The BOLD Launch Note by ByteTree and 21Shares

%20(1).webp)

The 21Shares ByteTree BOLD ETF (“BOLD”) blends bitcoin and gold on a risk-adjusted basis. This unique asset combination blends one of the oldest assets with one of the newest. The gold provides safety in a storm while the bitcoin captures the growth of the digital economy. BOLD protects investors from inflation and acts as an effective portfolio diversifier.

What is gold?

Gold is a highly liquid, globally accepted long-term store of value that has been used since the early days of civilization. It is categorized as a commodity and is owned by investors and central banks to protect against inflation. Gold has great appeal during times of economic or political stress. It is also used for jewelry, dentistry, and other technological applications.

What is Bitcoin?

Bitcoin is frequently characterized as digital gold. It was released in 2008 with similar, finite, supply-side characteristics as gold. It is the most widely owned and liquid crypto asset, which, despite its volatility, is seen as an emerging store of value. It is owned mainly by private investors to capture the growth associated with fintech and the exchange of value over the internet. Institutional adoption of bitcoin as an alternative asset is in its early stages.

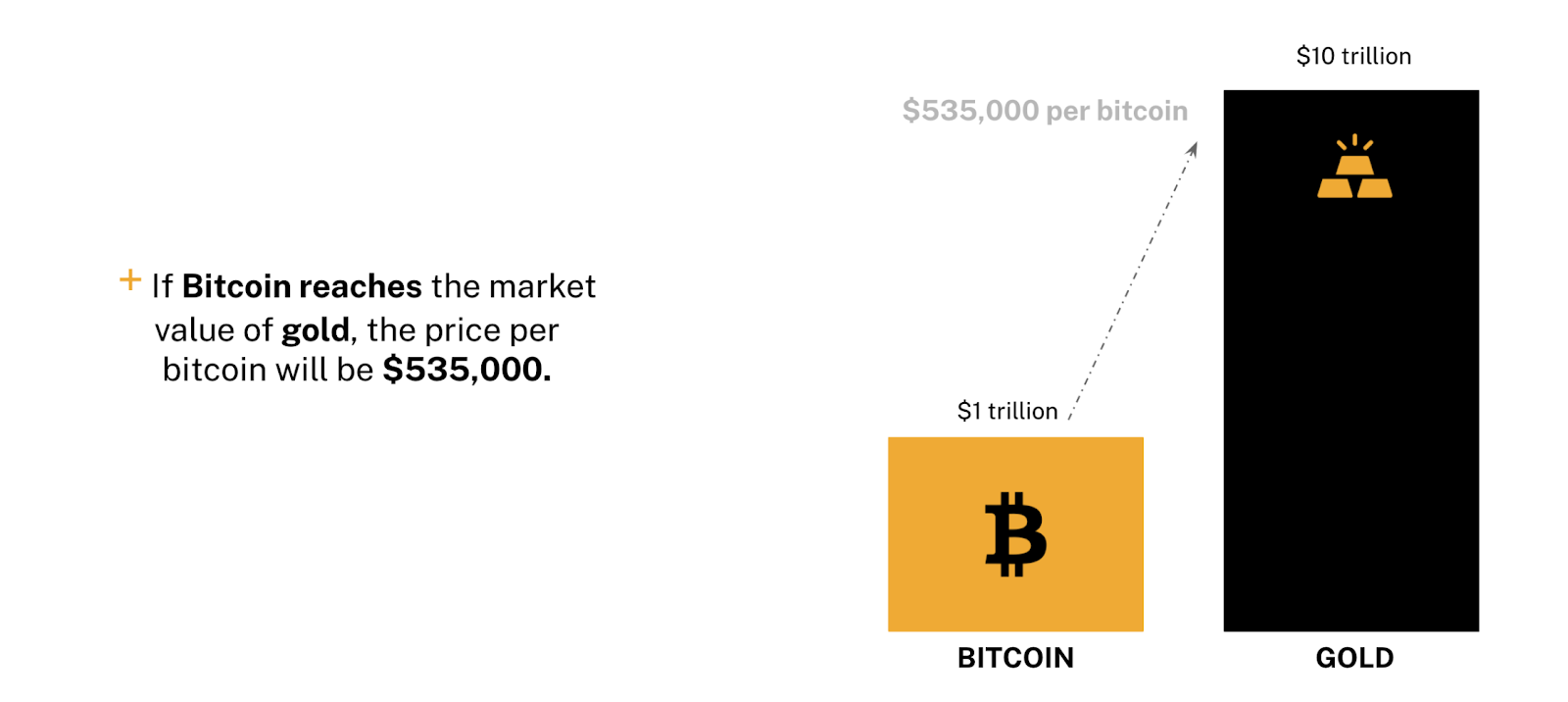

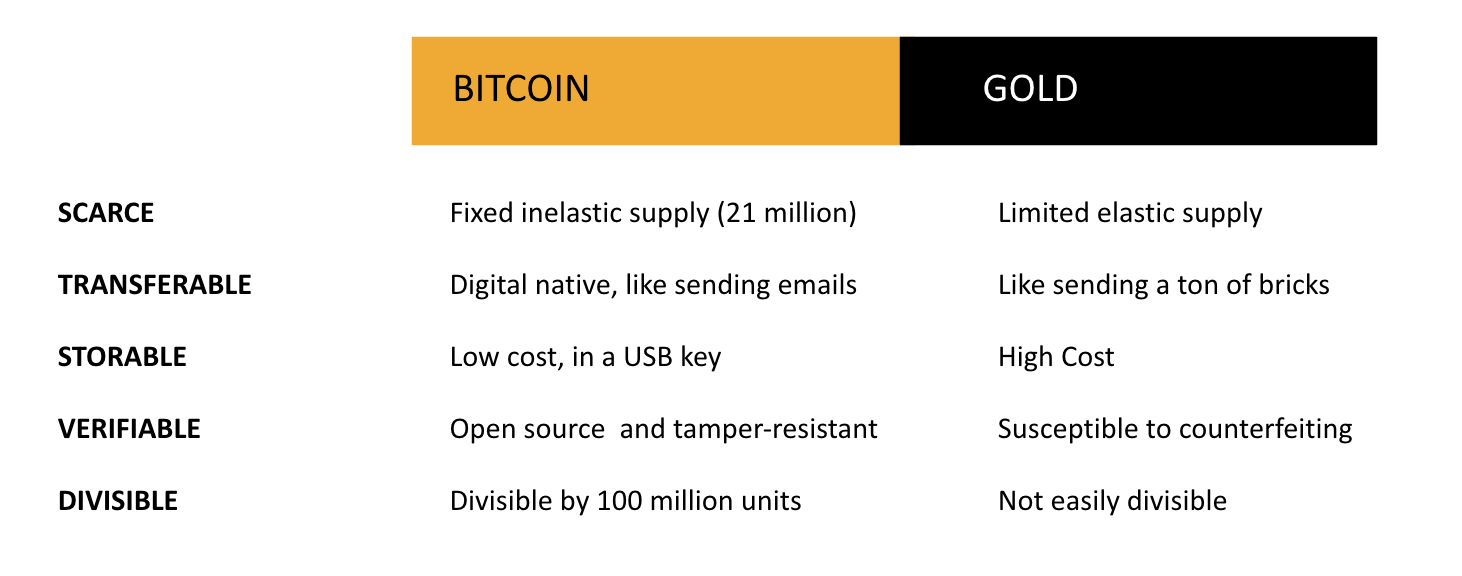

The Case For Bitcoin As Digital Gold

Bitcoin has similar supply-side characteristics to gold, and for this reason, is often characterized as “digital gold”. By relying on the market-sizing method, we can estimate the total addressable market (TAM) for bitcoin, which in this specific case is the market capitalization of gold, valued at approximately $10 trillion. In theory, if bitcoin reaches the market value of gold, the price per bitcoin will be more than $500,000. To be more specific, by dividing the market cap of gold by the outstanding number of bitcoins ever created — hence 10 trillion divided by 19 million, we get a bitcoin price of roughly $526,000.

Source: 21Shares

Bitcoin could exceed the market value of gold. Bitcoin is a digital-native asset, accessible anywhere in the world with an internet connection. The asset has a fixed, predictable supply of 21 million units ending in approximately 119 years, which since inception has been programmatically declining every four years (i.e., the halving). More importantly - in the context of social distancing, closed borders, and fear of virus transmission — bitcoin, unlike gold, is easily transferable, and billions of dollars worth of bItcoin can be stored on a USB key.

