UK promises robust crypto regulation, Hamilton Lane tokenizes fund on Polygon, and More!

.webp)

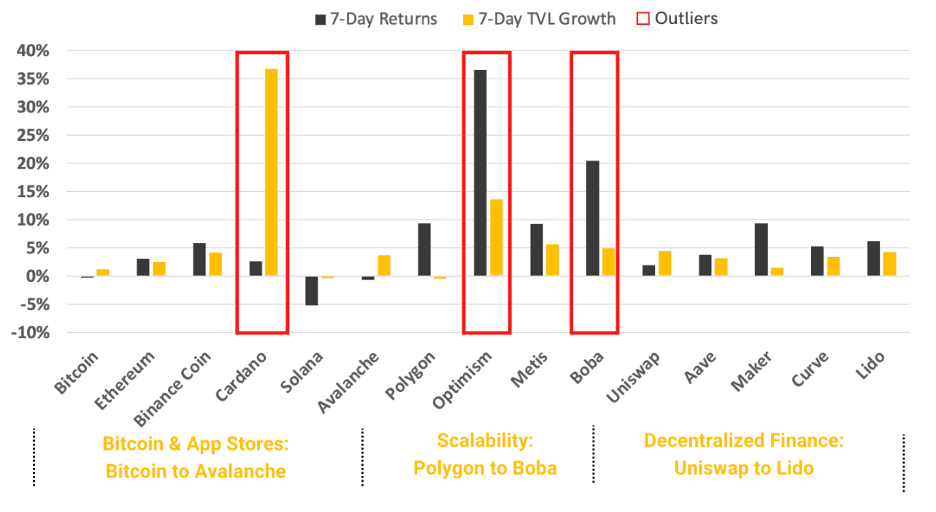

The crypto market traded sideways in a macro-heavy week, with some notable outperformers. All eyes were on the FOMC meeting on February 1 as the Fed hiked interest rates by 25 bps, as widely expected, while the UK government introduced a plan to regulate cryptoasset activities. Bitcoin registered a flat performance (-0.24%) week-over-week, while Ethereum rose by 3.09%. The scalability vertical was this week's big outperformer, with Optimism registering a 36.62% price increase, followed by Boba (20.46%) and Polygon (9.37%). Cardano stood out amongst smart contract platforms with a TVL increase of 36.80% as Djed – Cardano's first decentralized stablecoin – launched on January 31.

Figure 1: Weekly Price and TVL Performance of Major Crypto Categories

Source: CoinGecko, DefiLlama, Close Data as of February 6, 2023

Key takeaways:

- UK government promises robust crypto regulation, Treasury and Bank of England detailed the groundwork for a potential CBDC launch this decade.

- Avalanche onboards first institutional “subnet,” BNB introduces native storage solution.

- Hamilton Lane launches an on-chain tokenized fund on Polygon, Rocket Pool voting to limit its growth.

- Roofstock onChain completed its second property sale on an NFT marketplace, with Teller Protocol providing on-chain leverage for the transaction.

Spot and Derivatives Markets

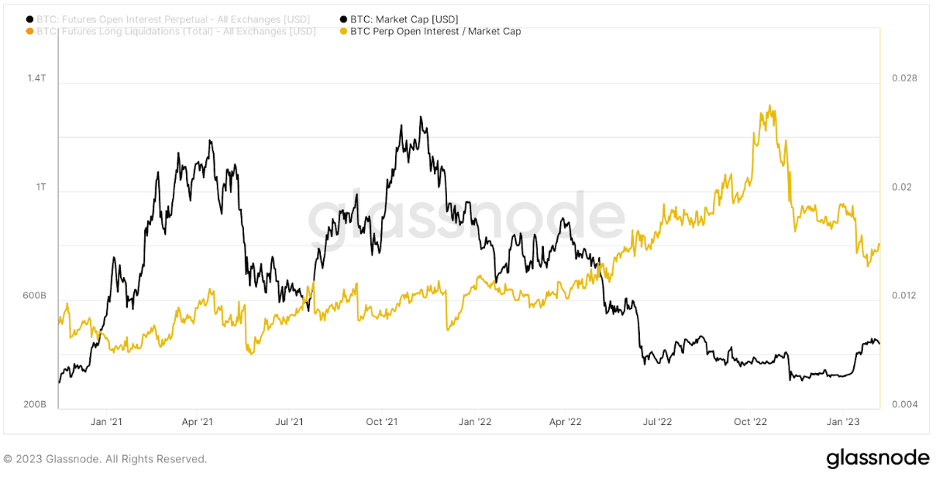

Figure 2 – BTC Perpetual Swap Open Interest / Market Cap

Source: Glassnode

Figure 2 shows BTC perpetual swap open interest (the number of futures contracts open) relative to Bitcoin's market cap. We can see that the number of contracts built up relative to the market size increased significantly in 2022 until the FTX collapse. Since then, we have observed a general deleveraging of the system. However, in the past two weeks, the ratio has increased slightly as BTC's price has consolidated, suggesting that risk appetite is picking up among investors.

