Bitcoin Dips Below 60% Dominance Amid DeFi Surge

.jpg)

Market Outlook

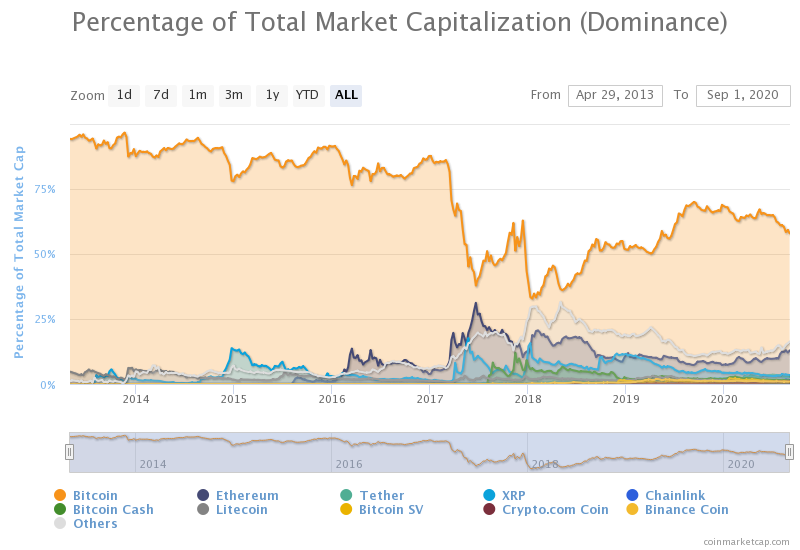

Bitcoin has returned more than 67% since the start of the year alongside a performance of 159% since the COVID19-induced market crash in mid-March, but the Bitcoin dominance metric dropped below 60% for the first time in more than a year. The last time Bitcoin’s market capitalization against the entire industry was below 60% was on June 24th, 2019. Currently, the market capitalization of Bitcoin of $220 billion represents around 57% of the entire cryptosset industry valued at $338 billion.

The burgeoning DeFi sector experiencing a 1,235% growth in total value locked (TLV) in smart contracts currently valued at $9 billion, undeniably has an impact on the behaviors of market participants. The metric measuring the number of Bitcoin transfers to another distinct blockchain is a testament to the attention drawn by the DeFi sector, as the transfer count has crossed the 800,000-mark for the first time this year. These transactions alongside the decreasing Bitcoin dominance metric indicate a growing need for portfolio diversification in the cryptoasset industry as market participants are likely selling a small percentage of their Bitcoin for other DeFi cryptoassets. On the final note, while the Bitcoin price has been oscillating between $11,190 and 11,955 this past week, the number of active addresses in the Bitcoin blockchain has reached more than 1 million for the first time in three years, since the ICO-led 2017 bull market when the price of Bitcoin topped $20,078. This pattern also confirms the growing number of eyeballs away from Bitcoin to other cryptoassets.

Weekly Returns

The top cryptoassets all were oscillating over the last week following a drop during the previous week. BTC (0.02%), ETH (0.13%), XRP (0.01%), LINK (0.10%), and BCH (-0.01%).

Media Coverage

We have some exciting news to announce today.

First, our Bitcoin and Ethereum ETPs — ABTC and AETH are the first crypto-centric ETPs admitted on Wiener Börse, the Vienna Stock Exchange, one of the most established exchanges in Central, Eastern, and Southeastern Europe! This new listing now makes Bitcoin accessible everywhere across the DACH region (Germany, Austria, and Switzerland) — for both retail as well as institutional investors. Read the press release here.

Secondly, our short Bitcoin ETP (SBTC) has been admitted to the regulated Deutsche Börse’s Xetra venue — becoming the world’s first listing of a centrally-cleared short Bitcoin ETP. Read the press release here.

- “Investors are now in a position to implement any bitcoin strategy in a safe, regulated, and conventional manner using a product that allows them to participate in the downwards movement of Bitcoin.” said our CEO, Hany Rashwan

- “We have lobbied carefully but vigorously with the exchange to be in a position to launch the world’s first centrally cleared short Bitcoin ETP on a regulated trading venue. The one missing trading product was to deliver a fully transparent financial instrument to capitalize on negative price movements within a complete regulated framework." noted our Managing Director, Laurent Kssis.

News - Uniswap’s 24-Hour Trading Volume Has Surpassed That of Coinbase | Uniswap.info

What happened?

The Ethereum-based decentralized exchange, Uniswap, has surpassed the 24-hour trading volume of the leading US-based exchange, Coinbase on August, 30th. The decentralized exchange crossed the $400 million mark for the first time since its inception in 2018 according to Uniswap.info.

Why does it matter?

While Coinbase has been among the leading fiat on-ramp in crypto by listing various cryptoassets to meet the market participants' demand, the innovation on Ethereum does not seem to rest. Uniswap enables traders to exchange any Ethereum-based tokens or ERC20 token, including ETH, without middlemen or banks, and allows anyone with an Ethereum wallet to contribute to the exchange’s liquidity, and earn from trading fees. Within just two years and especially this year, Uniswap has gained considerable traction and this new milestone in trading volume this year is a testament to the product-market fit. This pattern is also tied to our aforementioned analysis on the growing need of market participants to diversify their crypto-centric portfolio to have exposure to the DeFi sector through alternative means such as Uniswap.

Learn more here.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)