Finally, the bitcoin blockchain is tamper-resistant, open-source, and can be verified by anyone; look here. All the aforementioned points make the case why bitcoin has features that are an improvement on gold. Note that this analysis does not take into account the incredible innovations atop of bitcoin, such as the Lightning Network and Stacks, which could expand the potential total addressable market by orders of magnitude, and also the use cases documented by the Human Rights Foundation, proving that bitcoin serves as an alternative and censorship-resistant monetary system to protect human rights. The Ukraine-Russia conflict is the most recent example showcasing the human rights benefits of bitcoin.

Gold, unlike bitcoin, benefits from the test of time with thousands of years under its belt as a store of value. Also, gold has significantly more liquidity and is less volatile than the cryptoasset because bitcoin remains an emerging store of value. The first-ever exchange rate recorded was about $0.0009 per bitcoin by Martti Malmi, an early bitcoin developer, who transferred $5.02 for 5,050 BTC via PayPal to seed a bitcoin exchange called New Liberty Standard. Its value has increased by around 5 billion percent since.

Source: 21Shares

BOLD - The power of the combination

Combining bitcoin and gold on a risk-adjusted basis has delivered impressive results. Unlike most assets, which rise and fall together, bitcoin and gold tend to act inversely. This combination has delivered enhanced stability and resilience during a range of macroeconomic conditions.

The diagram shows how different asset classes behave in different macro conditions. When bond yields (interest rates) are rising, the economy is normally expanding, and when falling, the economy is typically slowing. It is no surprise that equities outperform bonds when the economy is growing. Yet both bonds and equities prefer inflation to be low.

Source: ByteTree Asset Management

In contrast, gold and bitcoin have demonstrated that they perform better when inflation is elevated or rising. Under these circumstances, bitcoin has performed better when the economy has been expanding and gold when it is contracting. Consequently, the combination of bitcoin and gold has delivered impressive risk-adjusted returns during inflationary times.