On-chain Indicators

Figure 3: Ethereum Spent Output Profit Ratio (SOPR)

Source: Glassnode

SOPR, or The Spent Output Profit Ratio, is a metric that can be used to visualize the rate of profit taking on a network at any given time. Looking at the period from January to December 2022, the purple line struggled to break out to the upside and was rejected at the 0 level, indicating that traders were very aggressive in liquidating their ETH. There is a slight change in behavior now, which signifies that traders are employing cautious risk-on behavior. SOPR bouncing off the support line of 0 suggests a positive sentiment from investors as they would be inclined to leaving their assets intact.

Macro and Regulations

It was a big week in terms of macroeconomic data, with some mixed signals:

- On January 30, data releases from Europe showed worse than consensus forecasts – Germany’s GDP unexpectedly shrank 0.2% in Q4 compared to the previous quarter, while Spain’s core inflation reached 7.5% in January, the highest since 1986.

- On January 31, Eurostat data showed that the Eurozone economy grew by 0.1% in Q4, while the Employment Cost Index (ECI) for the US came in at 1% – both better than consensus estimates.

- On February 1, the Federal Reserve raised interest rates by 25 bps, as expected. The move marked the eighth rate increase since March 2022, although the Fed is not yet ready to signal an end to the hiking cycle.

- On February 2, the European Central Bank (ECB) and the Bank of England hiked interest rates by 50 bps, as expected, signaling similar hikes in March.

- On February 3, the US Jobs Report stunned almost everyone – jobs increased by 517,000 in January, shattering the consensus forecast of 187,000, while the unemployment rate fell to 3.4%, the lowest since May 1969. In addition, Big Tech led the US market as Apple, Alphabet, and Amazon posted results for Q4, falling short of expectations.

- Overall, macro data throughout last week was conflicting regarding expectations for the months ahead, as shown by the fact that the DXY fell sharply on February 2 to levels not seen since April 2022, only to rise sharper still on February 3 and 6 to erase almost all of January’s decline.

Digital Currency Group (DCG) and its bankrupt Genesis subsidiaries have reached an initial agreement on a restructuring plan with a group of the firm’s main creditors, according to a CoinDesk article quoting a “person familiar with the situation” as the source. The agreement would entail winding down the Genesis loan book and the sale of the bankrupt Genesis entities. In addition, the term sheet would also involve refinancing the outstanding loans where DCG borrowed $500 million in cash and about $100 million worth of bitcoin (BTC) from Genesis.

Celsius final court report: Shoba Pillay, who was appointed as an independent examiner of bankrupt crypto lender Celsius, released a nearly 700-page report describing the downfall of the firm, which failed to report about $800 million in losses, all the while CEO Alex Mashinsky cashed out more than $68 million.

UK Regulation: On February 1, the UK government introduced a plan to regulate cryptoasset activities, “providing confidence and clarity to consumers and businesses alike.” The goal is to mitigate the most significant risks associated with crypto without preventing innovation and the industry from flourishing. The proposal will strengthen rules around financial intermediaries and custodians. In addition, crypto businesses registered with the FCA for anti-money laundering purposes will be allowed to issue their own promotions while the broader cryptoasset regulatory regime is being introduced. Finally, the Treasury and the Bank of England published a report on February 7 detailing a plan with the groundwork for a potential CBDC to launch before 2030.

Indian Regulation: On the same day the UK government promised robust crypto regulation, Indian Finance Minister Nirmala Sitharaman presented the Union Budget 2023 without mention of crypto, to the disappointment of the Indian crypto community. The Budget introduced new tax penalties for failure of deduction or payment of crypto tax deducted at source (TDS). In addition, crypto income remains taxed at 30% while TDS stays at 1%. On another note, Reliance Retail – India’s largest retail chain – announced it would start accepting payments in the country’s recently launched CBDC. India’s central bank launched a digital rupee on December 1 as part of the initial phase of a pilot.

