SEC Sues Terraform Labs, Polygon Sets Date for its Scaling Solution, and More!

.webp)

This Week in Crypto

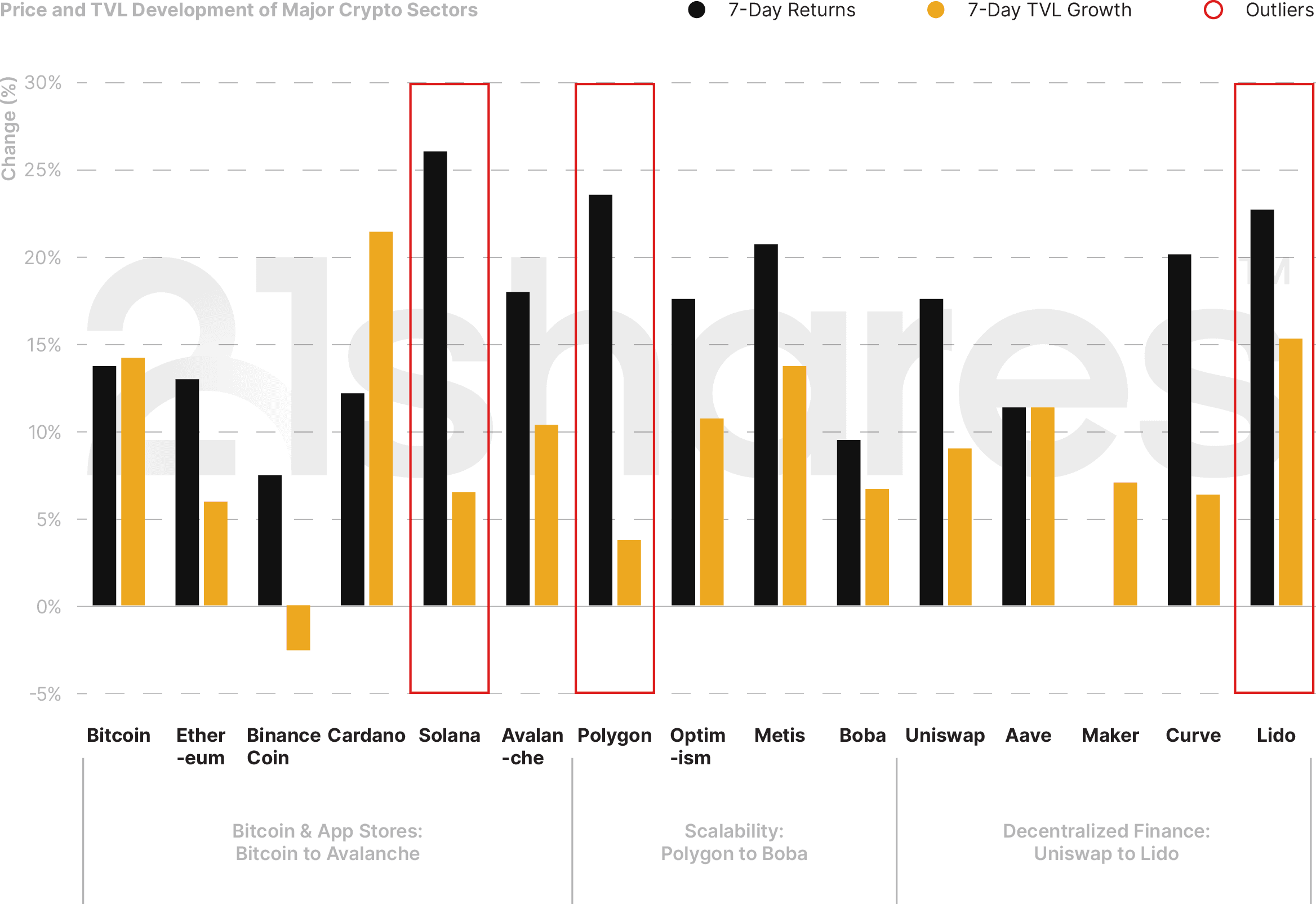

The crypto market performed well in a week filled with regulatory actions from the US and Hong Kong, exciting developments for blockchain-scaling solutions, and the anticipated token airdrop of the NFT marketplace Blur. Bitcoin and Ethereum traded up 13.85% and 12.99% week-over-week, respectively, while Solana outperformed the majors with a 25.99% return. On the scaling front, Polygon traded up 23.53% as it set March 27 as the target date for the launch of its Ethereum-compatible upgrade (zkEVM). Finally, Lido stood out in the DeFi sector with a 22.69% price increase. The staking platform will benefit from the Shanghai upgrade, expected around mid-March, as it will enable staked ETH withdrawals on Ethereum. Last week, Ethereum core developers agreed on February 28 as the target date for a new withdrawal-testing phase dubbed the Sepolia testnet.