Asset allocation and monthly rebalancing

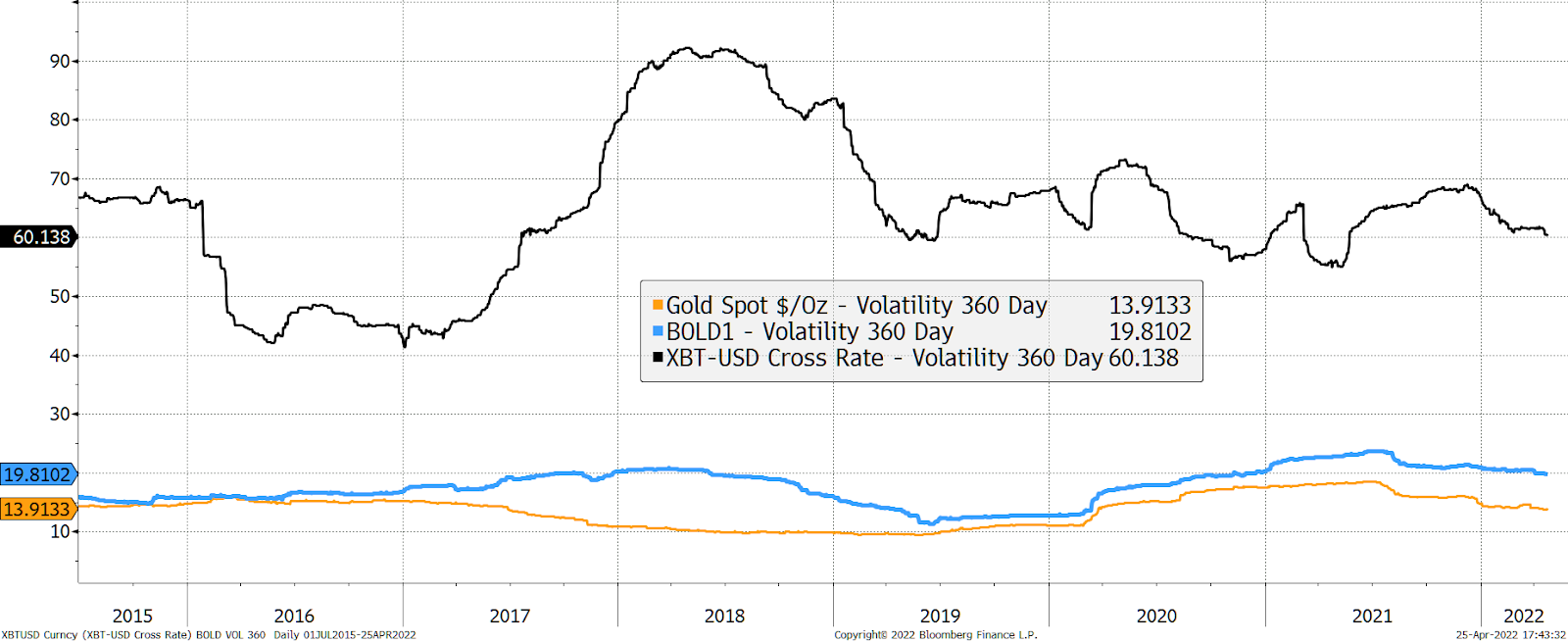

The weightings of bitcoin and gold in the BOLD strategy are allocated according to the riskiness of each asset, as defined by their historical volatility. The less volatile asset has a larger weight, and the higher volatility asset has a lower weight. At present, the gold weighting is substantially larger than bitcoin, but should bitcoin’s volatility fall over the coming years, then its allocation will increase.

The BOLD Index uses 360-day volatility to capture the long-term risk profile of the asset. This avoids any tactical signals which would be generated by shorter-term measurements. Whilst there are other ways to combine bitcoin and gold, this risk-weighted asset allocation technique is a tried-and-tested approach that has been shown to reduce portfolio volatility and drawdowns.

The target weights are recalculated monthly, with rebalancing transactions carried out to return the allocations to the new target weights. This means that the BOLD strategy purchases the poorer performing asset and sells the better performing asset at the start of every month. By repeatedly carrying out rebalancing transactions, the strategy adopts a value-based approach.

Rebalancing transactions can be a powerful source of excess return over the long term, provided low asset dispersion. If either gold or bitcoin was to materially outperform the other asset, then picking the winner would be a superior strategy with the benefit of hindsight. However, if the dispersion is low, meaning that bitcoin and gold enjoy similar returns over time, rebalancing will significantly outperform a buy-and-hold approach.

