, according to the team.

A 51 percent attack is conducted by actors who are able to mine a blockchain network with more than half its hashing power, hence the name. This enables transactions to be rewritten, potentially diverting previously spent funds to a different address, as was the case here.

Why does this matter?

The possibility of such an attack being possible for a lesser-known crypto asset like Bitcoin gold has been known for a while — given the relative ease with which one could theoretically rent the necessary hashrate to carry off a 51 percent attack.

Looking at data from Crypto51.app, we can look at how vulnerable different crypto assets are to such attacks. Using the prices NiceHash — a mining rental service — lists for different algorithms we are able to calculate how much it would cost to rent the hashing power required to match the current network's hashing power for an hour. The "NiceHash capacity" metric measures how much of the necessary hashing power NiceHash could provide currently.

One can see how the cost of a 1-hour attack on Bitcoin Gold (BTG) is only $820 and relatively feasible given its NiceHash capacity of 54%. Compare this to Bitcoin where the theoretical cost of a 1-hour attack is over $800,000 and isn't even feasible given its NiceHash capacity of 0%.

Learn more here.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction.

Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.

The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.png)

_logo.svg)

.svg.png)