Figure 1: Weekly Price and TVL Performance of Major Crypto Categories

Source: CoinGecko, DefiLlama, Close Data as of February 20, 2023

Key takeaways:

- The SEC sues Do Kwon and Terraform Labs nine months after the collapse of UST, while Hong Kong is planning to lift the ban on retail crypto trading.

- Polygon to deploy zkEVM rollup on March 27, zkSync opens up mainnet deployment for pre-registered applications.

- Siemens issues a 60M Euro-dominated public bond on Polygon, Centrifuge proposing to back Aave’s GHO with RWAs.

- NFT marketplace Blur airdropped its token BLUR, and OpenSea responded by temporarily moving to a zero-fee scheme to retain users.

Spot and Derivatives Markets

Figure 2: BTC Funding Rates

Source: lookintobitcoin.com

If we look at the derivatives market, BTC funding rates for perpetual futures have been consistently positive for over a month since January 15, indicating that many investors are positioned to the upside (see Figure 2). The fact that we are seeing positive funding rates with Bitcoin up ~50% year-to-date also suggests an increase in risk appetite.

On-chain Indicators

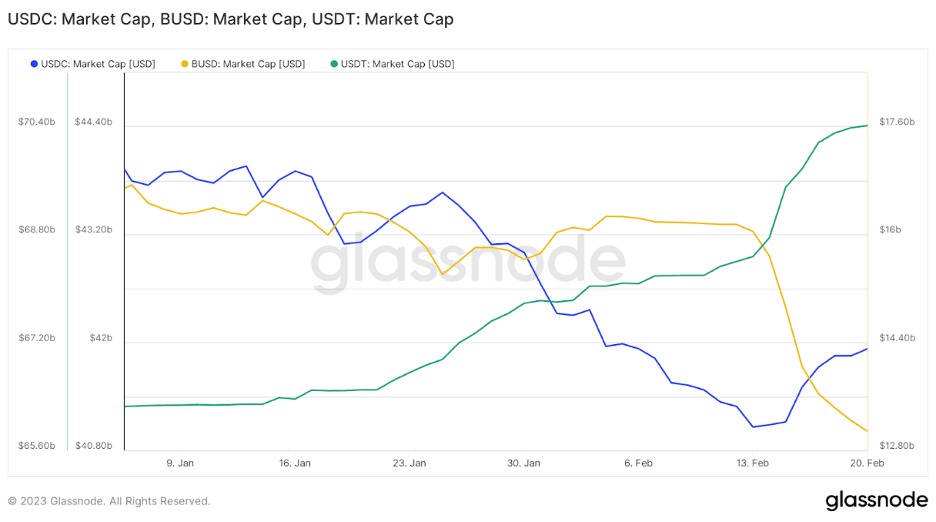

Figure 3: USDC, BUSD, and USDT Market Capitalization

Source: Glassnode

The crackdown on BUSD instigated by the New York regulator (NYDFS) has instantaneously shown its impact on the stablecoin market. The Binance-branded, yet Paxos-issued, stablecoin has fallen off a cliff as roughly 3 billion tokens were redeemed since February 13. Although USDT, depicted in the green line, has steadily increased in market cap since the beginning of the year, the recent clampdown has injected life into Tether. The rise could also be supported by the stablecoin issuer’s update last week, reporting that an excess reserve of 81% of cash and cash equivalents are now backing USDT.

Macro and Regulations

Last week, the spread between the 10-year and 2-year US Treasury yield reached its lowest level since September 1981. The deepened yield curve inversion reflects bond investors' increased expectations of a decline in longer-term interest rates, a leading historical indicator of a recession. There is also rising uncertainty about inflation, which raises uncertainty about the Fed's course of action. Two Fed officials – St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester – said they would have preferred raising rates by 50 bps earlier this month instead of the 25 bps hike we saw. As such, the bond market and the Fed are signaling that rate increases have not ended and that a 50 bps hike in March is back on the table. In addition, other developments regarding macroeconomic data included:

- Argentina's monthly inflation rose 6% in January, reaching a year-over-year inflation rate of 98.8%.