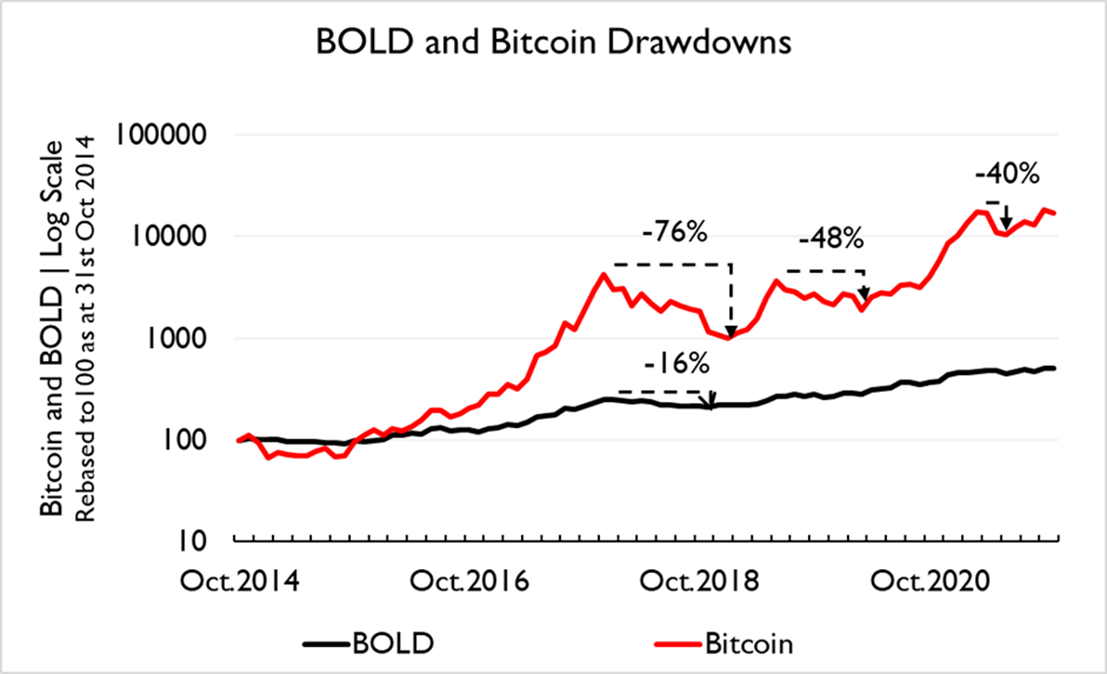

Drawdowns

Automatically rebalancing the weights each month aims to smooth and enhance combined returns over time. BOLD barely registered the sharp drawdowns experienced by Bitcoin in 2014, 2018, and 2020. The maximum drawdown incurred by BOLD from 2014 to 2021 was 16% — around 20% of that experienced by Bitcoin. Thus the lower volatility profile of BOLD, compared to Bitcoin, is matched by a lower drawdown risk profile as well.

Source: ByteTree Asset Management

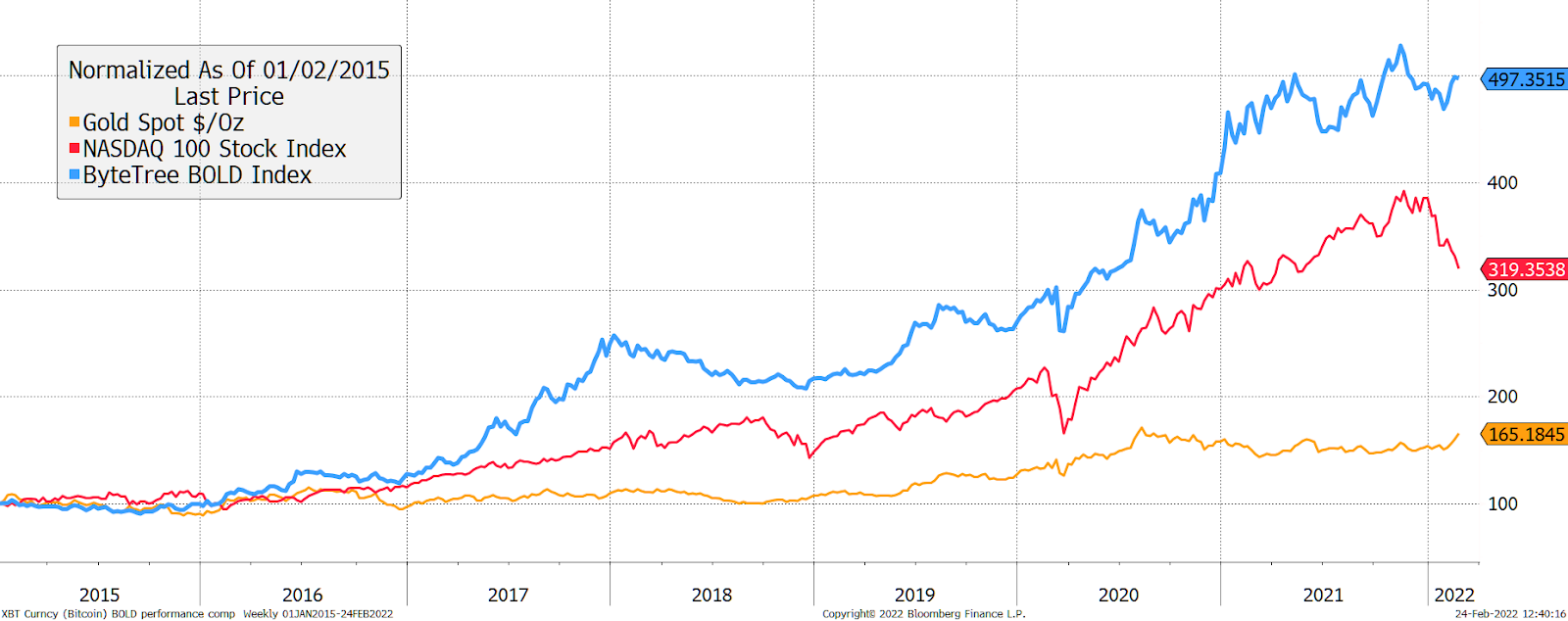

BOLD Performance

In 2017, Bitcoin peaked at nearly $20,000, only to fall to $3,156 in November 2018 – an 83% fall. Gold has been more stable but is still subject to 30% falls over 12 months.

The strength of BOLD is that the falls in these two assets have historically occurred at different times. Except for deflationary shocks such as March 2020, one asset has tended to offset the other. The performance of BOLD, gold and the Nasdaq Index since 2015 is shown in the chart below and shows the remarkable impact that a small amount of blended bitcoin has had on a gold allocation.