Crypto Infrastructure

Layer 1:

The core team behind the BNB network revealed the latest addition to the BNB ecosystem, a decentralized storage solution. Dubbed Greenfield, the new protocol will enable developers and users to host their data across a distributed network of storage providers. The solution complements the BNB ecosystem as the L1’s native token will be used as the gas currency to interact with the network. Community developer teams from Block Daemon, AWS, and NodeReal have collaborated to help the Binance Smart Chain deploy its testnet. The protocol will also use NFTs to register and maintain data ownership, storing the metadata on the BNB backend while distributing the storage across the GreenField layer node providers. That said, the initiative is a crucial addition to the BNB ecosystem as it introduces further utility for the native token while empowering the network’s participants with novel instruments to unlock monetization for their data. In addition, the solution will help bring on a broader type of applications heavily reliant on storage, like social media applications, content creation, and even website and server hosting. What could set the initiative apart from comparable storage projects is that Greenfield will be natively integrated into the BNB tech stack, meaning that developers and users will have an interrupted experience utilizing the new solution. Arweave and Filecoin, the two infamous data hosting protocols, have their network, which slightly takes away from the composable benefits as utilizing their technology would require third-party integrations rather than a mere addition to the already existing infrastructure.

Avalanche: The ETH-alternative L1 has greeted the first institutional subnet to its network. Intain INC, the leading blockchain-based provider of structured finance protocol that managed over $4B on its platform, has raised the curtain on its new marketplace for tokenized asset-backed securities, IntainMARKETS. The new platform is designed to offer efficient intermediation by automating the functionalities of many key stakeholders like underwriters, issuers, verification agents, rating agencies, trustees, and investors. Putting the entire process on-chain will tackle the unsustainable high fees present in TradFi, reducing costs to debt issuers and helping them target a broader pool of investment pools that would be more economically accessible. The tokenization will also supplement superior transparency into the composition and collateral backing of some of the securitized instruments, allowing revenue to be accrued more promptly.

Intain chose to build on top of Avalanche as the network’s design equips them with the flexibility to create a permissioned chain that still leverages the benefits of being anchored to a wider trustless public network, mingled with a far more decentralized validator set - a reality that satisfies essential requirements for regulatory frameworks. IntainMAREKTS is also a net positive for the broader blockchain ecosystem as it would signal more institutions to begin taking their business operations onchain and deepen the liquidity in the process. Moreover, it would cement the L1 as the preferred provider for building institutional offerings mirroring those of Traditional Finance.

Layer 2:

Optimism: After months of R&D around refining the tech stack of the Optimistic rollup L2, the Optimism foundation finally proposed a set date to implement the next major protocol upgrade. Dubbed Collective Bedrock, the slew of technical improvements will offer cheaper gas fees, reduce deposit times, and move the network closer toward Ethereum equivalence. The upgrade will most excitingly implement modularity at the protocol level, separating the main OpStack into three layers: execution, settlement, and consensus. The change in design should enhance the network’s scalability and, accordingly, its performance in the process. The proposal to deploy the upgrade on the mainnet is currently being voted on until February 15.