- On a more positive note, the UK inflation rate fell for the third consecutive month in January to reach 10.1%, beating consensus expectations. However, food and energy prices remain historically high, suggesting inflation remains sticky.

- Finally, US retail sales increased 3% in January, beating consensus expectations and showing the current strength of the US economy despite inflation pressures — possibly due to a warmer winter.

The SEC sues Terraform Labs: The past two weeks were perhaps the most consequential in the past fourteen years regarding crypto regulation in the US. After entering into an agreement with Kraken for its staking-as-a-service offering in the US and issuing a Wells Notice to Paxos over BUSD, the SEC charged Terraform Labs – the company behind Terra's UST algorithmic stablecoin – and its CEO, Do Kown, with defrauding investors. Among many revelations, the press release stated that UST was a security because "investors who bought UST had the right to subscribe to or purchase a security (i.e., LUNA)." Thus, one could infer that fiat-backed stablecoins like USDC or USDT are not considered securities, as no one buys them with the expectation of profits but solely as a means of exchange.

Hong Kong is considering lifting the ban on retail crypto trading: On February 20, the Securities and Futures Commission (SFC) of Hong Kong proposed softening the rules which ban retail investors from buying cryptoassets from licensed platforms. In addition, the proposal states that all crypto trading platforms operating in Hong Kong will have to be approved by the SFC by June 2024 or close down their operations. The push for sensible crypto regulation by Hong Kong coincides with US regulators overreaching and failing to provide clear regulatory guidelines for legitimate crypto businesses, a blunder that may drive capital and innovation to more favorable jurisdictions.

Crypto Infrastructure

Layer 0:

Cosmos: Implemented its latest update last Wednesday on the 15th of February. Dubbed RHO, the upgrade introduces the Global Fees Module. A component that would allow the Cosmos governance to set minimum gas prices, in addition to accepting a wider list of Cosmos-based tokens to be used as the currency for the gas fees, via a series of governance proposals. This means that users wouldn’t be limited to paying fees exclusively in ATOM. Most importantly, the upgrade paves the path for the next major technical hurdle known as Replicated Security. Check out our latest SoC-Issue9 for a deeper dive into what this innovation will introduce to the Cosmos ecosystem.

Layer 1:

Flashbots: The R&D organization responsible for mitigating the negative externalities of front-running and arbitrage on Ethereum revealed its latest tool designed to further democratize accessibility to transaction-shared revenue with the broader community. MEV-share, the newly introduced tool by Flashbots, will now allow users to also receive rewards that were previously only allotted to validators and builders

BNB published its technical roadmap for 2023, focused on four key areas of growth:

- On the scalability front, the team will increase the block's gas limit to 300M, up from 150M, and introduce a Rust-based client to separate the state verification from the processing transactions, to enhance the client's performance. The L1 will also include optimistic and ZeroKnowledge rollups to the network's stack to help cater to diverse use cases.

- Improve the user experience by bringing in augmented cross-chain solutions and smarter wallets built on the back of Account Abstraction (AA) and MultiParty Computation (MPC). AA is a concept that allows for wallets' social recoveries, amongst other user-intuitive features. At the same time, MPC is a form of cryptography that enhances secure key management by eliminating the risk of a single point of failure.

- The network will also vitalize its security by introducing AvergerDAO2.0, a community-driven initiative involving a collaboration between the top security firms designed to protect users from fraud and scams. The project's first iteration introduced Meter, a service to provide security ratings for smart contracts. Meanwhile, the second iteration will focus on launching Watch and Vault. The former is an API stream to issue active alerts when users interact with malicious protocols. The latter acts as a short-term escrow that locks funds until specific preconditions are met.

- Retain its own native storage network, dubbed GreenField, to help develop the blockchain's ecosystem's data economy.

- Finally, BNB will grow its validator size to 100 nodes, up from 40, to further decentralize the network.

BNB's roadmap is a significant endeavor as it helps the network adopt some of the vital scalability features shaping the rising growth of L2s, such as the rollup technology with its two subset classes. The developments will be crucial for BNB to protect its market positioning and remain competitive against networks like Optimism, Polygon, zkSync and Arbitrum.