Source: Bloomberg

Volatility

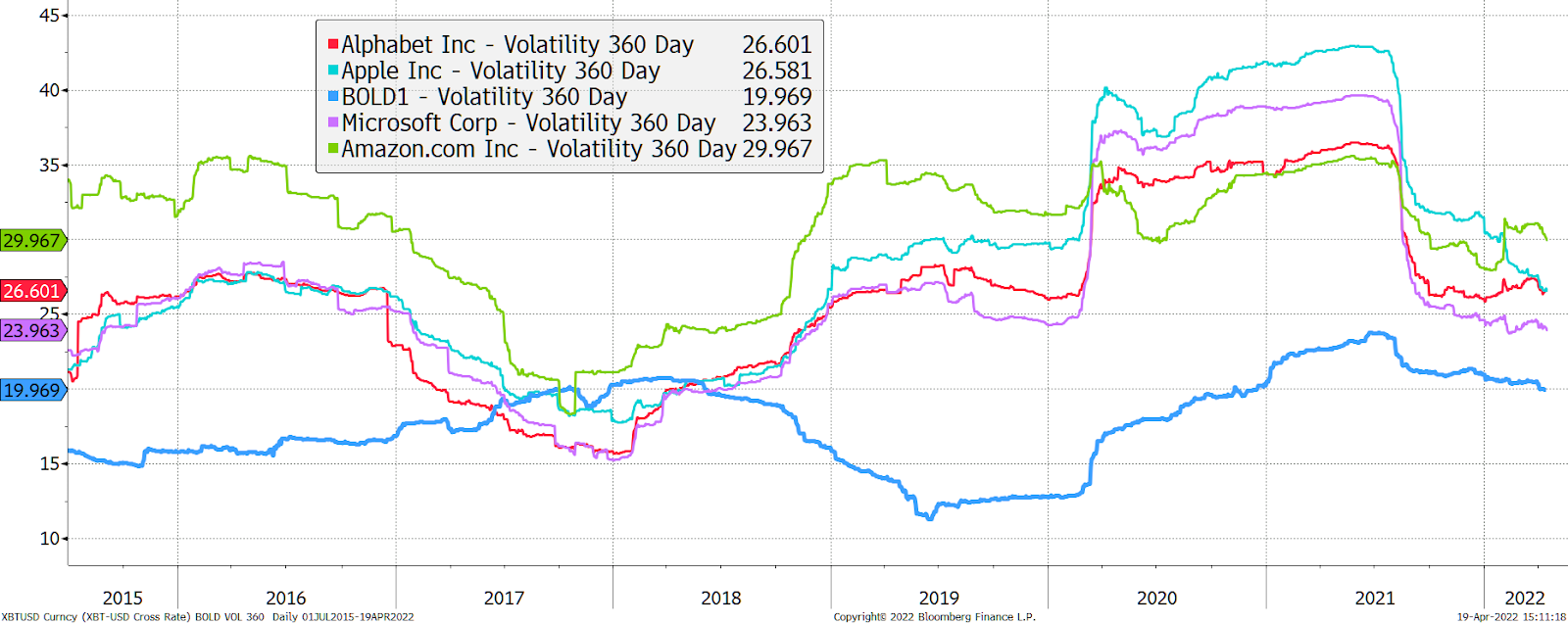

BOLD has low volatility in part because it has a high exposure to gold, a low volatility asset. However, as mentioned above, gold and bitcoin have a degree of offset which means the combination benefits. The result is that BOLD has been consistently less volatile than some of the most valuable companies in the S&P500, as shown in the following chart.

Volatility of BOLD and selected leading US stocks

Source: Bloomberg

This low volatility makes BOLD a strong candidate to become a core long-term allocation in diversified portfolios, a role historically taken by gold despite the frustration of some prolonged periods of poor performance.

Inflation hedge

Inflationary pressures have been building in the global economy for many years but have been exacerbated firstly by Central Banks’ response to the COVID-19 pandemic and, more recently, by growing political tensions, most notably the Russian invasion of Ukraine. For example, the annual inflation rate in the USA rose to 7.9% in February 2022, the highest seen since 1982.

The main drivers of inflation have been as follows:

- Expanding money supply, exacerbated by central banks’ emergency money-creation measures in response to the global pandemic

- The end of a multi-decade era of cheap Chinese exports

- Lack of investment in resources, particularly energy, in response to concerns about climate change and ESG (Environmental, Social and Governance) pressures

- Supply-chain disruption. The politics of energy are particularly important here; countries are likely to want to become energy self-sufficient rather than rely on potentially bad actors.

- Labour market tightness

These factors have resulted in years of high asset inflation, most notably in property, bonds (which benefit from very low-interest rates), and equities (which are valued highly, again because of low discount rates).

There is a school of thought that inflation will be a temporary phenomenon in the hope that disinflationary forces, such as technology and demographics will apply downward pressure to aggregate prices. Long term, this is plausible. However, as the chart below shows, the structural drivers of inflation have become more widespread since the start of the pandemic in March 2020.

The structural drivers of inflation

Source: Bloomberg

The classic response to subdue high inflation is to raise interest rates. Recently, central banks such as the US Federal Reserve have started to raise policy rates and have signaled that they are prepared to continue on this path. While this will help reduce demand, a higher interest rate policy can do little to address most of the structural issues identified above. Indeed, central banks will almost certainly be constrained to the extent that interest rates can rise by the substantial amount of debt accumulated over this cycle. Raising the cost of debt too far or too fast could trigger a financial crisis such as the one experienced in 2007/8.

This suggests that while policymakers are addressing the inflation problem, there is only so much that can be achieved purely through monetary policy. Indeed policy options are limited, particularly at heightened political tensions.

There is a distinct possibility that inflation is not a temporary phenomenon, which would be negative for both equities and bonds, and would support the argument for an allocation to BOLD in a diversified portfolio.