Decentralized Finance

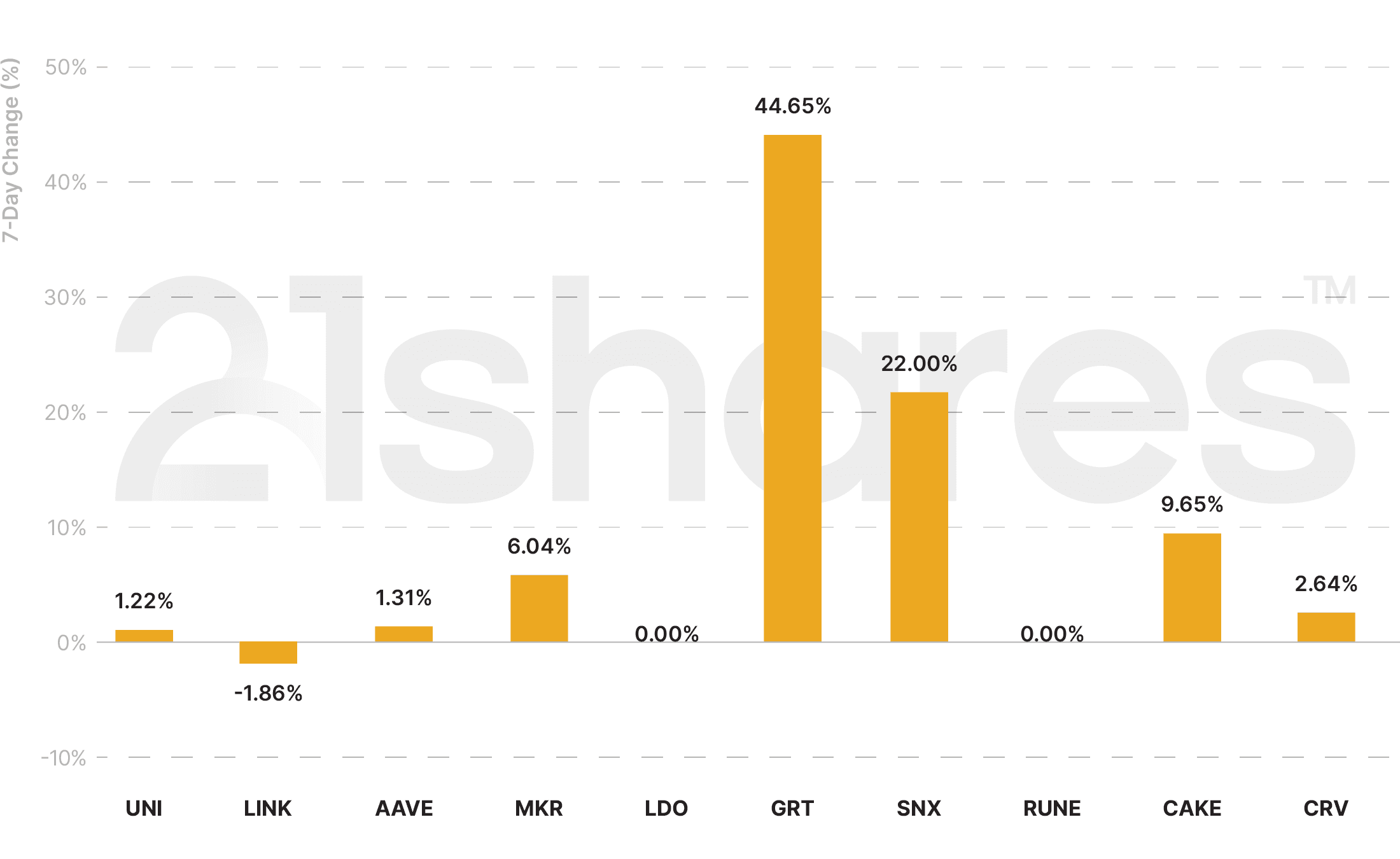

Figure 4 – Top 10 DeFi Assets Weekly Performance

Source: Coingecko, DeFi Llama. Data as of February 6 close

Stablecoins:

A new crypto-native over-collateralized stablecoin has set foot in the Cardano ecosystem. Issued by Coti Network - a payments protocol built on top of Cardano - Djed is an algorithmic stablecoin that requires an over-collateralization ratio of 400%-800% to mint new units of the token pegged to the US dollar. Although Djed is backed by ADA (native asset of the Cardano network and independent of the operations of Djed), it uses a third asset known as SHEN serving as an additional reservoir for the smart contract responsible for maintaining Djed’s price parity with the US dollar. The employed algorithmic model prevents the burning of SHEN and the minting of Djed once the collateralization ratio has fallen below 400%, in contrast to users only losing the ability to mint SHEN once the ratio exceeds 800%, but can issue and redeem DJED. The mechanism is designed to dodge the fragility of the Luna ecosystem along with its fully-algorithmic UST stablecoin, whereas the latter’s backing was entirely dependent on the usability and adoption of the governance token (Luna) functioning as the reserve. In that view, Djed doesn’t belong to the fully algorithmic stables such as UST and FEI due to its reliance on exogenous rather than endogenous collateral. Although fully decentralized stablecoins are key factors in serving the censorship-resistant needs of the blockchain-based economy, we remain wary of the sustainability of the existing models. That said, we’ll be closely monitoring the novel dual-token architecture backing Djed.

Ethereum Ecosystem:

Rocket Pool: The second largest liquid staking platform by market share, and the third by Total Value Locked, is holding a vote on how much power it should reside over Ethereum. Rocketpool protocol has been riding on a wave of growth driven by the excitement around the upcoming withdrawal for ETH but is now mulling over self-limiting its size to act in the best interest of the blockchain. Aiming to prevent a monopoly over ETH staking is significant for the network’s health to avoid the emergence of a single point of failure. Although Rocketpool’s current dominance is only at 2.1% of the beacon chain deposits, initiating this discussion is encouraging as it sets a model behavior for how other protocols should be thinking of the bigger picture in terms of the network’s decentralization and not just the short-term financial benefits of a particular strategy. The governance vote, which is slated to carry on until the 12th of February, has so far catalyzed the majority leaning towards agreeing on capping the protocol’s growth. For context, Lido finance, the biggest staking-as-a-service provider, held a similar vote in June last year, where the majority were against curbing the protocol’s dominance.