Layer 2:

Polygon is ready to implement the production-environment version of its scaling solution. The network has achieved multiple milestones since the testnet deployment in mid-October. Polygon also conducted two public audits in addition to shrinking the time needed to create settlement proofs to two minutes combined with a minimal production cost of 6 cents. We at 21shares anticipate that scaling solutions will remain a dominant narrative this year. We also expect an escalation of an arm’s race between the different scalability protocols toward launching the first fully-functional solution to the market. That is evident by Metis’s hint at expanding into the ZK space and corroborated by zkSync’s move, which shortly followed Polygon’s statement on releasing the mainnet beta version of the protocol on March 27.

Matter Labs, the company behind zkSync, announced a limited beta launch. Specifically, teams aspiring to launch their applications on top of the L2 must log their addresses on the rebranded zkSync Era platform before advancing to the Fair Onboarding Alpha stage. The announcement came a day after Polygon’s revelation and thus shows the fierce competition that this vertical is about to undergo. Matter Labs will also open-source Era’s code base to allow the broader community to experiment with the innovation that’s been live on testnet for over a year. The development is significant to Ethereum at a time when the mainnet layer is struggling to cope with the increased demand for block space perpetrated by Blur’s recent airdrop - causing gas prices to soar.

Decentralized Finance

Figure 4: Top 10 DeFi Assets Weekly Performance

Source: CoinGecko

Tokenization

Centrifuge: The protocol that most recently tokenized BlockTower’s Real World debt — including receivables, loans, and structured products, is now suggesting to back Aave’s new stablecoin GHO with real-world assets (RWAs). As a reminder, RWAs refer to asset classes that exist in the physical world, like real estate and commodities. Tokenizing them would help significantly improve liquidity on-chain as it offers a more sustainable yield that is uncorrelated to the crypto market conditions, and thus supports protocols in continuing to generate revenue during turbulent times. Maker, for instance, leverages trade finance transactions and freight forwarding invoices - tokenized via Centrifuge’s Tinlake platform - as one example of the collateral that backs DAI, so we can expect to see similar activity once Centrifuge officially publishes their formal facilitator proposal.

Tokenized Bonds: Siemens, the industrial German giant, disclosed that it had issued its first digital bond on a public blockchain. The bond worth 64M euros is tokenized on top of the polygon network, and has a maturity of one year. That said, its interest rate remains a mystery. Although this move isn’t the first of its kind, as the European Investment Bank (EIB) and ABN AMRO have both recently issued their own respective bonds over the past 30 days, it nevertheless highlights the increased awareness of harnessing public DLT technology to address the shortcomings of the traditional financial system. In that regard, Blockchain-based bonds effectively deem paper-based global certificates and central clearing as avoidable. An additional benefit is providing bond issuers with the ability to sell directly to investors. Furthermore, tokenizing bonds opens up new venues of financing from seemingly illiquid assets, freeing up capital and liquidity in the process. Finally, tokenization should help increase the accessibility of the bond market to the broader retail segment by allowing smaller investment sizes via fractionalization.

NFTs and Metaverse

BLUR airdrop: NFT marketplace Blur airdropped its token BLUR amid reports of a potential raise for the company at a billion-dollar valuation. The airdrop rewarded active NFT traders retroactively — the BLUR token has a total supply of 3 billion tokens, of which 360 million (12%) were claimable by users on February 14. As of February 20, BLUR was trading at $1.20, valuing the airdropped tokens at more than $430 million.

OpenSea goes zero-fee as Blur gains market share: OpenSea announced three big changes in response to a significant amount of volume and users moving to other marketplaces in the past few months.

- OpenSea will move to a 0% fee scheme temporarily.

- The company is also moving to a minimum 0.5% creator earnings model for all collections without on-chain enforcement, allowing sellers to pay more.

- They will update the "operator filter" to allow sales using NFT marketplaces with the same policies (including Blur).

OpenSea's announcement comes as marketplaces that don't enforce royalties, like X2Y2 and Blur, gain market share, raising a debate over the need to defend creator earnings. In the past week, the Blur marketplace has registered ~$460 million in trading volume (excluding wash trades), compared to ~$306 million for OpenSea, about 50% higher. Since December, this has been the norm, with Blur surpassing OpenSea in trading volume almost every week. However, when looking at the number of users, we see nearly the opposite, with OpenSea registering about 50% more users than Blur in the past week, though the latter keeps gaining ground.

Next Week’s Calendar

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

_logo.svg)

.svg.png)