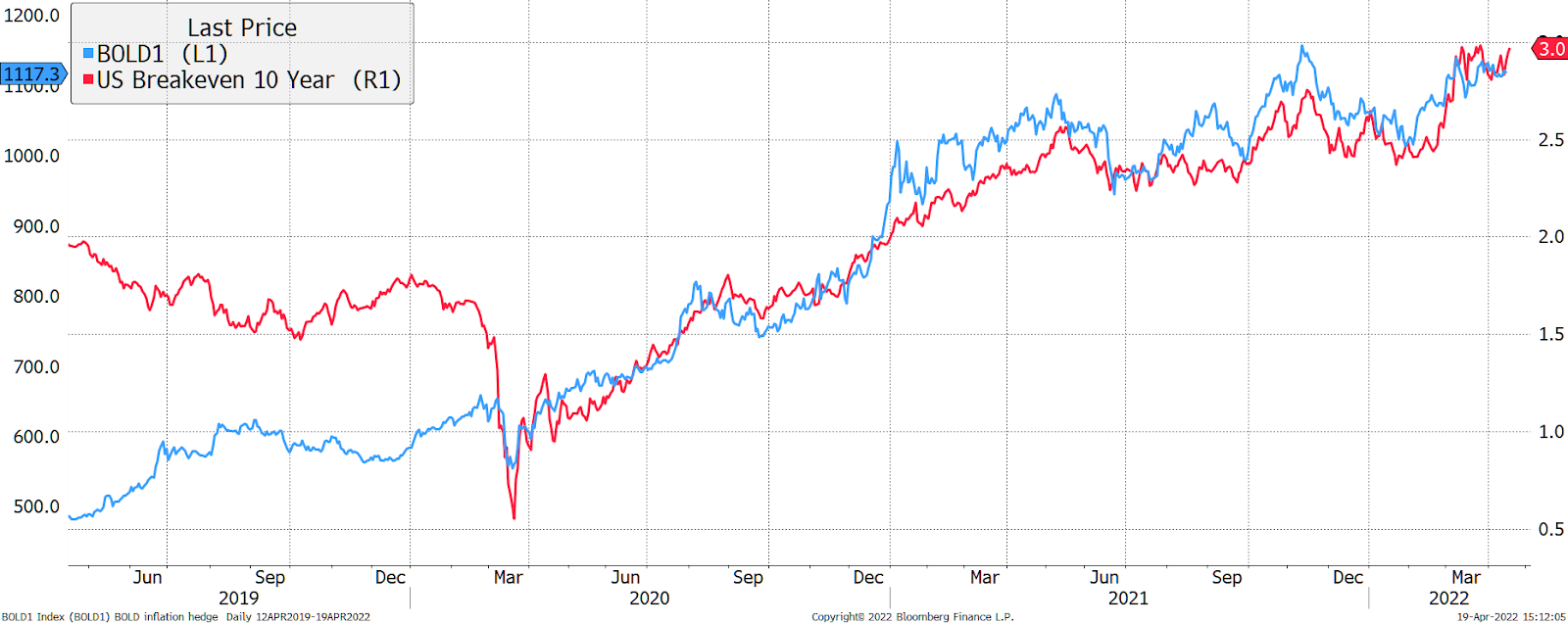

How have gold, bitcoin, and BOLD performed against inflation recently?

To some investors’ surprise, gold performed poorly in 2021, despite growing inflationary data. This is explained by the idea that gold had anticipated the inflationary consequences of the massive monetary expansion in response to the COVID-19 pandemic in 2020. Gold didn’t respond to inflation in 2021 because it had already done so in 2020 when the price rallied 35% in the first few months after the first lockdowns in March.

On the other hand, Bitcoin saw more progress in late 2020 and 2021, as the gold price consolidated. Bitcoin effectively responded to higher inflation when the economy was strong, in contrast to gold which responded when the economy was weak during lockdowns.

These two assets have a natural ability to be counter-cyclical as they have a different appeal at different times. This is a key strength for BOLD and has helped it hedge a balanced portfolio during both good and bad markets.

This is shown by BOLD’s link to US 2-year inflation expectations (TIPS), which since March 2020 has been remarkable.