Polygon: Hamilton Lane, the leading global asset investment management company, has announced the tokenization of three of their private equity funds. The firm, which has managed up to $830B of assets under its management and supervision, will leverage the Polygon-based Securitize platform to tokenize a portion of its flagship Equity Opportunities Fund V. Through this collaboration, Hamilton lane will democratize access to the funds by significantly reducing the barrier of entry to investors. Instead of banking on a minimum of $5M deposit by high net worth individuals, the first of a series of 3 tokenized funds will allow a broader set of participants to gain exposure to the private equity market with an ask call of $20K. Equity Opportunities V isn’t the first attempt for Securitize as they’ve previously helped launch a $25M diversified art fund in a joint venture between Winston Art Group and Artory. The closed-end, actively managed fund was a diversified portfolio of curated physical arts combining blue chips and emerging and mid-career artists to achieve a diversified return, while enabling token holders to trade their respective equity on secondary markets after a one-year lockup in the process. To that end, we at 21shares have emphasized over the past months that asset tokenization will be the next catalyst to attract institutional adoption. So it is invigorating to see more bridges being built to extrapolate the benefits of DeFi to traditional finance.

VC Drama: The Uniswap community proposed to deploy the V3 protocol on the BNB chain. The proposition suggested the exchange would take advantage of the wormhole bridge to expand to the EVM-compatible network after multiple rounds of temperature checks. Although the governance vote has been live for the past 2 weeks, a16z (the crypto-focused VC fund) decided to defy the community’s consensus by deploying its entire 15M UNI holdings to vote against the proposal. A16z could not vote against utilizing the Wormhole bridge over LayerZero at an earlier stage due to its custodial asset structure. For context, Jump crypto and a16z are among UNI’s largest VCs with a sizable equity. However, a16z is an investor in LayerZero, while Jump Crypto is an investor in the WormHole bridge. The VC infighting has demonstrated the true extent of decentralization on the governance level and whether the community has any say when two entities control a significant amount of voting power. In addition, it showed the fragility of on-chain voting systems as a16z has been identified to own UNI through several wallets mounting to 41.5M tokens. This would help the VC exceed the 4% required quorum to pass any proposal. Despite a16z’s position, their UNI holdings may not be enough to cast the vote in their favor as there are multiple other whales like Argent and GFX labs with sizable possessions. Although the vote is expected to last until the 10th of February, only 3.95% of the total eligible UNI has been delegated so far, so a lot could change until the culmination of the polling process. 77% of the community is currently in favor of deploying on BNB via the wormhole integration.

NFTs and Metaverse

Roofstock onChain, an NFT-based protocol for tokenizing sole ownership of a Single Purpose Entity (SPE) with title to an individual single-family property, completed its second on-chain property sale on February 3. The property sold for $180,000 on an NFT marketplace built by Origin Protocol. Teller Protocol, a DeFi lending protocol on Ethereum and Polygon, provided on-chain leverage for the real estate transaction. In our last State of Crypto, in which we provided our market outlook for 2023, we anticipated a “major trend throughout 2023 will be the intersection of DeFi and NFTs.”

Meta reported a Q4 operating loss of $4.279 billion for its metaverse division Reality Labs on February 1. Reality Labs’ net loss totaled $13.7 billion last year. Susan Li, who was appointed as Meta’s chief financial officer in November, reiterated that the company will “continue to invest meaningfully in this area given the significant long-term opportunities that we see.” For additional context, it’s worth remembering that Facebook changed its name to Meta in October 2021 to focus its efforts on the anticipated metaverse trend.

Decentraland’s in-game token MANA rose 152.76% in January as the number of brands with a footprint on the user-owned metaverse continues to increase. Pet food maker Pedigree, a subsidiary of the American group Mars, recently launched the "FOSTERVERSE" program on Decentraland. The initiative will enable real-life rescue dogs to find shelter through donations in the metaverse. In exchange, donors will receive a donation receipt in the form of a virtual dog representing the rescued dogs, in line with the brand's ambition to end pet homelessness.

Next Week’s Calendar

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)