Source: Bloomberg

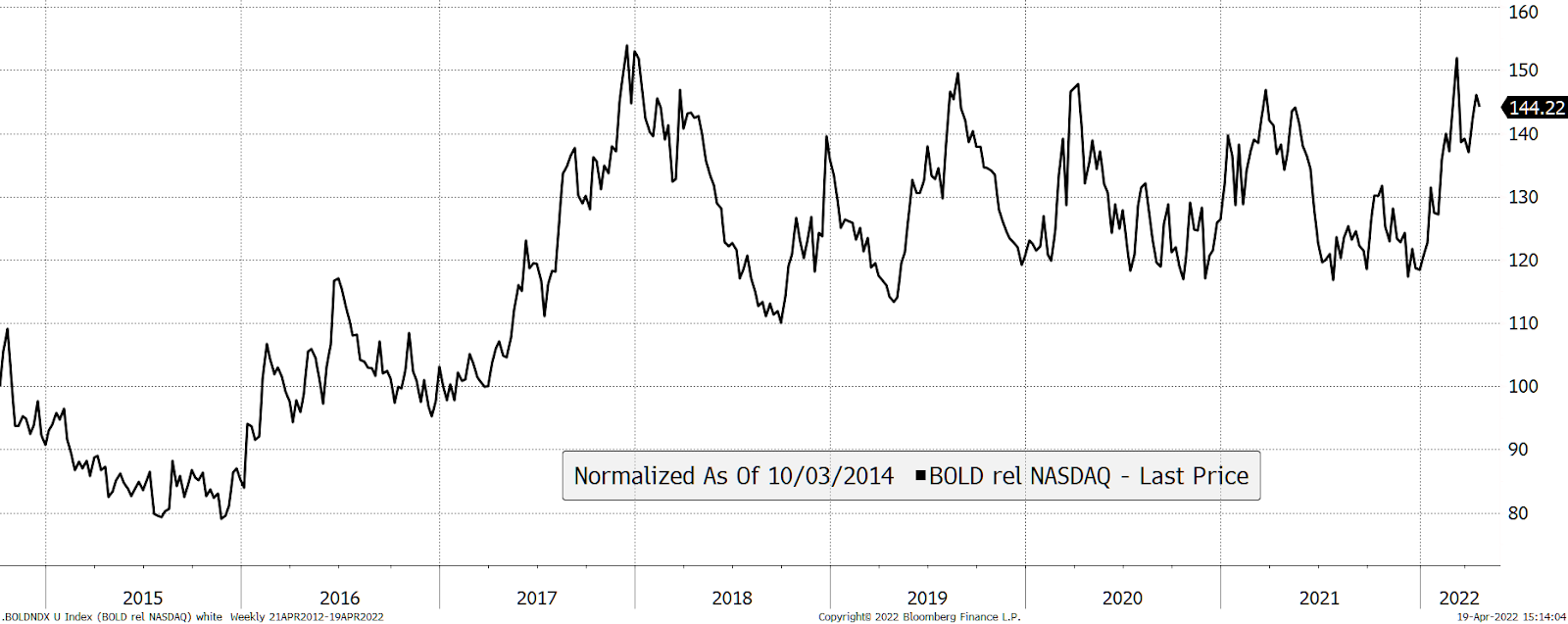

Bitcoin’s relationship with technology stocks

Bitcoin has long had links to tech stocks, which should come as no surprise as it is “internet money”. The simple evidence is that the best and worst years for the NASDAQ (a proxy for tech) and bitcoin have been the same. The best were in 2013, 2017, and 2020, and the worst were in 2014 and 2018. This demonstrates how bitcoin and tech have been correlated despite their divergence in performance. According to ByteTree, Bitcoin’s fair value is about $37,500 at the moment.

By taming Bitcoin by blending in a high weight in gold, as per the BOLD strategy, the performance starts to resemble NASDAQ. The performance has been remarkably similar over the last 5 years. BOLD did beat the NASDAQ in 2017 when Bitcoin surged and was able to hold onto most of those gains. Since 2018, BOLD and NASDAQ have traded within a range, as shown below.

Source: Bloomberg

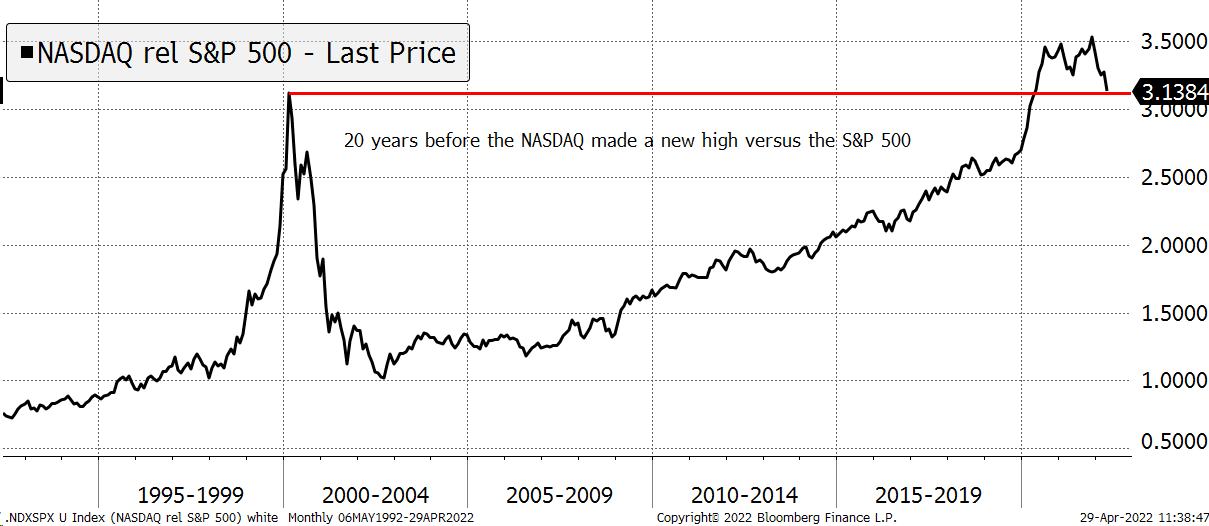

Bubbles take time to heal

It is often said that the US tech sector is richly valued. It has been performing well for many years, and the high expectations that have been built into the price will be difficult, if not impossible, to deliver on. The risk to investors is that tech underperforms the market for years to come. There is precedent as a purchase of the NASDAQ in March 2000 didn’t exceed the return of the S&P 500 until May 2020, as shown in the chart below.

Source: Bloomberg

A new era for gold?

While highly valued tech stocks may struggle for many years from here, the opposite holds true for gold. It outperformed significantly in the years following the tech boom, only to peak in 2011, before deflation took hold. Today, the gold price is undemanding, and with geopolitical tensions rising, investors are likely to increase their allocations.

Relative to the S&P500 gold is at levels not seen since the mid-2000s, before a period of substantial outperformance, as shown in the next chart.

Source: Bloomberg

Bitcoin is not a bubble

Some believe bitcoin is in a bubble. This is increasingly unlikely as it is still small in the context of other asset classes. Institutional investors still have minimal exposure to crypto assets, although it seems likely that this will change in the future.

It is also likely that bitcoin will see even wider ownership, especially after the rise in geopolitical tensions. The idea of portable wealth that is protected from repressive governments is an increasingly attractive idea.

BOLD makes Bitcoin institutionally investable

Bitcoin has been punitively volatile, making it difficult for institutional investors to allocate capital. The chart earlier showed how BOLD is less volatile than the major tech stocks.

By combining bitcoin with gold, the volatility comes down to acceptable levels. BOLD makes bitcoin an investable asset for a large liquidity pool. As can be seen in the chart below, the volatility of BOLD has been very similar to that of gold.

Source: Bloomberg

Portfolio diversifier

BOLD also acts as a genuine portfolio diversifier. BOLD is inflation-sensitive, as shown earlier, which is attractive in a portfolio dominated by bonds and equities. Assets that benefit from unexpected macroeconomic conditions make a portfolio stronger.

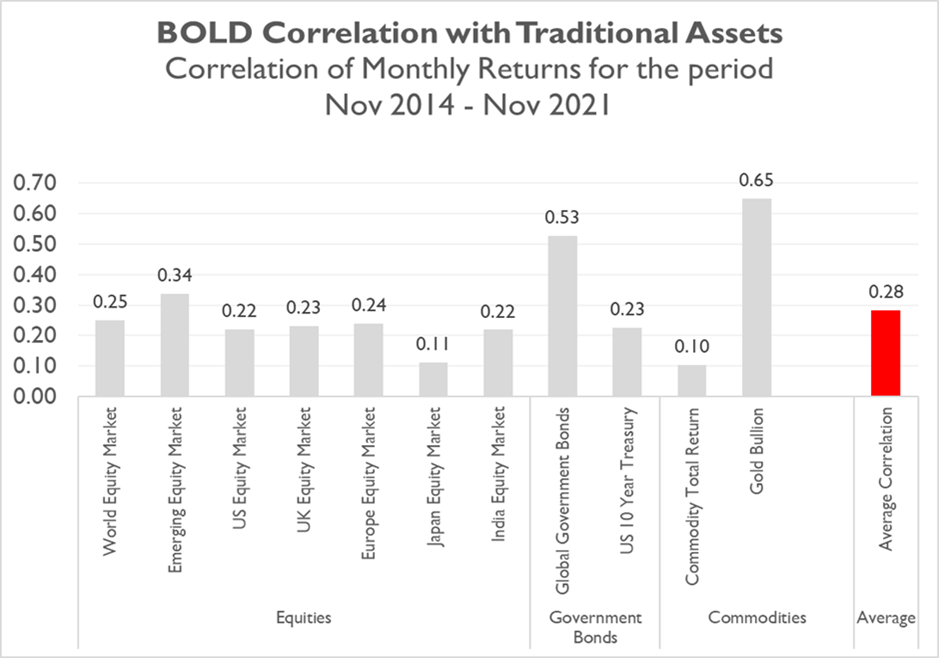

When assessing the diversification benefits of BOLD, a useful starting point is to analyze the correlation of this product compared to traditional asset classes.

Using monthly returns and covering the period of 2014 to 2021, we show below that the BOLD strategy has been very lowly correlated to traditional assets over this period, which covers a bull market as well as three significant corrections. As can be seen, the average correlation of BOLD versus traditional assets has been 0.28 over this period, with the highest correlation being with gold.

This analysis supports the idea that BOLD is a useful diversifying asset to include in a portfolio of traditional asset classes.

Source: Bloomberg, ByteTree Asset Management, Refinitiv Datastream

Risk

One of the benefits of BOLD is that it reduces the risk of owning bitcoin. Those risks include trading and custody, as well as reduced volatility, all of which are significantly improved by holding BOLD as opposed to Bitcoin directly.

Bitcoin and gold are inflation-sensitive assets, so BOLD is unlikely to perform well in a disinflationary or deflationary environment.

Frequently Asked Questions

Why does BOLD hold just Bitcoin and gold? What about other cryptoassets and commodities?

Gold is the most widely held, least volatile, and most liquid commodity. These attributes would deem it to be the highest quality commodity asset from an investor’s perspective. For Bitcoin, the same holds true in the crypto space. In contrast to other commodities and crypto, Bitcoin and gold are considered monetary assets.

If silver or copper were added to the mix, the commodity part of the portfolio would see volatility rise and liquidity fall. This would reduce the overall quality of BOLD’s asset base. If crypto was added other than Bitcoin, this would materially increase the risk to BOLD.

BOLD’s strength comes from combining two inflation-sensitive assets with opposing macro-economic credentials. This optimized blend gives investors from inflation protection during both the good times and the bad.

Why can’t I just own gold and bitcoin myself?

You can. Both are great assets that deserve to be widely held. The advantages of BOLD are that it is efficient, convenient, and disciplined.

Rebalancing strategies add value. They do this by buying the weaker asset and selling the stronger asset. Over the long term, this is likely to add value unless one asset is particularly strong compared to the other. Rebalancing can be done by yourself, but it is one of those things few people do. It is easy to forget or ignore, while frequent trading might also have tax implications and incur punitive trading costs. The turnover of BOLD is expected to range between 60-and 100%.

BOLD takes away the hassle while imposing a disciplined process.

Why does BOLD use volatility or risk weighting?

Risk-weighting asset allocation techniques are widely used in portfolio construction to improve risk-adjusted returns. They aim to reduce exposure to areas with the highest risk. This reduces portfolio volatility and drawdowns.

Why does BOLD use 360-day historical volatility?

360-day realised volatility (historical) was chosen because it captures the volatility over a year, which typically reflects a wide range of economic scenarios. This contrasts with short-term data (30, 90, or even 180 days), which is “noisy” and may capture specific events. By sticking to longer-term data, BOLD avoids a bias that could have resulted from recent events and focuses on the assets’ long-term stability.

Disclaimer

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Cryptoasset trading involves a high degree of risk. The cryptoasset market is new to many and unproven and may have the potential to not grow. Currently, there is a relatively small use of cryptoassets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in cryptoassets. In order to participate in the trading of cryptoassets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment. Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or solicitation by 21Shares AG or its parent of any offer to buy bitcoin or other cryptoassets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. This information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice, and users are cautioned against basing investment decisions or other decisions solely on the content hereof.

_logo.svg)

.svg.png)